Strong first quarter GDP growth and rapidly rising inflation pressure suggest that the RBNZ would at least maintain a hawkish stance at this week’s meeting. While the monetary policy measures will stay unchanged, policymakers will likely react to market expectations of a rate hike in November, compared with RBNZ’s projection of next year in May. The language in the accompanying statement should be amended to reflect stronger economic outlook.

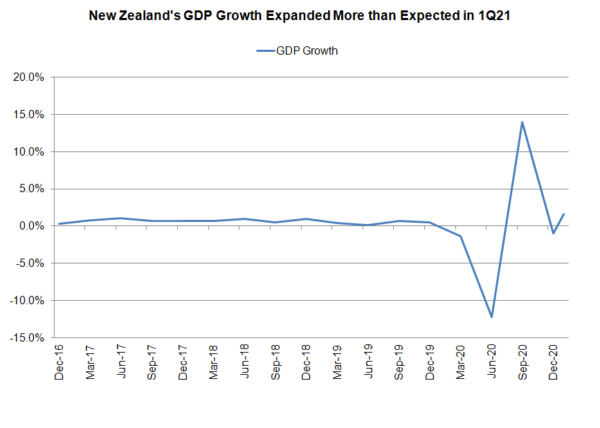

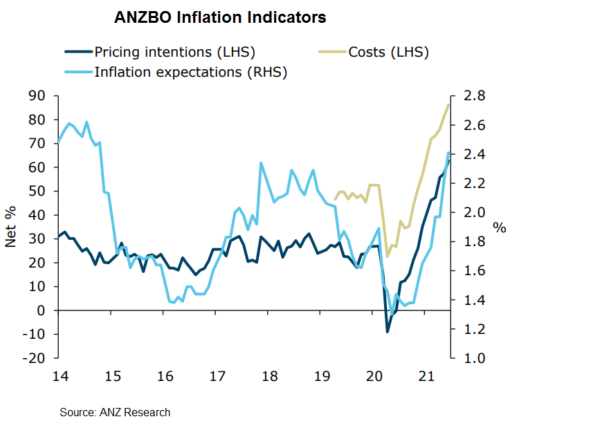

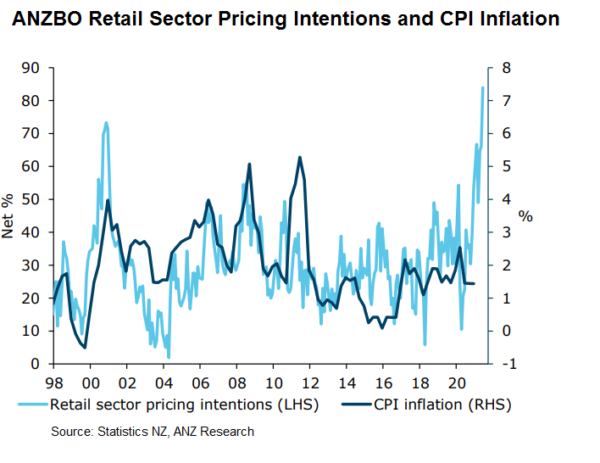

On the dataflow, GDP expanded +1.6% q/q in 1Q21, after contracting -1% a quarter ago. From the same period last year, the economy grew +2.4%, compared with a -0.8% decline in 4Q20. Inflation risk has intensified. In the June ANZ Business Outlook survey, it’s shown that 84% (pricing intention) of retailers intended to increase prices. Inflation expectations also reached +2.41%, significantly above RBNZ’s target range midpoint of 2%. The job market has also improved. Westpac’s quarterly Employment Confidence Index gained +4.4 points to 103.9 in 2Q21 amidst expectations of more vacancy. As suggested in the accompanying report, “the most notable result from the June survey was a strong lift in perceptions about current job opportunities, which are now above pre-Covid levels”.

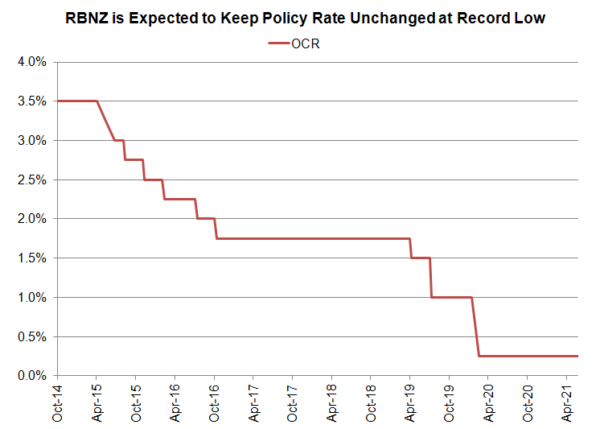

At the May meeting, the RBNZ turned more hawkish and pushed forward the first rate hike to 3Q22. Economic developments and the pandemic situation since then have led the market to anticipate an even earlier rate hike. Major banks such as ANZ and Westpac now expect to see the first rate hike in November. The market is already pricing in almost 90% odds of a hike by November, and “one and a half’ hikes by February. The central bank will leave the monetary policy unchanged but should indicated that rate hike could come earlier than previously suggested.

At the May meeting, the RBNZ turned more hawkish and pushed forward the first rate hike to 3Q22. Economic developments and the pandemic situation since then have led the market to anticipate an even earlier rate hike. Major banks such as ANZ and Westpac now expect to see the first rate hike in November. The market is already pricing in almost 90% odds of a hike by November, and “one and a half’ hikes by February. The central bank will leave the monetary policy unchanged but should indicated that rate hike could come earlier than previously suggested.

In May, the RBNZ took note of “the weak level of business investment” but there was a pleasant in the first quarter GDP data. It also suggested that “medium-term inflation and employment would likely remain below its Remit targets in the absence of prolonged monetary stimulus”. Yet, price pressure has been rising rapidly while the market has turned more optimistic about the job market. These references are now obsolete and should be amended.

The central bank also suggested in previous meetings that current levels of stimulus will remain in place for a “considerable” time. This can also be adjusted as the RBNZ prepares the market for a normalization of monetary policy.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals