New Zealand Dollar surges broadly again today as decade high CPI reading prompted more speculations on RBNZ rate hikes. That somewhat helps stabilizes the selloff in Aussie and Loonie. On the other hand, Yen appears to be softening slightly as rally lost steam. Dollar, Euro and Sterling are mixed. As for the week, Kiwi is overwhelmingly the strongest one, but Loonie and Aussie are the worst performers so far.

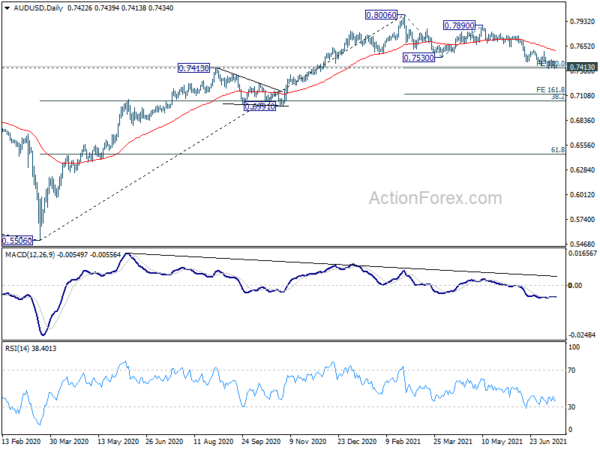

Technically, focus will stays on Dollar today, especially with retail sales data featured. USD/CAD’s break of 1.2589 resistance suggests resumption of rally from 1.2005. But no corresponding movement is seen in other Dollar pairs yet. Based on this week’s development elsewhere, we’d pay special attention to AUD/USD’s reaction to 0.7413 key support level, which it’s still defending. Sustained break there would indicate deeper medium term correction is underway, probably back to around 0.7.

In Asia, Nikkei closed down -0.98%. Hong Kong HSI is up 0.31%. China Shanghai SSE is down -0.60%. Singapore Strait Times is up 0.41%. Japan 10-year JGB yield is up 0.0083 at 0.023. Overnight, DOW rose 0.15%. S&P 500 dropped -0.33%. NASDAQ dropped -0.70%. 10-year yield dropped -0.059 to 1.297, back below 1.3 handle.

BoJ stands pat, upgrades inflation forecasts

BoJ kept monetary policy unchanged today. Under yield curve control framework, short term interest rate is held at -0.1%. 10-year JGB yield target is kept at around 0%, without upper limit on JGB purchases. The decision was made by 8-1 vote, with Goushi Kataoka dissented again, pushing for further strengthening of monetary easy, by lowering short and long term interest rates. BoJ will will also continue to buy ETFs and J-REITS with upper limit of JPY 12T and JPY 180B respectively.

In the new economic forecasts, BoJ:

- Downgraded fiscal 2021 GDP growth to 3.8% (from April’s 4.0%)

- Upgraded fiscal 2022 GDP growth to 2.7% (from 2.4%).

- Kept fiscal 2023 GDP growth at 1.3% (unchanged).

- Upgraded fiscal 2021 CPI core to 0.6% (from 0.1%).

- Upgraded fiscal 2022 CPI core to 0.9% (from 0.8%).

- Kept fiscal 2023 CPI core at 1.0% (unchanged).

New Zealand CPI rose 1.3% qoq, 3.3% yoy in Q2, RBNZ hike speculation intensifies

New Zealand CPI rose 1.3% qoq in Q2, well above expectation of 0.7% qoq. For the 12-month. CPI accelerated to 3.3% yoy, up from 1.5% yoy, well above expectation of 2.8% yoy. The annual rate is the highest in nearly a decade. Also, the figures were well above RBNZ’s forecast of 0.6% qoq 2.6% yoy inflation.

Speculations of an early RBNZ hike intensified further after the release. Westpac now expects a hike in OCR by 0.25% in August, with another hike at both October and November meeting. The developments pushed AUD/NZD through 1.0597 support today to resume the near term fall from 1.0944. Deeper decline could be seen towards lower part of the medium term range at 1.0415.

New Zealand BusinessNZ manufacturing rose to 60.7, facing labor shortages and logistics disruptions

New Zealand BusinessNZ Performance of Manufacturing Index rose from 58.6 to 60.7 in June. Looking at some details, production dropped slightly form 64.8 to 64.5. Employment rose from 52.0 to 56.5. New orders rose slightly from 63.5 to 63.6. Finished stocks rose from 53.6 to 57.3. Deliveries rose from 53.4 to 55.0.

BusinessNZ’s executive director for manufacturing Catherine Beard said: “Despite the overall pick-up in activity, the proportion of negative comments (53.1%) remained higher than positive ones (46.8%). Many of the positive comments outlined increased demand, but this is counterbalanced by significant labour shortages and logistics disruptions many manufacturers are now facing.”

Looking ahead

Eurozone CPI final, trade balance, Italy trade balance will be featured in European session. Later in the day, Canada will release housing starts, foreign securities purchase and whole sales sales. US retail sales will be the main focus while U of Michigan sentiment and business inventories will also be featured.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2527; (P) 1.2570; (R1) 1.2639; More…

USD/CAD’s rise from 1.2005 resumes by taking out 1.2589 today. Intraday bias is back on the upside for 1.2653 structure resistance. Decisive break there would confirm larger bullish reversal and target 1.3022 fibonacci level next. On the downside, break of 1.2423 support is needed to indicate short term topping. Otherwise, outlook will stay mildly bullish in case of retreat.

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). It might have completed after hitting 1.2061 (2017 low) and 50% retracement of 0.9406 to 1.4689 at 1.2048. Sustained break of 38.2% retracement of 1.4667 to 1.2005 at 1.3022 will pave the way to 61.8% retracement at 1.3650. Overall, medium term outlook remains neutral at worst with 1.2048/61 support zone intact.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | BusinessNZ Manufacturing Index Jun | 60.7 | 58.6 | ||

| 22:45 | NZD | CPI Q/Q Q2 | 1.30% | 0.70% | 0.80% | |

| 3:00 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 8:00 | EUR | Italy Trade Balance (EUR) May | 5.87B | |||

| 9:00 | EUR | Eurozone Trade Balance (EUR) May | 8.2B | 9.4B | ||

| 9:00 | EUR | Eurozone CPI M/M Jun F | 0.30% | 0.30% | ||

| 9:00 | EUR | Eurozone CPI Y/Y Jun F | 1.90% | 1.90% | ||

| 9:00 | EUR | Eurozone CPI Core M/M Jun F | 0.30% | 0.30% | ||

| 9:00 | EUR | Eurozone CPI Core Y/Y Jun F | 0.90% | 0.90% | ||

| 12:15 | CAD | Housing Starts Jun | 270.0K | 275.9K | ||

| 12:30 | CAD | Foreign Securities Purchases (CAD) May | 9.95B | |||

| 12:30 | CAD | Wholesale Sales M/M May | -0.90% | 0.40% | ||

| 12:30 | USD | Retail Sales M/M Jun | -0.60% | -1.30% | ||

| 12:30 | USD | Retail Sales ex Autos M/M Jun | 0.40% | -0.70% | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Jul P | 86.5 | 85.5 | ||

| 14:00 | USD | Business Inventories May | 0.40% | -0.20% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals