There were two main highlights from last week: The Federal Reserve meeting and earnings reports from some of the planet’s most valuable companies. As we noted in our Fed recap, the central bank hinted at progress toward its goals for tapering asset purchases, but some of the comments from Chairman Powell’s testimony suggest that the full taper plan won’t be revealed until closer to Q4 (especially after Friday’s Core PCE reading, the Fed’s preferred inflation figure, fell to 3.5% y/y). Meanwhile, the big technology behemoths reported generally strong earnings, though with Tesla Motors (TSLA) as the lone exception, each of their stocks closed notably lower on the week.

Bank of England

The Bank of England meets on Thursday, and though COVID cases in the country appear to have peaked for this wave (knock on wood), the central bank is unlikely to make any immediate changes to policy. That said, there have been some hawkish sentiments emerging from the Monetary Policy Committee in recent weeks following a jump in inflation to 2.5% in June, the highest reading in three years and above the central bank’s 2.0% target. As such, traders will be watching to see if the BOE raises its inflation forecasts moving forward, hinting that the price pressures may be less transitory than expected. Finally it’s worth noting that the UK furlough scheme winds down at the end of September, so it will be interesting to see if the central bank acknowledges the potential for the labor market to weaken in the coming months.

Non-Farm Payrolls

The monthly US jobs report has been particularly volatile of late as workers remain reticent to return amidst concerns about safety and continued elevated levels of unemployment insurance. Nonetheless, traders and economists are expecting a reading in the 925K range, which would mark the strongest labor market growth in eleven months if seen. Astute readers will be watching the employment subcomponents of Monday’s ISM Manufacturing PMI report and Wednesday’s ISM Non-Manufacturing PMI report, as well as Wednesday’s ADP employment report for leading indications on whether Friday’s headline NFP report could beat expectations. Beyond the headline jobs figure, the accompanying average hourly earnings reading will also offer insight into the quality of the jobs created and potential for more inflation, with expectations currently centered on a 0.3% m/m rise.

Earnings

So far, this quarter’s earnings have been characterized by stellar business results but relatively disappointing stock market reactions, as the FAAMG names last week exemplified. As always, traders are looking ahead and realizing that though the Q2 results have been undeniably strong, profit and revenue growth are likely to slow across the board heading through the second half of the year as stimulus starts to fade and the comparable quarters from last year represent slightly more normal business conditions.

Below are a few of the more notable companies that will be reporting this week:

HSBC, BABA, LLY, AMGN, BP, CVS, ROKU, GSK, UBER, GM, BYND, MRNA, SQ

Economic data

Monday

- Global: Manufacturing PMI Finals (JUL)

- China: Caixin Manufacturing PMI (JUL)

- Japan: Consumer Confidence (JUL)

- Germany: Retail Sales (JUN)

- US: Construction Spending (JUN)

- US: ISM Manufacturing PMI (JUL)

Tuesday

- Japan: Tokyo CPI (JUL)

- Australia: Home Loans (JUN)

- Australia: Building Permits Prel (JUN)

- Australia: RBA Interest Rate Decision

- EU: PPI (JUN)

- Canada: Manufacturing PMI (JUL)

- US: Factory Orders (JUN)

Wednesday

- Global: Services and Composite PMIs Final (JUL)

- New Zealand: Employment Change (Q2)

- Australia: Retail Sales Final (JUN)

- Australia: RBA Chart Pack

- China: Caixin Services and Composite PMI (JUL)

- EU: Retail Sales (JUN)

- US: ADP Employment Change (JUL)

- Canada: Building Permits (JUN)

- US: ISM Non-Manufacturing PMI (JUL)

- Crude Inventories

Thursday

- Australia: Trade Balance (JUN)

- Germany: Factory Orders (JUN)

- EU: Construction PMI (JUL)

- UK: Construction PMI (JUL)

- UK: BOE Interest Rate Decision

- Canada: Trade Balance (JUN)

- US: Trade Balance (JUN)

Friday

- Australia: RBA Statement on Monetary Policy

- New Zealand: Business Inflation Expectations (Q3)

- Germany: Industrial Production (JUN)

- UK: Halifax House Price Index (JUL)

- Canada: Employment Change (JUL)

- US: Non-Farm Payrolls (JUL)

- Canada: Ivey PMI (JUL)

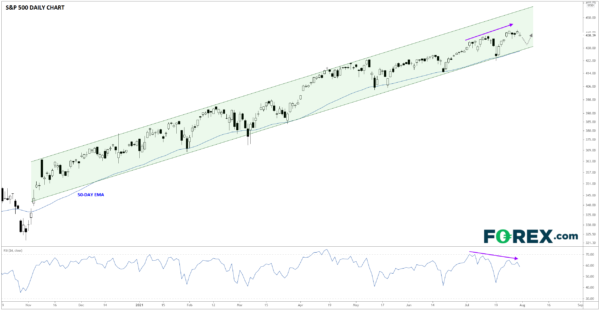

Chart of the week: S&P 500

The S&P 500, one of the most widely followed US stock indices, closed the week within a whisker of record highs. As the chart below shows, the index has consistently found support at its 50-day exponential moving average (EMA), signaling a strong, healthy uptrend. That said, the RSI indicator is showing a bearish divergence, forming lower highs at each of the last three price peaks; this divergence signals waning buying pressure and elevated odds of a near-term top, especially if this week’s earnings report come in soft or the highly-anticipated US infrastructure bill encounters a hiccup.

Source: Tradingview, StoneX

Regardless, traders are likely to buy any short-term dips in the index unless and until support at the rising 50-day EMA is conclusively broken.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals