Summary

United States: Demand Continuing to Outstrip Supply

- Although the headline rate of Q2 GDP came in softer than expectations, part of that was due to supply chain problems as businesses had to draw down inventories to meet demand, resulting in a drag on growth.

- Consumer spending exceeded expectations and the latest consumer confidence figures rose to a post-pandemic high.

- Next week: Construction Spending (Monday), ISM Manufacturing (Monday), Employment (Friday)

International: Eurozone Enjoying an Economic Recovery Sweet Spot

- Eurozone Q2 GDP rose more than expected, with particularly large gains for Italy and Spain, while confidence surveys suggest that momentum carried into at least the early part of the third quarter. Meanwhile, CPI inflation quickened only moderately in July, while core CPI actually slowed. Given this favorable growth and inflation mix, we expect the European Central Bank to maintain its accommodative monetary policy and, indeed, ease policy further by December.

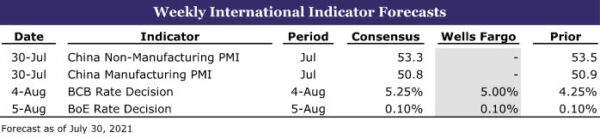

- Next week: China PMIs (Saturday), Brazil monetary policy announcement (Wednesday), Bank of England policy announcement (Thursday)

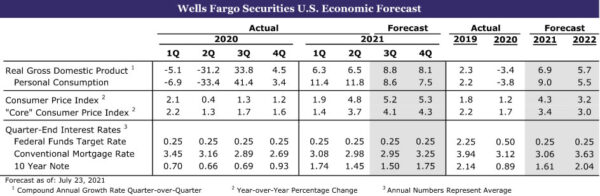

Interest Rate Watch: “Progress” Has Been Made, But Is It Enough To Taper?

- The Federal Open Market Committee (FOMC) announced no major policy changes at the conclusion of its two-day meeting on July 28, leaving the target range for the federal funds rate unchanged at 0.00% to 0.25%, and maintaining its monthly purchase rate of Treasury securities and mortgage-backed securities at $80 billion and $40 billion, respectively.

Credit Market Insights: Millennial Market Makers

- Despite high home prices and elevated debt burdens, homeownership among younger cohorts is starting to pick up meaningfully in the post-pandemic economy.

Topic of the Week: Infrastructure Deal Is the Appetizer to the Fall Fiscal Feast

- This week, Congress took a major step toward enactment of the $559 billion bipartisan infrastructure deal. The Senate voted 67-32 in favor of clearing an important procedural hurdle to eventual passage.

U.S. Review

Demand Continuing to Outstrip Supply

Despite a few misses on the headline numbers, economic data this week highlighted a theme of demand continuing to outstrip supply and ongoing slack in the labor market. In a way, this is the opposite problem of the prior cycle, when policymakers scratched their heads over why inflation remained tepid even amid the lowest unemployment rate in decades. At the press conference following the latest Fed meeting, it was clear from the Fed chair’s comments that policymakers are conflicted that inflation is on a tear even as slack remains in the labor market. When it comes to the tapering of asset purchases, there were still “a range of views” among members of the FOMC.

The Phillips curve tells us that inflation and unemployment should have a stable and inverse relationship. It stands to reason that a faster-growing economy should stoke inflation, while leading to less unemployment. But the past decade or so has demonstrated that this is not always how it plays out in reality. The economic data this week continued to reflect the labor market’s slow progress and the ongoing challenges of soaring demand amid worsening supply chain constraints. Initial jobless claims are now higher than at the end of May, and the number of those receiving ongoing jobless benefits also rose in the latest figures.

New home sales fell to their pre-COVID pace. Our best read here is that some home builders are limiting sales in new communities due to ongoing supply shortages of building materials, HVAC equipment and appliances. That is not to lay all the blame on supply chain woes, as sky-high prices play a role here as well. The drop in sales is helping inventory ramp back up. At 6.3 months’ worth of housing inventory, supply has almost doubled from a low of 3.5 months last summer. We look for sales and new home construction to rebound modestly from their current levels and for new home prices to moderate, as lower lumber prices allow builders to boost construction of more modestly priced homes.

Demand Strength Evident in This Week’s Data

Durable goods orders came in weaker than expected in June with an overall gain of just 0.8%, well short of the 2.2% consensus forecast, but the fact that prior month figures were revised higher takes some sting out of the miss. This was particularly true for core capital goods orders, which came in closer to consensus estimates, rising 0.5% in June versus an expected 0.7% on the heels of an upward revision that lifted May’s scant 0.1% gain to a respectable pickup of 0.5%. After having been beset by the combined challenges of aircraft safety concerns and the pandemic, which for a while sapped demand for travel, domestic manufacturing of aircraft is rebounding. Nondefense aircraft orders have risen by double digits in percentage terms in each of the past three months.

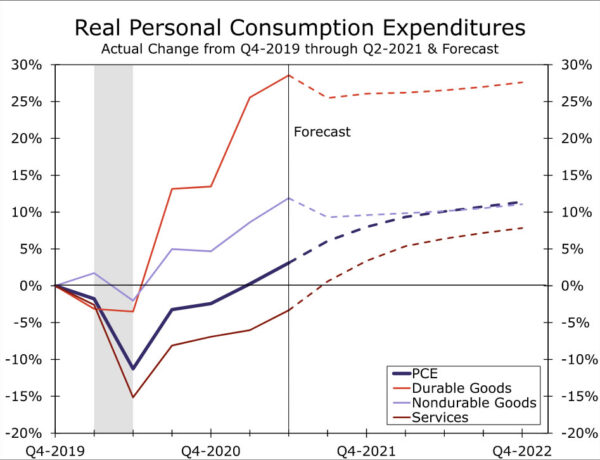

The orders’ strength bodes well for equipment spending, which we learned in this week’s GDP report has now grown at a double-digit percentage pace in each of the past four quarters. Although the headline real GDP growth rate of 6.5% was short of expectations, the miss was largely attributable to drags from inventories and trade (see chart). Growth in the second quarter was driven largely by consumer spending. Real personal consumption expenditures (PCE) shot up 11.8%, which was stronger than most analysts had expected, and every major category of spending posted solid gains. Specifically, spending on durable goods rose 9.9%, non-durable goods jumped 12.6% and services surged 12.0%. This robust growth in real PCE reflects the reopening of the economy that occurred in the second quarter and the fiscal relief measures that put money in consumers’ pockets (see chart).

Consumers are feeling more upbeat about their own short-term financial prospects as the share of those who expect their income to increase rose to 20.6%, the highest reading since the pandemic struck. These brighter income prospects may stem from a perception that labor market dynamics are improving. When asked about the labor market, the share of respondents seeing jobs as plentiful also rose to a new post-pandemic high of 54.9%, while the share of those who see jobs as hard-to-get remained at a very low 10.5%. As additional jobless benefits expire and kids return to school in coming months, these measures will offer early clues about how healthy job growth will be in the fall.

U.S. Outlook

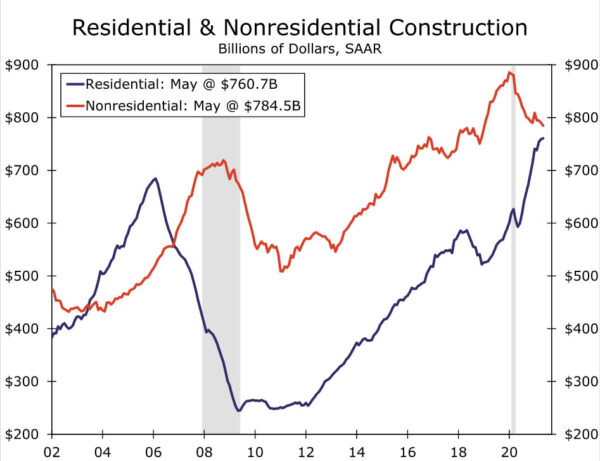

Construction Spending • Monday

During May, total construction spending declined 0.3% amid a slip in nonresidential activity and modest improvement in the residential sector. The weakness seen on the nonresidential side of the ledger is not surprising considering the sector continues to absorb the impacts of the pandemic. Warehouse construction remains a bright spot, but office, retail, lodging and education projects are struggling to get back on track. Meanwhile, residential construction continues to grow at a fairly strong pace as home builders rush to meet robust demand for single-family homes. The rapid recovery in apartment leasing as workers return to offices has encouraged developers to move forward with multifamily projects.

Looking ahead, overall construction spending looks set to climb higher in June despite the substantial headwinds of soaring building material costs and shortages of qualified labor. New nonresidential building starts have picked up in recent months, which is a harbinger for stronger spending in coming months. Residential activity appears poised for further improvement. Housing starts easily topped expectations and rose 6.3% to a 1.6 million-unit pace during June. Overall, we expect total construction outlays rose 0.6% during June.

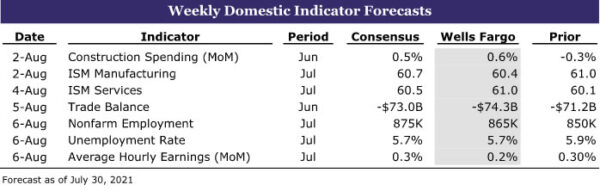

ISM Manufacturing • Monday

The ISM Manufacturing index slipped to a still-elevated reading of 60.6 during June. New orders and production both remain strong, but difficulties sourcing raw materials and finding workers have become massive constraints for producers. The employment component of the headline index fell into contraction territory during the month, which reflects just how pervasive labor shortages have become throughout the entire factory sector. What’s more, supply chain bottlenecks have rapidly raised the cost of procuring key input materials. During June, the prices paid component jumped to the highest level since 1979.

Supply-side headwinds notwithstanding, demand remains robust, which should support manufacturing activity for the foreseeable future. The Fed’s regional surveys of manufacturers generally came in strong during July, with the Empire, Kansas City and Richmond surveys beating consensus expectations.There are also tentative signs that some supply bottlenecks are starting to ease, as evidenced by the incremental improvement in wait times for supplier deliveries during June. Still, we expect a modest decline in the ISM for July, as hiring difficulties and supply chain bottlenecks continue to weigh on manufacturing activity.

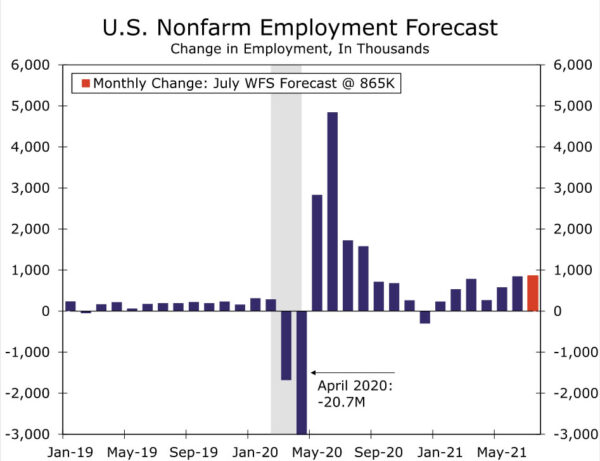

Employment • Friday

The labor market recovery is gaining momentum. Employers added 850,000 new jobs during June, the strongest gain since last August. Most major industries added to payrolls during the month, particularly in the leisure and hospitality, wholesale trade and transportation, retail and professional services industries. Hiring in the public sector also picked up notably. The unemployment rate edged up to 5.9%, but there was a jump in labor force participation among prime-age workers. The monthly jump in payrolls comes as many businesses are raising wages in order to attract and retain workers amid widespread labor shortages. Average hourly earnings rose 0.3% during June, with some of the largest gains occurring in lower-paying industries.

Worker shortages are clearly still holding back the pace of hiring, but those constraints should continue to ease over the next few months. The recent improvement in prime-age participation indicates that an abundance of job openings and rising wages are coaxing some workers off the sidelines. Even with the recent uptick in COVID case counts, schools appear set to reopen, which should lessen childcare issues. The extra $300 in federal unemployment benefits is scheduled to lapse in September, and many states have already withdrawn from the program. Bearing this is mind, we expect employers added 865,000 jobs in July.

International Review

Eurozone Enjoying an Economic Recovery Sweet Spot

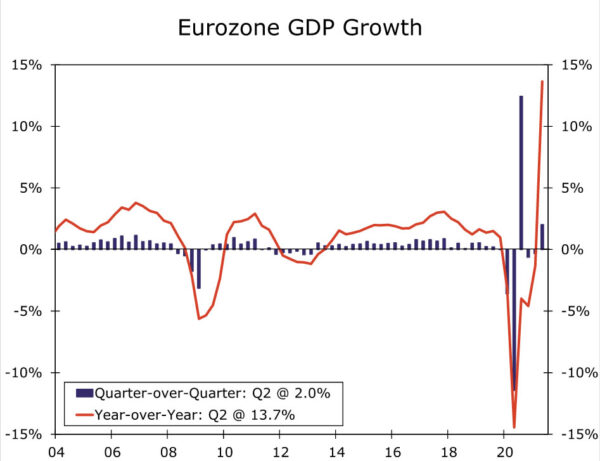

This week saw a trifecta of good news regarding the renewed Eurozone economic expansion. Eurozone Q2 GDP rose 2.0% quarter-over-quarter and jumped 13.7% year-over-year, the latter boosted by base effects. Not only was the outcome stronger than expected, but the sequential quarterly increase represented a return to growth after two straight quarters of contraction. Economic growth was also fairly broad-based across the region. With respect to the region’s larger economies, German GDP rose 1.5% quarter-over-quarter, French GDP rose 0.9%, Italian GDP rose 2.7% and Spanish GDP rose 2.8%. In terms of the countries that released details on the breakdown of growth, France saw Q2 household consumption rise 0.9% quarter-over-quarter, while Spain’s Q2 household consumption surged 6.6%.

In addition to the confirmation of strong growth in Q2, survey data suggest that activity remained firm at least during the early part of the third quarter. Eurozone July economic confidence rose more than expected to 119.0, a record high since the series began in 1985. The details showed both services confidence and industrial confidence rose, to 19.3 and 14.6, respectively. While the strong confidence surveys (along with last week’s PMIs) are encouraging for the Q3 growth outlook, some caution remains regarding growth prospects given the renewed spread of COVID cases across the region. Accordingly, confidence surveys will continue to be watched closely in the months ahead for any hints of whether the latest wave of COVID cases is weighing on activity.

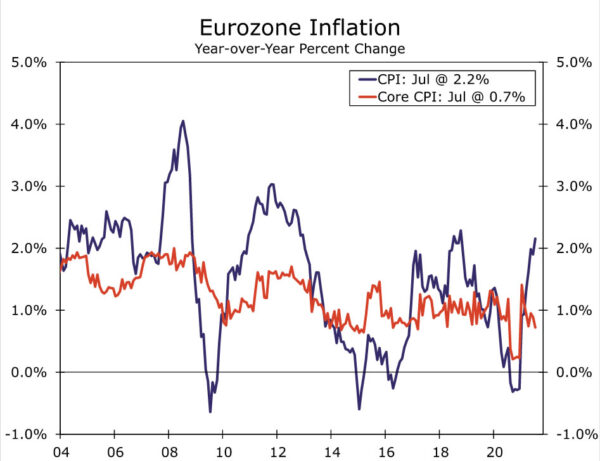

So far, stronger growth in the Eurozone has not been accompanied by significantly faster inflation, in contrast to the sharp uptick of inflation seen in the United States. The Eurozone July CPI firmed moderately to 2.2% year-over-year, while the core CPI slowed to 0.7%. Services inflation quickened slightly to 0.9% year-over-year, while inflation for non-energy industrial goods decelerated to 0.7%.

What are the potential implications of this growth and inflation mix for the European Central Bank’s (ECB) monetary policy? The ECB will certainly welcome the improvement in growth, while the moderate inflation trends means there is no need for the central bank to move to less accommodative monetary policy any time soon. That is reinforced by recent changes by the ECB to its policy strategy, which included a shift to a symmetric 2% inflation target, and the dovish policy guidance from the ECB following its July monetary policy meeting. Given the latest COVID developments have added some element of near-term uncertainty, we now expect the ECB to refrain from tapering its bond purchases in September, and instead signal that Q4 buying for the Pandemic Emergency Purchase Program (PEPP) will continue to be conducted at a significantly higher pace than during the early months of this year.

In addition, if recent COVID developments do eventually have some influence on confidence and activity, and more importantly should underlying inflation trends fail to move meaningfully higher, we expect the ECB to announce a further increase in bond purchases. Our base case for the European Central Bank’s December monetary policy announcement is for the central bank to announce a further €500 billion increase in PEPP purchases, taking the size of that program to €2.350 trillion, with purchases under the PEPP program to continue until at least September 2022.

Mixed Economic News From Japan and Canada

There was both good and bad economic news emanating from Japan and Canada this week. In Japan, June activity data were a pleasant surprise as retail sales rose 3.1% month-over-month, a bit more than expected, while June industrial output rose 6.2%, also an upside surprise. However, with the government imposing a renewed state of emergency for the Tokyo area in recent weeks, there are concerns about how sustainable that upswing might be. Indeed, those concerns are apparent in Japan’s July PMI surveys, as the manufacturing PMI eased to 52.2 and the services PMI fell more noticeably, to 46.4.

In Canada, May GDP registered another small decline of 0.3% month-over-month, following a slightly larger fall in April. May service sector activity fell 0.2%, while industrial output rose 0.2%. More recently, however, new COVID cases have slowed and restrictions have been lifted. Against this backdrop, Statistics Canada’s early estimate for June GDP is more encouraging. June GDP is expected to rise 0.7% month-over-month, which would mean an overall Q2 growth of around 0.6% quarter-over-quarter (not annualized). Canada’s June inflation figures were also good news, at the margin. While still elevated, June CPI inflation slowed to 3.1% year-over-year, while the average of the core CPI measures was steady at 2.2% year-over-year.

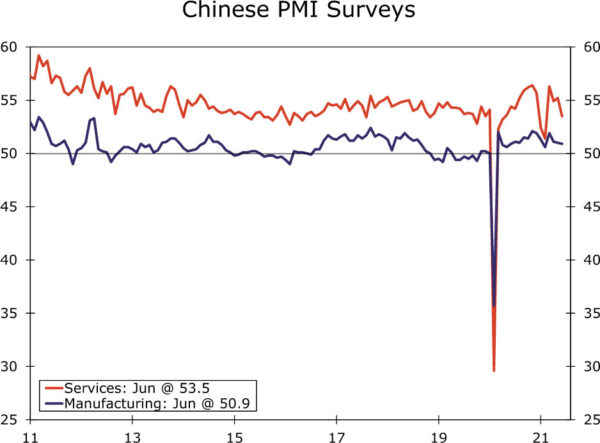

International Outlook

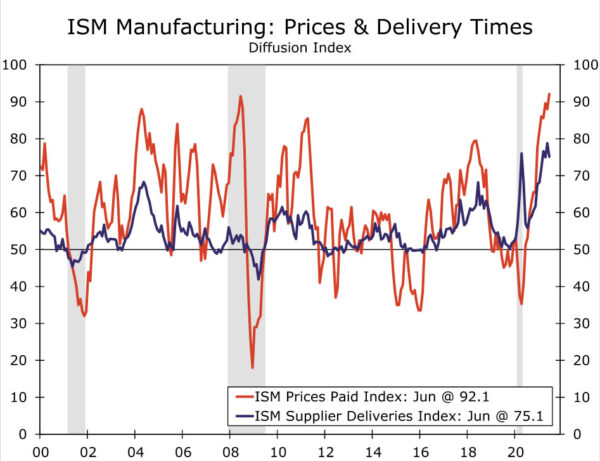

China PMIs • Saturday

China’s July manufacturing and services PMIs are due next week. These surveys will be closely scrutinized by market participants for signs of a stabilizing economy. China’s Q2 GDP slowed a bit more than expected to 7.9% year over year, although June retail sales and industrial output both surprised to the upside, hinting at some resilience in the economy moving forward. The July PMIs may offer indications of whether that resilience is temporary or the beginning of a new trend.

The July official manufacturing PMI is forecast to ease further to 50.8, while the services PMI, which will probably be even more closely watched, is expected to fall to 53.3. In addition, the July Caixin manufacturing PMI is expected to fall to 51.0, while the Caixin services PMI should rise to 50.5. Overall, a more moderate fall in China’s July PMIs would not be a surprise or a cause for concern. An unexpected increase in the July PMI would likely be taken as an encouraging sign and could boost broader sentiment for the global economy.

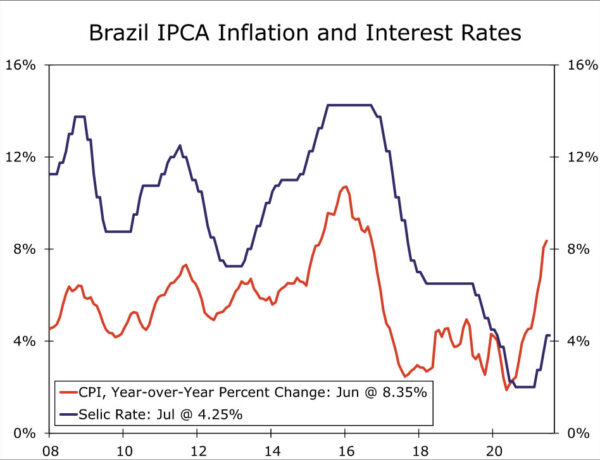

Brazil Monetary Policy Announcement • Wednesday

Brazil’s central bank (BCB) announces its monetary policy decision next week and is expected to deliver a rate increase. The consensus forecast is for BCB to raise its Selic rate by 100 bps to 5.25%. We anticipate a slightly smaller, but still sizable, 75-bp hike, though we also believe the risks are tilted toward a larger hike.

The key driver of the central bank’s tightening cycle is still elevated inflation, as June CPI inflation quickened to 8.35% year-over-year. Potentially adding to the rationale for monetary tightening has been some improvement in economic activity in recent months. For example, the manufacturing and services PMIs both increased in June, to 56.4 and 53.9, respectively, and next week’s release of the July PMIs will also be closely watched. June industrial output is also forecast to rise 0.2% month-over-month. Regardless of the size of next week’s rate increase, we expect a series of hikes over the balance of this year and forecast the Selic rate to finish 2021 at 7.50%.

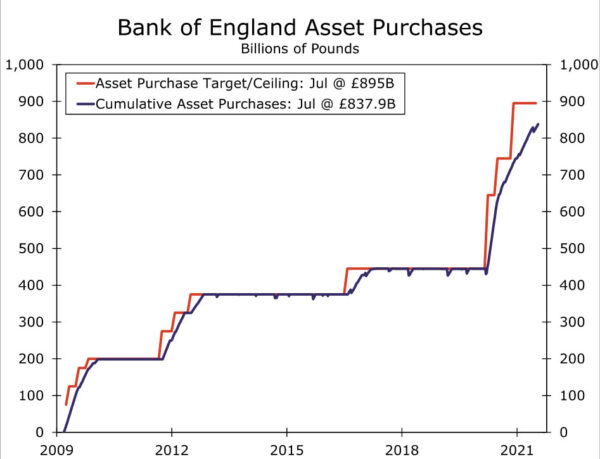

Bank of England Policy Announcement • Thursday

The Bank of England (BoE) makes its monetary policy announcement next week, and while no major changes are expected, we will be watching closely for whether the BoE offers any new hints on future policy moves. For next week’s meeting, we expect the BoE to hold its policy rate at 0.10% and to keep its asset purchase target at £895 billion.

The U.K. economy has enjoyed steady, and at times quite strong, gains since early this year. However, a sharp spike in new COVID cases in recent weeks, which has since receded, has created some concern regarding the outlook. Comments from central bank policymakers have also been somewhat mixed. As a result, while it is a close call on whether the Bank of England will taper its bond purchases further, on balance we do expect the central bank to announce slowing in the pace of purchases by £1 billion per week to £2.44 billion per week. The central bank’s updated forecasts in its August Inflation Report will also be scrutinized for indications of whether the BoE expects a significant hit to growth from the latest wave of COVID cases. If the central bank’s GDP growth is only little changed from previously, it is possible that more market participants will expect an earlier Bank of England rate hike.

Interest Rate Watch

“Progress” Has Been Made, But Is It Enough To Taper?

As was widely expected, the Federal Open Market Committee (FOMC) announced no major policy changes at the conclusion of its two-day meeting on July 28. The FOMC left its target range for the federal funds rate unchanged at 0.00% to 0.25%, and it also decided to maintain its monthly purchase rate of Treasury securities and mortgage-backed securities at $80 billion and $40 billion, respectively. Both decisions were unanimously supported by all 11 voting members of the committee.

But, the FOMC did make an important tweak to the policy statement that it released at the conclusion of the meeting. The FOMC has been stating that “substantial further progress” needs to be made toward the committee’s twin goals of maximum employment and price stability before a tapering of asset purchases is warranted. The statement that was released on Wednesday said that “the economy has made progress toward these goals” and that the committee “will continue to assess progress in coming meetings.” In other words, progress has been made, but not quite enough to warrant a near-term commencement of “tapering.” Note the reference to “coming meetings.” It does not seem that the FOMC is in any hurry to taper, although the committee does seem to acknowledge that the time is drawing nearer.

As we discussed in our recent July Flashlight for the FOMC Blackout Period, we look for the FOMC to make a formal announcement regarding the tapering of its asset purchases at the December 14-15 meeting, and we expect the Fed to begin the process of winding down its purchases early next year. But, before that formal announcement is made, we suspect Fed officials will hint that tapering will be forthcoming. These hints could potentially come as early as next month when Chair Powell is expected to make a speech at the Jackson Hole Symposium or at the conclusion of the September 22 FOMC meeting. Long-term interest rates could begin to creep higher as expectations of Fed tapering ramp up.

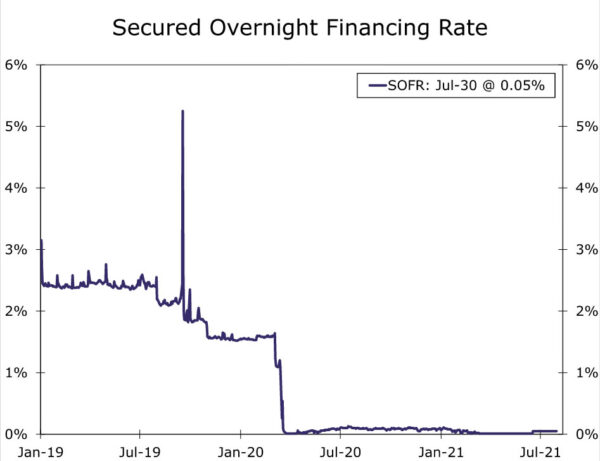

Fed Establishes Standing Repo Facilities

The FOMC also made a policy change that was less noticed because it is largely technical in nature. Specifically, the committee established two standing repurchase agreement facilities, one for domestic financial institutions and one for foreign central banks. The Fed is establishing these facilities to “serve as backstops in money markets to support the effective implementation of monetary policy and smooth market functioning.”

These standing repo facilities will help to provide liquidity to the financial system when it is needed. Previously, the Fed engaged in repos when stress appeared in the system. For example, the stress that appeared in the system in mid-September 2019 caused many short-term interest rates to spike at that time (see chart). The Fed eventually stepped in to provide liquidity, and rates subsequently receded.

The Fed plans to conduct overnight repo auctions every day. The maximum size of each auction will be $500 billion at a rate of 0.25%. Given that the financial system is currently awash in liquidity and that short-term interest rates are significantly less than 0.25%, the Fed likely will get very little interest in its repo facilities at this time. But, the facilities will already be operational when stresses appear, and financial institutions and foreign central banks will likely quickly turn to the Fed when liquidity gets tight. The upshot is that the Fed’s standing repo facilities will likely help to mitigate spikes in short-term rates when financial market stresses inevitably appear.

Credit Market Insights

Millennial Market Makers

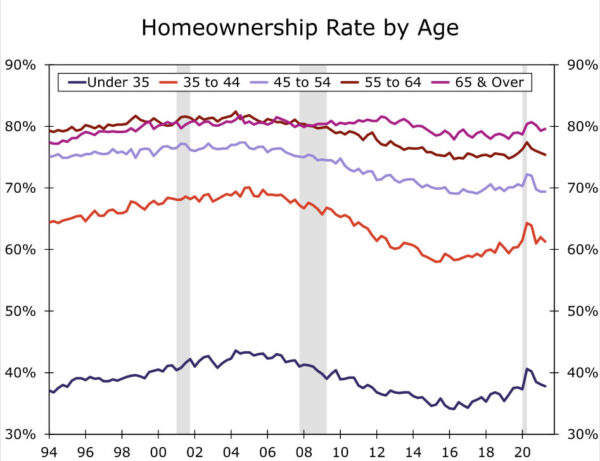

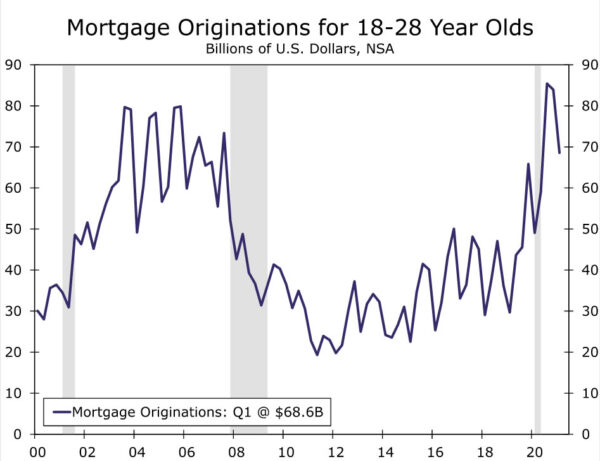

Prior to the pandemic, one of the concerns within the housing market was that millennials would not be buying homes. The percentage of 18- to 29-year-olds living with their parents had been trending up since the Great Recession. Those living on their own were opting to rent in the urban core relative to prior generations. Part of this shift was blamed on increasing debt, particularly from student loans. The amount of student debt held by those under 39 more than tripled between 2004 and 2017, according to the Federal Reserve Bank of New York. Despite this apparent shift in preferences and higher debt burdens, the nation’s largest generation has started to help prop up housing demand. Data released by the Census Bureau this week showed that the spike in the homeownership rate during the pandemic had more to it than just pandemic-related survey distortions. In the Q2, homeownership rates for those under 35 were up to 37.8%, a 1.4 percentage point increase from Q2-2019. Furthermore, homeownership rates for this age cohort during the pandemic have been the highest since Q3-2011. For 35- to 44-year-olds, homeownership was up to 61.3%, a 1.9 percentage point increase from two years ago.

With their eyes set on becoming first-time home buyers, millennials have had to face a red-hot housing market, as the median existing home price increased 23.4% over the past year to $363,300 in June. A potential headwind for millennial housing demand stems from trying to finance housing purchases. Despite these high prices, millennials have still been able to capitalize off of the promising mortgage market. According to Freddie Mac, the current 30-year fixed mortgage rate sits at 2.8%, which is among record-low levels. Younger millennials and Gen Z have also benefited from these historically low rates, as those between the ages of 18 and 29 accounted for $68.6 billion in mortgage originations during Q1 of this year, a 131% increase from two years ago.

Despite a plethora of potential drawbacks, including elevated debt and high home prices, housing demand among millennials has remained strong. While home prices may remain elevated in the coming months, we can expect housing demand among the millennial cohort to continue to contribute to a robust housing market.

Topic of the Week

Infrastructure Deal Is the Appetizer to the Fall Fiscal Feast

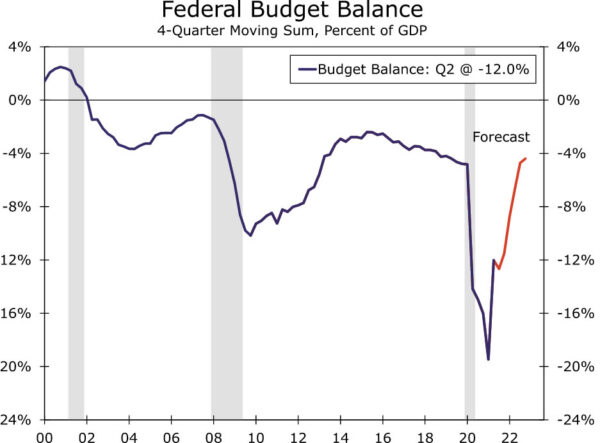

About one month ago, a group of bipartisan Senators and the White House reached an agreement on an infrastructure plan that included $559 billion of new spending over a five-year period. Since then, legislators and White House officials have been haggling over the specifics of the agreement and, on the Democratic side, contemplating how it fits into the Biden administration’s larger ambitions for the American Jobs Plan and the American Families Plan. This week, Congress took a major step toward enactment of this bipartisan infrastructure deal. The Senate voted 67-32 in favor of clearing an important procedural hurdle to eventual passage. Note that this was not a vote on the actual piece of legislation; the writing of the bill and final passage may take another week or so. That said, 17 Republicans joining 50 Democrats on this procedural vote signals that the final bill will likely pass. Although there were some changes relative to the original agreement, the broad strokes of the plan are more or less the same.

One might think that the next step for this infrastructure bill would be a quick stop in the House of Representatives before being sent to the president’s desk for his signature. However, it appears that if the Senate passes the legislation as is expected, the Democratic majority in the House will sit on the bill indefinitely. Democratic leaders in the House do not want to pass the bipartisan infrastructure package until they see more meaningful progress on a much larger budget reconciliation bill that contains more of the president’s priorities.

So what happens next? We suspect the main action will remain in the Senate as it turns to the first step of the budget reconciliation process: passing a budget resolution. Democrats in the Senate appear to be circling the wagons around a budget resolution that would permit up to $3.5 trillion of new spending over a decade. A critical thing to understand about this step is that if Democrats agree to and pass a budget resolution along these lines, the $3.5 trillion figure is a ceiling, but not a floor. Meaning, the eventual budget reconciliation bill can include less spending, but it cannot contain more. A similar dynamic was at work in 2017 when Republicans passed the Tax Cuts and Jobs Act. Their budget resolution permitted tax changes that reduced revenues by no more than $1.5 trillion over a decade, a ceiling they eventually hit in full.

It is possible that the Senate will vote on a budget resolution before leaving for a monthlong recess on August 6. Other than that, we doubt much more will happen with the reconciliation bill in the next week or so. As a result, the timeline we have laid out in previous reports now looks locked in place: The fall will contain the main drama as the moderate and progressive wings of the Democratic party lock horns over a rewrite of the nation’s tax code and social welfare programs. We continue to believe a reconciliation bill will eventually become law, but that new spending will be lower than the proposed $3.5 trillion. We think something along the lines of $2.0 trillion to $2.5 trillion in new spending over a decade, with roughly half of that paid for with higher tax revenues, is around where the reconciliation bill will ultimately land. This would be in addition to the $500 billion or so of new spending from the bipartisan infrastructure agreement.

We have written previously that even if the reconciliation bill effort fails, something will eventually become law. The bipartisan infrastructure plan agreed to this week appears poised to become that fallback plan. If Democratic leaders in the House face the prospect of passing nothing or passing just the standalone infrastructure bill, we believe they would ultimately adopt the latter approach.

In addition to these ongoing policy developments, Congress must also fund the government past September 30 to avert a government shutdown and increase or suspend the debt ceiling sometime before late October/early November. With so much action looming on the horizon, we encourage our readers to enjoy the final month of summer and prepare for a fall full of fiscal policy twists and turns.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals