Overall markets were rather mixed for the moment. Dollar’s selloff was quickly choked off by strong ISM services overnight, even though there is no clear follow through buying. Traders are holding off the bets for now, awaiting tomorrow’s non-farm payroll figures. Sterling will come to the center of the stage today first, with BoE super Thursday. But barring the situation of drastic surprise in asset purchase voting, the event is unlikely to trigger some sustainable moves.

Technically, development in gold is a clear reflection of indecisiveness in the markets. Another attempt on breaking through 1833.91 resistance failed. Yet, it’s still holding on to 4 hour 55 EMA and 1800 handle. At this point, further rise is still in favor and break of 1833.91 would finally resume the rebound from 1750.49 to 61.8% retracement of 1916.30 to 1750.39 at 1852.96. On the downside, firm beak of 1789.42 support is needed to confirm completion of the rebound from 1750.49, in case of any pre- and post-NFP jitters.

In Asia, at the time of writing, Nikkei is trading up 0.44%. Hong Kong HSI is down -0.38%. China Shanghai SSE is down -0.06%. Singapore Strait Times is down -0.36%. Japan 10-year JGB yield is up 0.0046 at 0.009. Overnight, DOW dropped -0.92%. S&P 500 dropped -0.46%. NASDAQ rose 0.13%. 10-year yield rose 0.008 to 1.184.

Fed Kaplan wants tapering soon, but not aggressive on rate

Dallas Fed President Robert Kaplan told Reuters that, “as long as we continue to make progress in July numbers and in August jobs numbers, I think we’d be better off to start adjusting these purchases soon,” referring to the QE program.

He added that tapering over a time frame of “plus or minus” about eight months would help give the Fed ” as much flexibility as possible to be patient and be flexible on the Fed funds rate.”

He emphasized it’s “important to divorce discussion of the Fed funds rate from discussion of our purchases.” His comments on purchases are not intended to suggest I want to take more aggressive action on the Fed funds rate.”

Fed Daly ready for tapering by the end of the year or early next

San Francisco Fed President Mary Daly said in a PBS interview, she didn’t expect the Delta variant to “derail recovery” in the US. nevertheless, “it’s already very seriously interrupting the recoveries in the global economy,” which is a “headwind on US growth.

She’s looking for “continued progress in the labor market, continued putting COVID behind us, rising vaccination rates, the things that are so fundamental to us saying that the economy has achieved that metric of substantial further progress.”

Right now, her modal outlook is that “we will achieve that metric later this year or early next”. And, “we will do something on the asset front, asset purchase tapering, by the end of this year or early next.”

Fed Clarida: Will provide advance notice before making any changes to purchases

Fed Vice Chair Richard Clarida said in a speech that “we are clearly a ways away from considering raising interest rates and this is certainly not something on the radar screen right now”.

If outlook of inflation and unemployment turn out to be the actual outcomes, the necessary conditions for raising federal funds rate “will have been met by year-end 2022.” If inflation remain well anchored at 2%, commencing policy normalization in 2023 would then be “entirely consistent with our new flexible average inflation targeting framework.”

As for asset purchases, he said FOMC members expected the economy to continue to move toward the standard of “substantial further progress.”

FOMC will asses the progress in coming meetings. He reiterated the pledge that, “we will provide advance notice before making any changes to our purchases.”

Australia trade surplus widened to AUD 10.2B in Jun

Australia exports of goods and services rose AUD 1489m (4% mom) to AUD 43.34B in June. Imports of goods and services rose AUD 261 m (1% mom) to AUD 32.84B. Trade surplus widened to AUD 10.50B, from AUD 9.27B, slightly above expectation of AUD 10.20B.

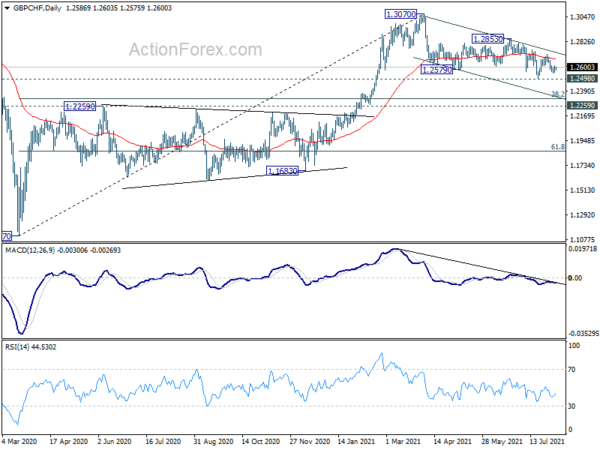

BoE to remain upbeat on outlook, GBP/CHF trading with undertone

No policy change is expected from BoE today. But recent development suggests that policymakers would remain upbeat about the economic outlook. Upgrades in the near-term GDP growth and inflation forecasts are likely. The development to keep Bank Rate unchanged at 0.10% should be unanimous. Yet, the vote on maintaining asset purchase target at GBP 895B would be divided. Michael Saunders and Dave Ramsden could vote for an early end to the program. At the May and June meetings, the now-departed Chief Economist, Andy Haldane, was the only member dissenting to leave the size of QE purchases unchanged.

Suggested readings on BoE:

GBP/CHF continues to trade with an undertone for the near term, as recoveries were limited by 55 day EMA. At this point the choppy correction from 1.3070 is still in favor to continue. Break of 1.2498 support would target 1.2259 key resistance turned support next.

Looking ahead

Germany will release factory orders and France will release industrial output in European session. later in the day, US will release Challenger job cuts, trade balance and jobless claims. Canada will release trade balance.

USD/JPY Daily Outlook

Daily Pivots: (S1) 108.91; (P) 109.29; (R1) 109.87; More…

Intraday bias in USD/JPY is turned neutral with current recovery. Some consolidation would be seen first but further decline remains in favor as long as 110.58 resistance holds. On the downside, break of 108.71 will resume the decline from 111.65 to 38.2% retracement of 102.58 to 111.65 at 108.18. Nevertheless, firm break of 110.58 will argue that that corrective fall has completed and bring retest of 111.65.

In the bigger picture, medium term outlook is staying neutral with 111.71 resistance intact. Firm break of 107.47 will argue that pattern from 101.18 has started another falling leg already. Deeper decline could be seen back to 101.18/102.58 support zone. For now, outlook won’t turn bullish as long as 111.71 resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:30 | AUD | Trade Balance (AUD) Jun | 10.50B | 10.20B | 9.68B | 9.27B |

| 6:00 | EUR | Germany Factory Orders M/M Jun | 1.50% | -3.70% | ||

| 6:45 | EUR | France Industrial Output M/M Jun | 0.50% | -0.30% | ||

| 8:00 | EUR | ECB Economic Bulletin | ||||

| 8:30 | GBP | Construction PMI Jul | 63.8 | 66.3 | ||

| 11:00 | GBP | BoE Rate Decision | 0.10% | 0.10% | ||

| 11:00 | GBP | BoE Asset Purchase Facility | 895B | 895B | ||

| 11:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | ||

| 11:00 | GBP | MPC Asset Purchase Facility Votes | 0–1–8 | 0–1–8 | ||

| 11:30 | USD | Challenger Job Cuts Y/Y Jul | -88.00% | |||

| 12:30 | CAD | International Merchandise Trade (CAD) Jun | 0.4B | -1.4B | ||

| 12:30 | USD | Trade Balance (USD) Jun | -72.5B | -71.2B | ||

| 12:30 | USD | Initial Jobless Claims (Jul 30) | 400K | |||

| 14:30 | USD | Natural Gas Storage | 36B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals