Yen rises broadly in Asian session on a couple of risk off factor, all linked to the pandemic. The set of weaker than expected data from China suggested that recovery is losing much momentum as the coronavirus is back. Japan reported surge in infections while Australia is also back in tighter restrictions. Commodity currencies tumble in general, with Aussie hardest hit. European majors are currently mixed, but stays firm against Dollar for now.

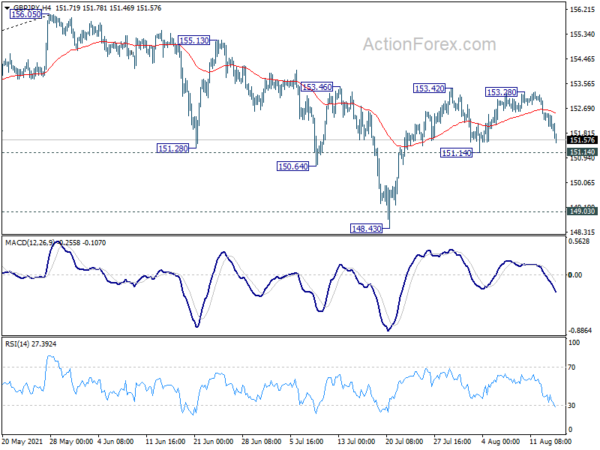

Technically, EUR/JPY looks heading back to retest 128.58 support after multiple rejections by 4 hour 55 EMA. GBP/JPY is also eyeing 151.14 support and break will bring deeper fall towards 148.43 support. Developments in these two crosses will be watch to gauge the underlying strength in Yen for the days ahead.

In Asia, at the time of writing, Nikkei is down -1.86%. Hong Kong HSI is down -0.74%. China Shanghai SSE is up 0.37%. Singapore Strait Times is down -0.34%. Japan 10-year JGB yield is down -0.015 at 0.009.

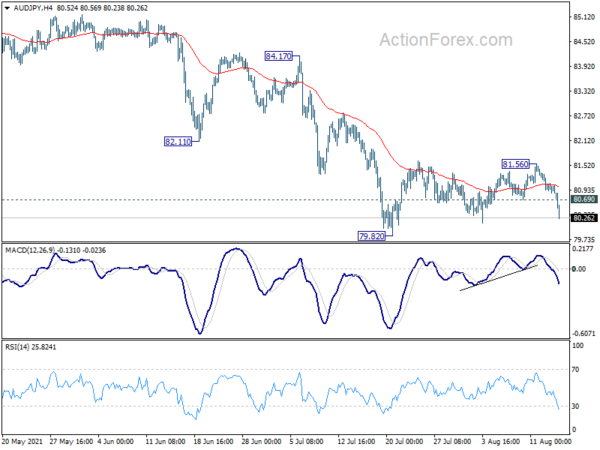

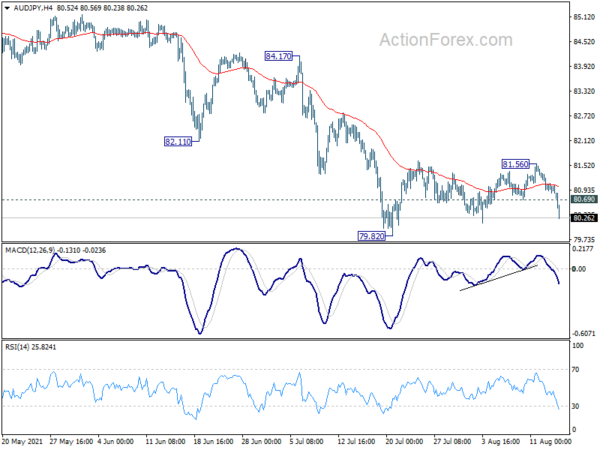

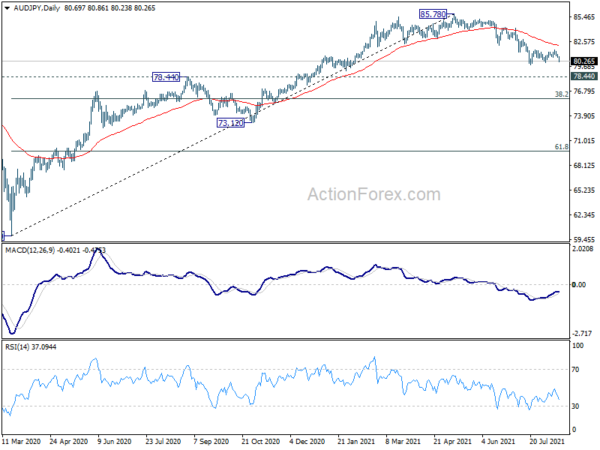

AUD/JPY falls sharp on surging delta infections, tougher restrictions

AUD/JPY drops sharply today on a couple of risk-off factors. Australia itself is troubled by heavier restrictions on surge of Delta variant. New South Wales reported record infections while Melbourne is back in night curfew. Lockdown in the Australian Capital territory was extended for another two weeks. Northern Territory also enters a three day snap lockdown.

AUD/JPY’s strong break of 80.69 support suggests that consolidation from 79.82 has already completed at 81.56, capped well below falling 55 day EMA. Deeper fall is now expected to 79.82 support first. Break will resume the whole decline from 85.78. Such decline is possibly correcting the whole up trend from 59.85, and would target 78.44 resistance turned support, or further to 38.2% retracement of 59.85 to 85.78 at 75.87 before completion.

China industrial production, retail sales, investment missed expectations

Industrial production rose 6.4% yoy in July, below expectation of 7.8% yoy. Retail sales rose 8.5% yoy, below expectation of 11.5% yoy. Fixed asset investment grew 10.3% ytd yoy, below expectation of 11.3% ytd yoy.

“Given the combined impact of sporadic local outbreaks of Covid-19 and natural disasters on the economy of some regions, the economic recovery is still unstable and uneven,” said NBS. “We should not only look at the growth to analyze the economic situation, but also need to look at the overall picture of employment, prices and residential incomes.”

Japan GDP grew 0.3% qoq, 1.3% annualized in Q2

Japan GDP grew 0.3% qoq in Q2, above expectation of 0.2% qoq. The economy was back in growth after -1.0% qoq contraction in Q1. In annualized term, GDP grew 1.3%, above expectation of 0.7%.

Looking at some details, external demand contracted -0.3% qoq, versus expectation of -0.1% qoq. Capital expenditure rose 1.7% qoq, matched expectations. Private consumption grew 0.8% qoq, much better than expectation of -1.0% qoq. Price index dropped -0.7% yoy, worse than expectation of -0.4% yoy.

Fed Kashkari: Ready to start tapering after a few more strong job reports

Minneapolis Fed President Neel Kashkari said in a Bloomberg interview, “if we see a few more jobs reports like the one we just got, then I would feel comfortable saying yeah, we are — maybe haven’t completely filled the hole that we’ve been in — but we’ve made a lot of progress, and now, then will be the time to start tapering our asset purchases.”

“I’m not convinced we were actually at maximum employment before the Covid shock hit us. So, that’s exactly why I want us to be really humble about declaring, ‘This is as good as it can get’,” he said.

He added that labor force participation and employment rates have to be “at least back to where they were before” and that’s a “reasonable thing for us to try to achieve.”

RBNZ to hike, consumers, inflation and employment to watch

RBNZ is set to the the first major central bank to raise interest rate this week, lifting the OCR from 0.25% to 0.50%. There is even some speculation of a 50bps hike, but it’s very unlikely for now. Main focus is needed on the central bank’s guidance on whether it will hike again later this year, and on what conditions. Minutes of RBA and FOMC meeting will be closely watched too.

On the data front, anything related to US consumers will carry a higher weight for now, like retail sales. UK will also release employment, CPI and retail sales. Canada will release CPI while Australia will release employment. These are the data which could be more market moving. Here are some highlights for the week:

- Monday: Japan GDP, industrial production final; China fixed asset investment, industrial production, retail sales, unemployment; Canada manufacturing sales, wholesale sales; US Empire State manufacturing index.

- Tuesday: RBA minutes, Japan tertiary industry index; UK employment; Eurozone GDP, employment; Canada housing starts, foreign securities purchases; US retail sales, industrial production, business inventories, NAHB housing market index.

- Wednesday: Japan trade balance, machine orders; Australia wage price index; RBNZ rate decision; UK CPI, RPI, PPI; Eurozone CPI final; Canada CPI; US housing starts and building permits; FOMC minutes.

- Thursday: Australia employment; Swiss trade balance; Eurozone current account; Canada ADP employment; US Philly Fed survey, jobless claims, leading indicators.

- Friday: Japan CPI, Germany PPI; UK retail sales, public sector net borrowing; Canada retail sales, new housing price index.

GBP/JPY Daily Outlook

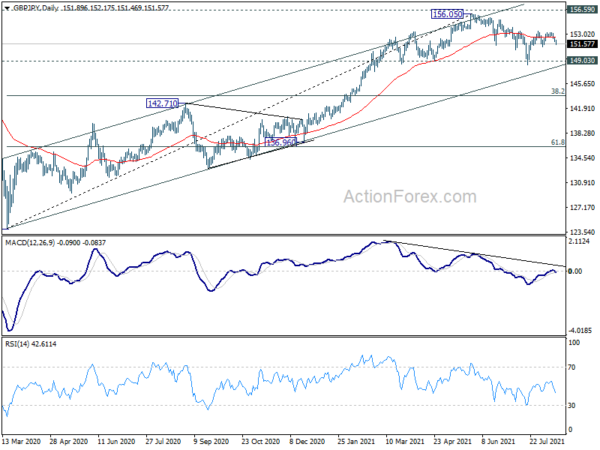

Daily Pivots: (S1) 151.77; (P) 152.17; (R1) 152.40; More…

GBP/JPY drops notably today but stays in range of 151.14/153.42. Intraday bias remains neutral at this point. On the downside, firm break of 151.14 will suggest that rebound form 148.43 has completed. Intraday bias will be turned back to the downside for retesting 148.43 low. On the upside, break of 153.42/46 resistance will reaffirm the case that correction from 156.05 has completed at 148.43. Intraday bias will be back on the upside for retesting 156.05.

In the bigger picture, rise from 123.94 is seen as the third leg of the pattern from 122.75 (2016 low). Focus remains on 156.59 resistance (2018 high). Sustained break there should confirm long term bullish trend reversal. Next target is 61.8% retracement of 195.86 (2015 high) to 122.75 at 167.93. On the downside, sustained break of 149.03 support, however, will indicate rejection by 156.59. Fall from 156.05 would be at least correcting the whole rise from 123.94. Deeper fall would be seen back to 142.71 resistance turned support first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Price Index M/M Aug | -0.30% | 0.70% | ||

| 23:50 | JPY | GDP Q/Q Q2 P | 0.30% | 0.20% | -1.00% | |

| 23:50 | JPY | GDP Deflator Y/Y Q2 P | -0.70% | -0.40% | -0.10% | |

| 02:00 | CNY | Retail Sales Y/Y Jul | 8.50% | 11.50% | 12.10% | |

| 02:00 | CNY | Industrial Production Y/Y Jul | 6.40% | 7.80% | 8.30% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Jul | 10.30% | 11.30% | 12.60% | |

| 04:30 | JPY | Industrial Production M/M Jun F | 6.50% | 6.20% | 6.20% | |

| 12:30 | USD | Empire State Manufacturing Index Aug | 28.9 | 43 | ||

| 12:30 | CAD | Manufacturing Sales M/M Jun | -0.30% | -0.60% | ||

| 12:30 | CAD | Wholesale Sales M/M Jun | 0.10% | 0.50% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals