Selling of Dollar picks up momentum again in Asia today, with EUR/USD breaking through 1.18 handle finally. On the other hand, New Zealand Dollar is staging a notable rebound as Covid case number dropped to the lowest level in six days. The markets are mixed elsewhere though, with some additional strength see in Euro, followed by Sterling. Canadian and Australia Dollars are lagging behind the Kiwi.

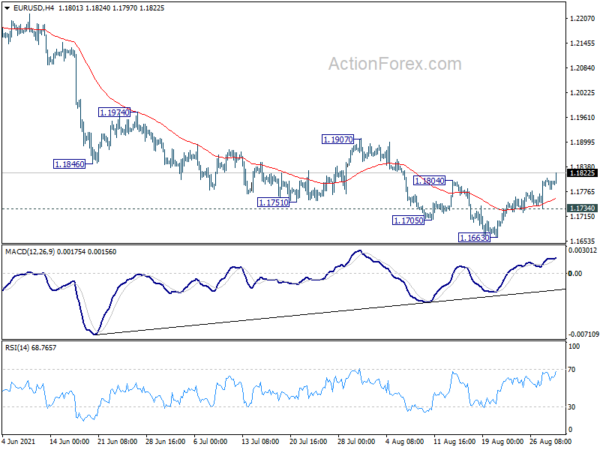

Technically, EUR/USD’s break of 1.1804 resistance should now put 1.1907 resistance in focus. Firm break there will turn outlook bullish for 1.2265/2348 ahead. We’ll see if the move is accompanied more Dollar selling elsewhere, like break of 1.3785 resistance in GBP/USD and 0.9098 support in USD/CHF. Or, that would be followed by break of 130.54 resistance in EUR/JPY and 0.8592 resistance in EUR/GBP to signal Euro strength.

In Asia, at the time of writing, Nikkei is up 0.62%. Hong Kong HSI is down -1.43%. China Shanghai SSE is down -0.75%. Singapore Strait Times is down -1.41%. Japan 10-year JGB yield is up 0.0002 at 0.020. Overnight, DOW dropped -0.16%. S&P 500 rose 0.43%. NASDAQ rose 0.90%. 10-year yield dropped -0.027 to 1.285, back below 1.3 handle.

Japan industrial production dropped -1.5% mom in Jul, but expected to bounce back ahead

Japan industrial production dropped -1.5% mom in July, better than expectation of -2.5% mom. The overall output was back below pre-pandemic levels already. The Ministry of Economy, Trade and Industry expects, however, a bounce back of 3.4% in production in August, and 1.0% in September.

Unemployment rate ticked down to 2.8%, better than expectation of 2.9%.

China PMI manufacturing dropped to 50.1, services tumbled to 47.5

China’s official PMI Manufacturing dropped slightly from 50.4 to 50.1 in August, below missed expectation of 50.2. PMI Non-Manufacturing dropped sharply from 53.3 to 47.5, well below expectation of 52.8, back in contraction for the first time since Q1 last year.

“This epidemic in multiple provinces and locations was a fairly big shock to the services industry, which is still in recovery,” said Zhao Qinghe, of China’s National Bureau of Statistics.

New Zealand ANZ business confidence dropped to -14.2 on Delta lockdown

New Zealand ANZ Business Confidence dropped sharply from -3.8 to -14.2 in August. Own Activity Outlook dropped from 26.3 to 19.2. Looking at some more details, export intentions ticked down from 7.6 to 7.4. Investment intentions dropped from 17.4 to 14.4. Employment intentions dropped from 21.4 to 17.0. Profit expectations dropped from 0.0 to -5.5. Inflation expectations, however, rose further from 2.70 to 3.05, above RBNZ’s target band. ANZ said that the “initial responses after level 4 lockdown look encouragingly robust”.

ANZ also noted while Delta is a “formidable opponent”, there are some reasons to the “glass-half-full about the situation”. The economy had “significant momentum” going into the lockdown. People will be a lot more confidence than last time regarding their job. Also evidence there and overseas suggests that the bounce out of lockdowns tends to be vigorous. But it’s still too soon to be sure when the level 4 restrictions will stamp out Delta.

Also released, New Zealand building permits rose 2.1% mom in July.

From Australia, current account surplus widened to AUD 20.5B in Q2, versus expectation of AUD 21.0B. Private sector credit rose 0.7% mom in July versus expectation of 0.5% mom. Building permits dropped -8.6% mom, versus expectation of -5.0% mom.

Looking ahead

France GDP, Germany unemployment, UK mortgage approvals will be released in European session. But main focus will be in Eurozone CPI flash. Later in the day, Canada will release GDP. US will release house price index, Chicago PMI, and more importantly consumer confidence.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1783; (P) 1.1797; (R1) 1.1810; More…

EUR/USD’s break of 1.1804 resistance should now confirm short term bottoming at 1.1663, on bullish convergence condition in 4 hour MACD. Intraday bias is back on the upside for 1.1907 resistance first. Firm break there will indicate that fall from 1.2265, as well as the consolidation pattern from 1.2348, have completed. Near term outlook will be turned bullish for 1.2265/2348 resistance On the downside, break of 1.1734 minor support will turn focus back to 1.1602/1703 key support zone instead.

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally remains in favors long as 1.1602 support holds, to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). However sustained break of 1.1602 will argue that the rise from 1.0635 is over, and turn medium term outlook bearish again. Deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Jul | 2.10% | 3.80% | 4.00% | |

| 23:30 | JPY | Unemployment Rate Jul | 2.80% | 2.90% | 2.90% | |

| 23:50 | JPY | Industrial Production M/M Jul P | -1.50% | -2.50% | 6.50% | |

| 01:00 | CNY | NBS Manufacturing PMI Aug | 50.1 | 50.2 | 50.4 | |

| 01:00 | CNY | Non-Manufacturing PMI Aug | 47.5 | 52.8 | 53.3 | |

| 01:00 | NZD | ANZ Business Confidence Aug | -14.2 | -3.8 | ||

| 01:30 | AUD | Current Account Balance (AUD) Q2 | 20.5B | 21.0B | 18.3B | 18.9B |

| 01:30 | AUD | Private Sector Credit M/M Jul | 0.70% | 0.50% | 0.90% | |

| 01:30 | AUD | Building Permits M/M Jul | -8.60% | -5.00% | -6.70% | -5.50% |

| 05:00 | JPY | Housing Starts Y/Y Jul | 4.80% | 7.30% | ||

| 05:00 | JPY | Consumer Confidence Index Aug | 37.4 | 37.5 | ||

| 06:45 | EUR | France Consumer Spending M/M Jul | 0.70% | 0.30% | ||

| 06:45 | EUR | France GDP Q/Q Q2 | 0.90% | 0.90% | ||

| 07:55 | EUR | Germany Unemployment Rate Aug | 5.60% | 5.70% | ||

| 07:55 | EUR | Germany Unemployment Change Aug | -34K | -91K | ||

| 08:30 | GBP | Mortgage Approvals Jul | 79K | 81K | ||

| 08:30 | GBP | M4 Money Supply M/M Jul | 0.60% | 0.50% | ||

| 09:00 | EUR | Eurozone CPI Y/Y Aug P | 2.80% | 2.20% | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y Aug P | 1.50% | 0.70% | ||

| 12:30 | CAD | GDP M/M Jun | 0.70% | -0.30% | ||

| 13:00 | USD | S&P/Case-Shiller Composite-20 HPI Y/Y Jun | 17.50% | 17.00% | ||

| 13:00 | USD | Housing Price Index M/M Jun | 2.10% | 1.70% | ||

| 13:45 | USD | Chicago PMI Aug | 69.8 | 73.4 | ||

| 14:00 | USD | Consumer Confidence Aug | 123.3 | 129.1 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals