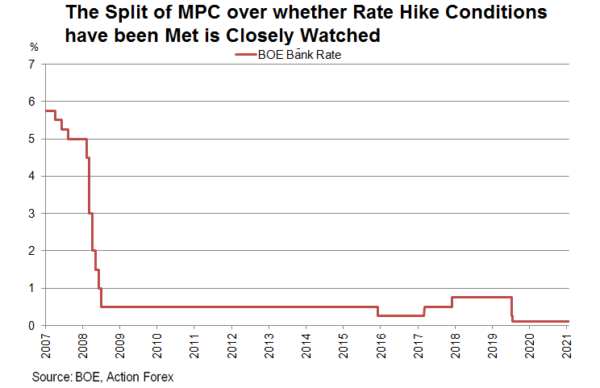

Economic developments since the last meeting have raised concerns of “stagflation” in the UK, i.e. slow growth with strong inflation. As the main constraint to growth is supply chain, we do not expect this to derail BOC’s monetary policy stance. We expect the central bank to vote unanimously to leave the Bank rate unchanged at 0.1% and 8-1 to keep the asset purchase program at 875B pound. BOE split evenly in August on whether basic conditions for rate hike have been met. The focus of this meeting is whether and how the two new committee members would affect this balance.

The dataflow released since the last meeting has sent a mixed picture about the economic outlook. On the positive side, the job market has continued to thrive. The unemployment rate slipped further to 4.6% in the three months to July. Meanwhile, the number of payrolls gained +241K to 29.1M in August. This marks a return to the pre- pandemic (February 2020) levels. Vacancies rose to a record 1.034M in June to August 2021. Inflation strengthened further. Headline CPI jumped +3.2% y/y in August, from +2% a month ago. The market had anticipated a jump to +2.9%. Note also that the increase of 1.2 ppts was the biggest on record. The ONS continued to warn of the temporary nature of strong price levels. Core CPI rose to +3.1% y/y from July’s +1.9%, beating consensus of 2.9%.

The dataflow released since the last meeting has sent a mixed picture about the economic outlook. On the positive side, the job market has continued to thrive. The unemployment rate slipped further to 4.6% in the three months to July. Meanwhile, the number of payrolls gained +241K to 29.1M in August. This marks a return to the pre- pandemic (February 2020) levels. Vacancies rose to a record 1.034M in June to August 2021. Inflation strengthened further. Headline CPI jumped +3.2% y/y in August, from +2% a month ago. The market had anticipated a jump to +2.9%. Note also that the increase of 1.2 ppts was the biggest on record. The ONS continued to warn of the temporary nature of strong price levels. Core CPI rose to +3.1% y/y from July’s +1.9%, beating consensus of 2.9%.

On the flip side, GDP growth eased to +0.1% m/m in July, from +1% a month ago. The PMI data also show that both services and manufacturing sectors are losing momentum. The services PMI dropped -4.6 point to 55 in August. While staying in the expansionary territory, the reading marks the slowest since February. The manufacturing PMI also eased to 60.3 in August, from 60.4% a month ago. However, slowdown in economic activities has mainly been brought about by the supply chain disruption, rather than demand.

On the flip side, GDP growth eased to +0.1% m/m in July, from +1% a month ago. The PMI data also show that both services and manufacturing sectors are losing momentum. The services PMI dropped -4.6 point to 55 in August. While staying in the expansionary territory, the reading marks the slowest since February. The manufacturing PMI also eased to 60.3 in August, from 60.4% a month ago. However, slowdown in economic activities has mainly been brought about by the supply chain disruption, rather than demand.

We expect the BOE to vote unanimously to leave the Bank rate unchanged at 0.1% and 8-1 to keep the asset purchase program at 875B pound. Michael Saunders will likely dissent as he prefers to end the program early. What interests us the most is the members view on whether the economic conditions have been met for tightening. Earlier this month, Governor Andrew Bailey indicated that four of the eight MPC members who voted in August judged that some initial conditions for tightening have been met. The Governor himself, Dave Ramsden, Ben Broadbent and Silvana Tenreyro are amongst the hawks. With the departure of a hawkish member, Andy Haldane, the MPC will be joined by two new officials, Chief Economist Huw Pill and external member Catherine Mann. Their stance is worth watching. Note, however, that a majority of members judging that the minimum necessary conditions have been met would not automatically trigger a rate hike. As Bailey noted, the guidance is a “necessary but not a sufficient condition for raising interest rates”.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals