There was a barrage of central bank meetings last week, with the FOMC and the BOE having the most market impact. Watch for the volatility to continue this week. In addition, there will be plenty of storylines to follow, including the results of the German elections. The drama around the US debt ceiling and the infrastructure spending bill also will be watched in the US. Will Congress be able to raise the debt ceiling by September 30th? Traders also will continue to monitor the fallout from the Evergrande saga. How much of their debt is China willing to bailout? In addition, with colder months right around the corner, an energy crisis may be looming, beginning with the UK. And, it’s month end! Therefore, traders will most likely face month end and quarter end volatility.

Central Banks

September’s FOMC statement was mostly in line with expectations, in that most thought the Fed would signal that tapering will occur sometime in the near future. They chose to use the words “moderation in bond buying may soon be warranted”. However, it was the press conference afterwards which got traders excited. The first comment from Powell that drew attention was that the “taper could conclude in the middle of next year”. Powell didn’t even give a start date, and yet, he already said when tapering may end! His next comment was even more of a surprise, “Language in statement was meant to be bar for taper could be as soon as next meeting”. And the cherry on top of the cake was “Many of the FOMC feel substantial further progress test on employment has been met. My own view is that it is all but met”. And with that, Powell instantly went from dove to hawk. Stocks bonds, and the US Dollar traded erratically into the close on Wednesday and they have continued to trade volatile since, including a possible “By the rumor sell the fact” in the DXY.

The BOE wasn’t quiet as dramatic, though the hawkish statement gave GBP a bid. The Committee noted that “some market tightening over the forecast period was likely to be necessary to be consistent with meeting the inflation target sustainably in the medium term”. In addition, Ramsden joined Saunders as the two dissenting voters. They voted to reduce total asset purchases to GBP 865 billion vs the current amount of GBP 890 billion.

Other central banks of note from last week were the CBRT, which surprisingly lowered Turkey’s interest rates from 19% to 18% and sent the Turkish Lira to all time lows, and the Norges Bank, which hiked 25bps (as expected) to become the first central bank in the developed world to hike rates. They also suggested an additional hike of 25 bps may be on the way!

German Elections

Moving into the week, German elections will take place on Sunday. Although current Finance Minister Olaf Scholz is predicted to be the next German Chancellor, his lead has shrunk from a probability of over 80% to 61%, as of the time of this writing. Anything less than a Scholz victory could send the Euro lower. There is also currently a 32% chance of a CDU/CSU-Greens-FDP coalition. Watch the opening on Sunday evening if the outcome is different than expected!

US Politics

The House Budget Committee will have an emergency meeting over the weekend in order to get their ducks in a row for a possible vote on the $3.5 trillion social welfare spending package. However, even if passed by the House, there is little chance it would pass the Senate in its current form. Nancy Pelosi also said the House of Representatives would take up the $1.2 trillion bi-partisan infrastructure bill. In addition, if Congress doesn’t raise the debt ceiling by Thursday, the government will shut down. Although Senate Minority Leader Mitch McConnell said that Democrats will have to “go it alone” to raise the debt ceiling, Democrats say they will not be solely responsible, as both parties have been spending over the years. They feel it should be a bi-partisan issue. Watch this week for more!

Evergrande

Evergrande seems to be a story that just won’t go away! Earlier last week, Evergrande, China’s number two property developer said they would pay their interest payments for bonds issued in Yuan. However, at the time, it was still up in the air as to what would happen to the bondholders that held bonds in US Dollars. China began pumped Yuan into the markets over the last 4 days (460 billion Yuan in total) in case of any liquidity problems (recall Lehman Brothers). In addition, China warned local governments to prepare for a potential downfall of Evergrande. The company failed to make their $83.5 million payment on Thursday, and they have another $47.5 million payment this week. The company has many ties to the national government; therefore, it is unlikely China will let the firm fail on its local payments. However, internationally may be a different story. There is a 30-day grace period for Evergrande to make its payments. Watch as the story continues to unfold this week.

UK energy crisis?

On Friday, cars lined up to fill their tanks at petrol stations as some wells went dry. Brent Crude rose above $77 a barrel as supply issues of fuel gasoline initially hit truck drivers. In addition, Natural Gas prices are surging as the colder months draw nearer. As a result, smaller UK energy operators are going out of business. Green and Avro are the latest casualties. Electricity prices have skyrocketed across Europe due to shortages of Natural Gas. This may be just the beginning. As it gets colder, prices may continue to increase over the coming weeks and months. Energy commodities such as WTI, Brent, and Natural Gas may continue higher this week.

Economic Data

As mentioned earlier, end of month means end of month data. China will release its PMI data, Germany and the EU will release inflation data, and the US will release the Fed’s favorite measure of inflation, Core PCE. Other important economic data due out this week is as follows:

Sunday

- Germany: Federal Election

Monday

- US: Durable Goods Orders (AUG)

- US: 2-Year Note Auction

- US: 5-Year Note Auction

Tuesday

- Japan: BOJ Monetary Policy Meeting Minutes

- Australia: Retail Sales (AUG)

- Germany: Gfk Consumer Confidence (OCT)

- US: S&P/Case-Schiller Home Price Index (JUL)

- US: CB Consumer Confidence (SEP)

- US: 7-Year Note Auction

Wednesday

- UK: Mortgage Approvals: (AUG)

- UK: BOE Consumer Credit (AUG)

- EU: Consumer Confidence Final (SEP)

- EU: Economic Sentiment (SEP)

- EU: Consumer Inflations Expectations (SEP)

- Canada: PPI Final (AUG)

- US: Pending Home Sales (AUG)

- Crude Inventories

Thursday

- New Zealand: Building Permits (AUG)

- Japan: Retail Sales (AUG)

- Japan: Industrial Production Prel (AUG)

- New Zealand: ANZ Business Confidence (SEP)

- China: NBS Manufacturing PMI (SEP)

- Australia: Building Permits (AUG)

- China: Caixin Manufacturing PMI (SEP)

- Japan: Housing Starts (AUG)

- Germany: Unemployment Rate (AUG)

- UK: Nationwide Housing Prices (SEP)

- UK: GDP Growth Rate Final (Q2)

- EU: Unemployment Rate (AUG)

- Germany: Inflation Rate Prel (SEP)

- US: GDP Growth Rate Final (Q2)

- US: Chicago PMI (SEP)

Friday

- Global Manufacturing PMIs Final (SEP)

- New Zealand: ANZ Roy Morgan Consumer Confidence (SEP)

- Japan: Unemployment Rate (AUG)

- Japan: Tankan Large Manufacturers Index (Q3)

- Japan: BOJ Summary of Opinions

- Australia: Home Loans (AUG)

- Japan: Consumer Confidence (SEP)

- Germany: Retail Sales (AUG)

- EU: Inflation Rate Flash (SEP)

- Canada: GDP (JUL)

- US: Personal Spending (AUG)

- US: Personal Income (AUG)

- US: PCE Price Index (AUG)

- US: Core PCE Price Index (AUG)

- US: Construction Spending (AUG)

- US: ISM Manufacturing PMI (SEP)

- US: Michigan Consumer Sentiment Final (SEP)

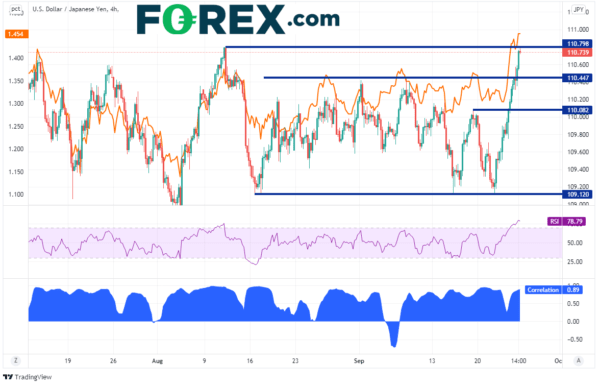

Chart of the Week: USD/JPY vs US 10-Year Yields (240 minutes)

Source: Tradingview, Stone X

Early on Wednesday last week, USD/JPY was trading near 109.12, retesting the prior week’s lows. However, the pair began moving higher on hopes of a more hawkish FOMC statement, which would result in higher bond yields. USD/JPY traders were correct, as the FOMC was hawkish and yields began to move higher. Notice how yields skyrocketed (orange line) over the past few days, helping to push USD/JPY even higher. The current correlation coefficient between US 10-Year yields and USD/JPY is +0.89. Readings above +0.80 or below -0.80 are considered strongly correlated. USD/JPY ran into resistance on Friday at the August 11th highs of 110.80 (price traded less than 1 pip away!). The RSI is in overbought territory, indicating a pullback may be ahead. Horizontal support in USD/JPY is below at 110.45 and then again at 110.08. For reference, US 10 Year Yields are at horizontal resistance and approaching the 61.8% Fibonacci retracement level from the May 13th highs to the July 20th lows near 1.481. Therefore, they may be ready for a pullback as well. With the high correlation coefficient between the two assets, USD/JPY traders could look to 10-Year Yields for help in determining direction in the shorter-term.

So much has happened last week and there is still so much yet to come this week! We didn’t even get to China’s assertion that cryptocurrency trading is illegal (for the 100th time). Watch for potential surprises over the weekend in the German elections, the Evergrande saga, the US debt ceiling drama, and comments from central bank speakers this week.

Have a great weekend!

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals