Canadian Dollar leads commodity currencies higher in Asian session, with help from extended rally in oil price. Overall sentiment is mixed though and Yen is trying to pare back some of last week’s losses. Some weakness in seen in both European majors and Dollar but movements in respective pairs are limited. Euro is also stuck in range, mixed, shrugging off the results of elections in Germany.

Technically, the developments in both stocks and treasury yields would be watched initially this week. Firstly, a question is whether the late strong rebound in US stocks could extend and even resume larger record runs. Secondly, US 10-year yield might be able to stay firm above 1.4 handle, which in turn set the stage for that 1.765 high later in the year. Accompanying that, we’ll keep an eye on whether USD/JPY could break through 110.79 resistance decisively, which would pave the way for a retest on 111.65 high.

In Asia, at the time of writing, Nikkei is down -0.02%. Hong Kong HSI is up 0.28%. China Shanghai SSE is down -1.30%. Singapore Strait Times is up 1.14%. 10-year JGB yield is up 0.0013 at 0.056.

CAD/JPY eyeing 87.87 resistance as WTI breaches 75 handle

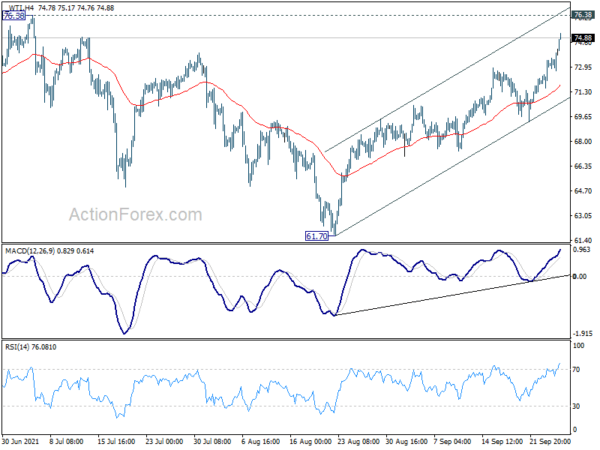

WTI crude oil extends near term rally in Asians session and breaches 75 handle. Oil price has been lifted since late August, on improving demand as well as supply tightness. On the one hand, demand is set to picking up with easing of pandemic restrictions, and more importantly, border restrictions. Additionally, surging gas prices are also driving oil higher. On the other hand, OPEC+ seems to be lagging behind the demand rebound, due to under-investment during the pandemic as well as maintenance delays. The question is whether WTI could power through 76.38 high made back in July, and that remains to be seen.

Riding on last week’s rally in oil prices and resilient risk appetite, CAD/JPY is also extending the rebound from 84.88. 87.87 resistance is now an immediate focus. Sustained break there will argue that whole correction from 91.16 has completed at 84.65 already. Break of 88.44 resistance will affirm this case and pave the way to retest 91.16 high. More importantly, with 38.2% retracement of 73.80 to 91.16 at 84.52 well defended, the medium term up trend from 73.80 could be ready to resume in this bullish scenario.

Gold resiliently defending 1740 fibonacci support

Gold’s rebound attempt last week once again faltered after rejection by 4 hour 55 EMA. Yet, it’s still resiliently holding on to 61.8% retracement of 1682.60 to 1833.79 at 1740.35. The price structure of the fall from 1833.79 is slightly favoring the case that it’s just a corrective move.

Firm break of 1787.02 will argue that such pull back has completed and bring stronger rise back to retest 1833.79/97 structural resistance zone. Such development would be in line with the case that whole correction from 2074.84 has completed after drawing support from long term fibonacci level of 38.2% retracement of 1046.27 to 2074.84 at 1681.92. However, sustained trading below 1740.35 would put focus back to this 1681.92 key fibonacci support level.

Economic data back to spotlights

Economic data will come back to spotlights this week. In particular, from the US, durable goods orders, consumer confidence, personal income and spending, and ISM manufacturing will be the major focuses. From Europe, Eurozone CPI, UK GDP and Swiss KOF will be featured. From Asia, main focuses will be on China PMIs and Japan Tankan surveys. BoJ will also release meeting minutes and summary of opinions. Here are some highlights for the week:

- Monday: Japan corporate services prices; Eurozone M3 money supply; US durable goods orders.

- Tuesday: BoJ minutes; Germany Gfk consumer climate; US goods trade balance, wholesales inventories, house price index, consumer confidence.

- Wednesday: Germany import prices; Swiss Credit Suisse economic expectations; UK M4 money supply, mortgage approvals; Canada IPPI, RMPI; US pending home sales.

- Thursday: Japan industrial production, retail sales, housing starts; China PMIs, Caixin PMI manufacturing; Australia building approvals, private sector credit; UK GDP, current account; Germany CPI flash, unemployment; Swiss KOF economic barometer; Eurozone unemployment rate; US GDP final, jobless claims, Chicago PMI.

- Friday: Australia AiG manufacturing; Japan unemployment rate, Tankan survey, BoJ summary of opinions, PMI manufacturing final, consumer confidence; Germany retail sales; Swiss PMI manufacturing; Eurozone PMIs final, CPI flash; UK PMI manufacturing final; Canada GDP, manufacturing; US personal income and spending, ISM manufacturing, construction spending.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2621; (P) 1.2676; (R1) 1.2711; More…

USD/CAD’s break of 1.2635 minor support suggests that rebound from 1.2492 has completed. Fall from 1.2891 is seen as the third leg of the pattern from 1.2947. Intraday bias is back on the downside for 1.2492 support and possibly below. On the upside, above 1.2729 minor resistance will turn bias back to the upside for 1.2891/2947 resistance zone instead. Overall, with 1.2421 support intact, rise from 1.2005 should still be in progress for another rally through 1.2947 at a later stage.

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). It should have completed after hitting 1.2061 (2017 low) and 50% retracement of 0.9406 to 1.4689 at 1.2048. Sustained break of 38.2% retracement of 1.4667 to 1.2005 at 1.3022 will pave the way to 61.8% retracement at 1.3650 and above. Overall, medium term outlook remains neutral at worst with 1.2048/61 support zone intact.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Aug | 1.00% | 1.20% | 1.10% | |

| 8:00 | EUR | Eurozone M3 Money Supply Y/Y Aug | 7.70% | 7.60% | ||

| 12:30 | USD | Durable Goods Orders Aug | 0.60% | -0.10% | ||

| 12:30 | USD | Durable Goods Orders ex Transportation Aug | 0.50% | 0.80% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals