Dollar trades mildly higher in early US session, lifted by stronger than expected durable goods orders data. But it’s being overwhelmed by both Sterling and Aussie. Commodity currencies are firmer on “stable” market sentiment, but there is no follow through buy yet, including Canadian Dollar. On the other hand, Euro and Swiss Franc are the weaker ones so far, together with Yen. Euro is having little reaction to news that German Social Democrat came in first in Sunday’s election, and is preparing a three-way coalition government with Greens and the liberal Free Democrats, without Angela Merkel’s CDU/CSU conservative bloc.

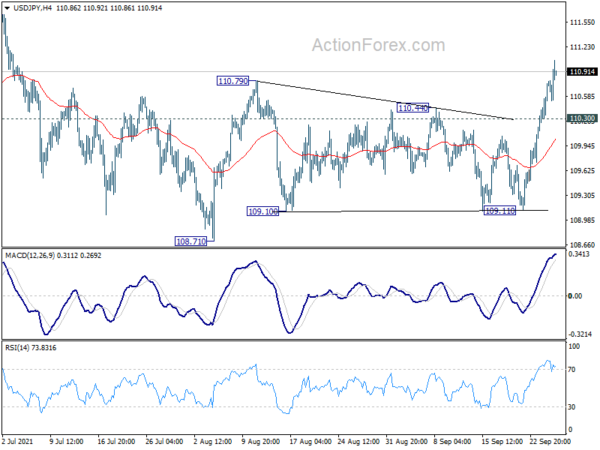

Technically, USD/JPY’s break of 110.79 resistance affirms the near term bullish view that consolidation from 111.65 has completed. Stronger rise should be seen next to retest this 111.65 high. We’d also keep an eye on whether EUR/USD would fall through 1.1682 temporary low, as well as 1.1663 support to signal general underlying buying in Dollar.

In Europe, at the time of writing, FTSE is up 0.01%. DAX is up 0.27%. CAC is up 0.23%. Germany 10-year yield is up 0.0197 at -0.205. Earlier in Asia, Nikkei dropped -0.02%. Hong Kong HSI rose 0.07%. China Shanghai SSE dropped -0.84%. Singapore Strait Times rose 1.27%. Japan 10-year JGB yield rose 0.0010 to 0.056.

US durable goods orders rose 1.8% in August, ex-transport orders rose 0.2%

US durable goods orders rose 1.8% mom to USD 263.5B in August, well above expectation of 0.6% mom. Ex-transport orders rose 0.2% mom, below expectation of 0.5% mom. Ex-defense orders rose 2.4% mom. Transportation equipment rose 5.5% mom to USD 80.8B.

Fed Evans more uneasy about not generating enough inflation in 2023 and 2024

In a speech, Chicago Fed President Charles Evans said, for the balance sheet, the economy as being close to meeting the “substantial further progress” standard for beginning to taper asset purchases. “If the flow of employment improvements continues, it seems likely that those conditions will be met soon and tapering can commence,” he added.

On inflation, Evans said, “long-run inflation expectations are still likely somewhat below target”, as ” inflation break-even rates in financial markets over the five- to ten-year horizon are still below the levels we saw in 2012 and 2013—a period when they were arguably better aligned with 2 percent PCE inflation.” And, “a ten-year nominal Treasury rate in the range we’ve seen recently simply can’t have a whole lot of expectations of long-run inflation built into it.”

“Taken altogether, I am more uneasy about us not generating enough inflation in 2023 and 2024 than the possibility that we will be living with too much,” he said. “My concern is that when the Covid distress ultimately recedes broadly around the world, we will not have been freed from the downward bias on inflation imparted by the ELB.”

ECB Lagarde expects continued strong growth in H2

In the hearing of the Committee on Economic and Monetary Affairs of the European Parliament, ECB President Christine Lagarde said, ” it is evident that the economic recovery in the euro area is increasingly advanced”. Policymakers expected “continued strong growth” in H2, “enabling euro area output to exceed its pre-pandemic level by the end of the year”. GDP growth is forecast to reach 5.0% in 2021, then 4.6% in 2022, and 2.21% in 2023. Risks to growth are “broadly balanced”.

Eurozone inflation, at 3% in August, is expected to “rise further this autumn”. But Lagarde reiterated, “we continue to view this upswing as largely temporary”. ECB’s projections foresee annual inflation at 2.2% in 2021, 1.7% in 2022, and 1.5% in 2023. There are factors that could lead to stronger price pressures than expected, inflation shortages of materials and equipment, and higher than anticipated wage demands. She said, “but we are seeing limited signs of this risk so far, which means that our baseline scenario continues to foresee inflation remaining below our target over the medium term.

Bundesbank: Inflation at 4-5% temporarily possible until year-end

In the monthly report, Bundesbank said German economy continued recovery at a “faster pace” in summer. economic output is “likely to grow more stronger in the third quarter than in Spring”. But, due to supply-side difficulties, output had not reached pre-pandemic level yet.

Production level “continued to lag behind strong demand” because of supply bottlenecks. In July, demand for industrial productions already exceeded pre-pandemic level by a whopping 18%. But production remained -3.5% below the pre-pandemic levels. Labor market “recovered extraordinarily strongly since June” and unemployment is likely to continue to fall sharply in the next three months.

On inflation, Bundesbank said, “rates between 4 percent and 5 percent are temporarily possible from September until the end of the year”. One reason for this is the base effect of the temporary VAT reduction in the previous year. The economists assume that inflation will decrease noticeably at the beginning of 2022, but will still be over 2 percent by the middle of the year.

Released from Eurozone, M3 money supply rose 7.9% yoy in August, above expectation of 7.7% yoy.

BoJ Kuroda: Must continue to focus on responding to the pandemic

BoJ Governor Haruhiko Kuroda admitted, “it’s true Japan’s economy has been held back by the successive waves of COVID-19.” “While corporate funding conditions have improved from a while ago, those of firms offering face-to-face services remain severe,” he added.

“Given high uncertainty over the outlook due to the spread of the Delta variant, the BOJ must continue to focus on responding to the pandemic for the time being,” he said.

Meanwhile, Kuroda is not concerned about the supply shortages that manufacturers are facing. “This will only be transitory, and from a somewhat long-term perspective, exports and production are expected to continue on an increasing trend, partly supported by the restocking of inventories and a recovery in production from the decline brought about by the supply-side constraints,” he said.

From Japan, corporate service price index rose 1.0% yoy in August, versus expectation of 1.2% yoy.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 110.40; (P) 110.60; (R1) 110.93; More…

USD/JPY rises further to as high as 111.05 so far today and intraday bias stays on the upside. Current development affirms that consolidation pattern from 11.65 has completed already. Further rise should be seen to retest this high, as well as 111.71 key resistance. On the downside, however, below 110.30 minor support will mix up the near term outlook and turn bias neutral again.

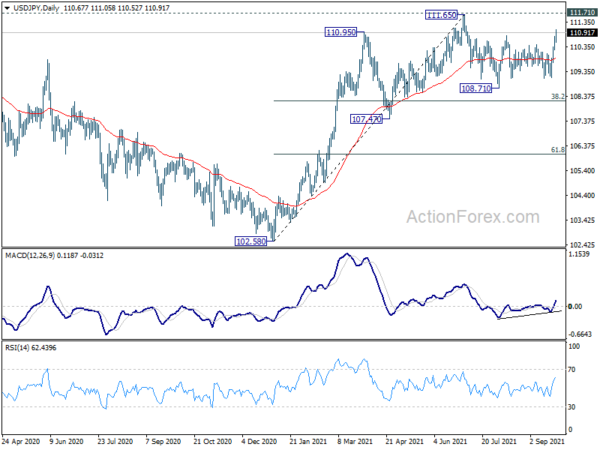

In the bigger picture, medium term outlook is staying neutral with 111.71 resistance intact. The pattern from 101.18 could still extend with another falling leg. Sustained trading below 55 day EMA will bring deeper fall to 107.47 support and below. Nevertheless, strong break of 111.71 resistance will confirm completion of the corrective decline from 118.65 (2016 high). Further rise should then be seen to 114.54 and then 118.65 resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Corporate Service Price Index Y/Y Aug | 1.00% | 1.20% | 1.10% | |

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Aug | 7.90% | 7.70% | 7.60% | |

| 12:30 | USD | Durable Goods Orders Aug | 1.80% | 0.60% | -0.10% | |

| 12:30 | USD | Durable Goods Orders ex Transportation Aug | 0.20% | 0.50% | 0.80% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals