US futures trade sharply lower as treasury yields rise to a 3 month high. The tech heavy Nasdaq is set to under perform. Concerns over China are adding into the hit on stocks. Energy stocks are a rare bright spot as oil prices extend gains.

US futures

- Dow futures -0.4% at 34700

- S&P futures -0.9% at 4403

- Nasdaq futures -1.6% at 14959

In Europe

- FTSE -0.13% at 7050

- Dax -1.4% at 15365

- Euro Stoxx -1.6% at 4094

Rotation out of tech.

US stocks are seeing opening lower on Tuesday with tech stocks taking the hardest hit ahead Fed Powell’s testimony before Congress later today.

US treasury yields have surged to fresh 3 month highs, over 1.5% following last week’s FOMC when the Fed teed-up from tapering bond purchases towards the end of the year. Powell is expected to warn that the rise in inflation could be more prolonged than initially expected, owing to supply chain bottlenecks, sparking bets of a sooner move by the Fed to raise interest rates.

As the markets prepare for a move by the Fed, a rotation out of high growth tech stocks is driving the Nasdaq sharply lower. The Nasdaq is significantly underperforming the Dow which is more closely tied to cyclicals and stocks which perform well as the economy recovers and interest rates rise.

Meanwhile concerns over a growth slowdown in China and a debt crisis in the Chinese property market are hitting risk sentiment.

Energy stocks are likely to be a bright spot once again putting in a solid performance tracing oil prices higher.

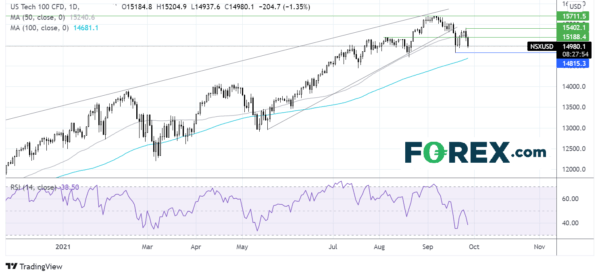

Where next for the Nasdaq?

The Nasdaq broke out of the rising wedge pattern last week falling to a low of 14818 before rebounding towards resistance at 15350. Today’s move lower has seen the price fall back below its 50 sma. The RSI supports further downside towards 14818 whilst a break below here would exposae the 100 sma at 14681. Ant recovery would need to retake the 500 sma at 15200 also a key horizontal level.

FX – USD extends gains, GBP tanks as outlook darkens

The US Dollar is rising tracing treasury yields higher as investors reposition for the Fed to taper bond purchases. Furthermore, safe have flows are also boosting the greenback amid the ongoing energy crisis and power cuts in China.

GBP/USD – The Pound is being pummeled today as risks to the UK economy keep mounting. Rising inflation expectations, supply bottleneck, labour shortages have weighed on output whilst the run of petrol at the pumps and loss of wind to generate energy are combing to create a tough picture for the UK economy.

- GBP/USD -0.7% at 1.3613

- EUR/USD -0.04% at 1.1692

Oil extends gains for 6th session

Oil prices are rising for a sixth consecutive session and trading at fresh three year highs amid supply tightness and draws on inventories. US producers have struggled to get back online after hurricanes caused damage earlier in the month.

Meanwhile Angola and Nigeria along with other OPEC countries are struggling to ramp up production to meet OPEC’s quota due to under investment and maintenance problems.

Tight supply is being met with rising demand as economies reopen, taking inventory cover to the lowest level in years.

API inventory data due later will be watched closely.

- WTI crude trades +0.9% at $75.95

- Brent trades +1.05% at $79.25

Looking ahead

- 14:00 US Housing Price Index

- 15:00 US Consumer Confidence

- 15:00 Fed Powell testifies

- 21:30 API Weekly Crude Oil Stocks

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals