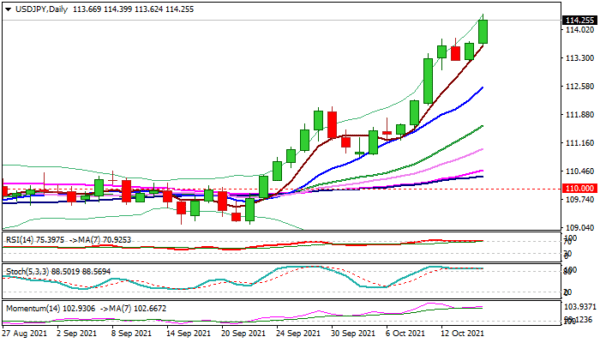

The USDJPY rose further on Friday, signaling bullish continuation after larger bulls took a breather in past three-day consolidation.

Fresh bullish acceleration broke above former high at 114.20 (Nov 2018) and hit new highest in nearly four years, pressuring pivotal Fibo barrier at 114.53 (76.4% retracement of 118.66/101.18, 2016/2020 fall).

The yen was sold on renewed risk appetite, while strong demand for USDJPY from Japanese importers additionally boosted the sentiment.

The pair is on course for the biggest weekly rally since the third week of March 2020, when the start of coronavirus pandemic strongly lifted dollar.

Bullish technical studies support the action, with firm break of 114.53 pivot to signal further advance and unmask targets at 118.60/66 (Jan 2017 / Dec 2016 highs).

Overbought conditions on daily and weekly chart warn of price adjustment in the near-term, with dips to offer better buying opportunities.

Res: 114.53, 114.73, 115.50, 116.00.

Sup: 114.00, 113.62, 113.23, 112.57.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals