As further QE tapering to CAD 1B/week has been fully priced in, the focus of this week’s BOC meeting is the forward guidance on rate hike. The market has priced in 3 rate hikes in 2022. We expect the central bank to maintain the guidance that a rate hike would come when “economic slack is absorbed so that the 2% inflation target is sustainably achieved”. On economic developments, policymakers should likely acknowledge the persistently strong inflation. They should, however, maintain the stance that the phenomenon had been driven by temporary factors.

Economic Developments

While Canada’s economy stays below the pre-pandemic level, the gap is narrowing. The flash estimate for GDP growth expanded +0.7% m/m in August, following a -0.1% decline a month ago. Economic activity was projected to be -1 ppt below pre-pandemic level in February 2020. In July, the gap was about -2 ppt.

Inflation continued its restive rally. Headline CPI accelerated to a 18-month high of +4.4% y/y in September, from +4.1% a month ago. Core inflation also accelerated to +3.7%, from August’s +3.5%. BOC’s preferred core inflation gauges averaged at +4% in September, up from +3.9% a month ago. Elevated price levels have proved more persistent than previously anticipated.

Inflation expectations remain firm. As suggested in the latest quarterly business outlook survey (BOS), 45% of businesses forecasts CPI to average above +3% in 2 years’ time, compared with BOC’s +2% midpoint target. Household expectations are at +3% during the period.

The job market is resilient with the number of payrolls up +157.1K in September, following a +90.2K addition a month ago. This beat consensus of an increase of +65K. The unemployment rate slipped -0.2 ppt to +6.9% during the month. The BOS indicated that “most firms see labour markets as tighter than last year” and “labour shortages are preventing more firms from meeting growing demand”.

Monetary Policy

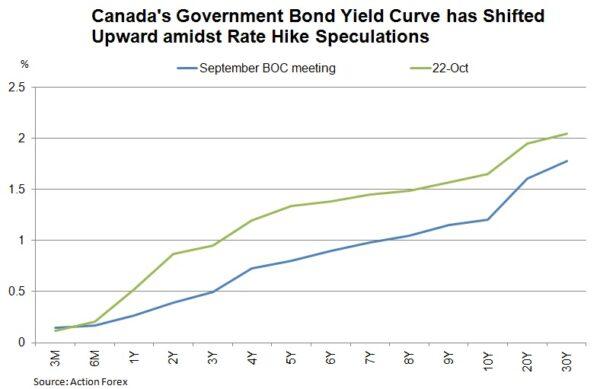

Against this backdrop, the BOC is in progress to further trim its asset purchases to CAD1B/week in October. The overnight rate will stay unchanged at 0.25%. Concerning the outlook to rate hike, we expect the central bank to reiterate that the policy rate would stay at “the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved”. A more hawkish guidance could come in December, should the economy continues to improve as more pandemic-related restrictions are lifted.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals