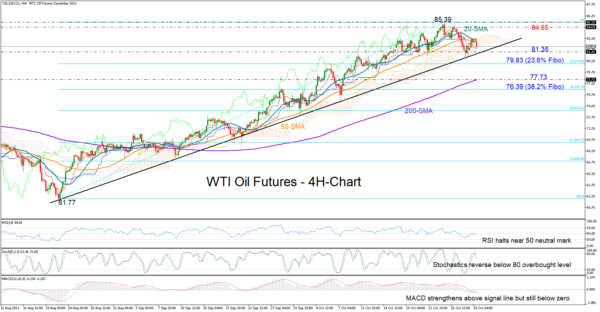

WTI oil futures (December delivery) charted a new lower low at 80.62 in the four-hour chart on Thursday but the tough ascending trendline, which has been strictly supporting the market since the bullish trend reversal in August came to the rescue once again, helping the price to crawl up to an intra-day high of 83.27 on Friday.

Negative risks, however, have not entirely evaporated yet as the RSI is stuck around its 50 neutral mark despite its latest upturn, the Stochastics are already flirting with overbought levels and the Ichimoku lines remain negatively aligned. The MACD has made some progress, advancing above its red signal line, but as long as the indicator continues to fluctuate within the negative area, downside corrections in the price are likely.

Technically, for the bulls to gain the upper hand in the very short-term picture, the price will need to close above the 20-period simple moving average (SMA) currently capping upside movements at 83.00. An extension above this line could see the price testing its previous highs registered within the 84.65 – 85.00 region. Any sustainable move higher would open the door for the 90.00 level.

On the downside, a decisive close below the trendline at 81.35 may press the price towards 79.83, this being the 23.6% Fibonacci retracement of the 61.66 – 85.39 upleg. The 200-day SMA could be the next barricade at 77.66 before the spotlight falls to the 38.2% Fibonacci of 76.39.

In brief, WTI oil futures have avoided a trend deterioration below a key ascending trendline, but the bears have not abandoned the battle yet. Failure to hold above 81.35 could confirm additional negative corrections.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals