Dollar rises sharply in early US session after much stronger than expected consumer inflation data, which hit multi-decade high. For now, New Zealand Dollar is the worst performer today, followed by Sterling and then Euro. Yen is retreating against the greenback but stays steady against others.

Technically, despite notable rally, Dollar is generally still stuck in range at the time of writing. To confirm underlying momentum in the greenback, we’ll need to see break of 1.1512 support in EUR/USD, 1.3423 support in GBP/USD, 0.9174 resistance in USD/CHF, and 113.65 minor resistance in USD/JPY.

In Europe, at the time of writing, FTSE is up 0.56%. DAX is down -0.10%. CAC is down -0.25%. Germany 10-year yield is up 0.0232 at -0.273. Earlier in Asia, Nikkei dropped -0.61%. Hong Kong HSI rose 0.74%. China Shanghai SSE dropped -0.41%. Singapore Strait Times dropped -0.37%. Japan 10-year JGB yield dropped -0.0061 to 0.060.

US CPI surged to 6.2% yoy, core CPI to 4.6% yoy, highest since early 90s

US CPI rose sharply by 0.9% mom in October, well above expectation of 0.5% mom. CPI core rose 0.6% mom, also well above expectation of 0.3% mom.

Over the 12-month period, headline CPI accelerated to 6.2% yoy, up from 5.4% yoy, well above expectation of 5.3% yoy. That’s also the highest level since November 1990.

Annual core CPI surged to 4.6% yoy, up from 4.0% yoy, above expectation of 4.0% yoy. That’s the highest level since August 1991.

US initial jobless claims dropped to 267k

US initial jobless claims dropped -4k to 267k in the week ending November 6, slightly above expectation of 266k. Four-week moving average of initial claims dropped -7k to 278k. Both were lowest since March 14, 2020.

Continuing claims rose 59k to 2160k in the week ending October 30. Four-week moving average of continuing claims dropped -111k to 2245k, lowest since March 21, 2020.

GCEE projects German economy to grow 2.7% this year and 4.6% next

In the latest annual report, the German Council of Economic Experts said, “a variety of bottlenecks on the supply side are disrupting global value chains and, combined with the pandemic-related restrictions that are still in place, are holding back growth.”

It forecasts Germany GDP to grow 2.7% in 2021 and 4.6% in 2022. And that subject to “significant risks” including “return of extensive measures to stop the spread of the coronavirus or persistent supply and capacity bottleneck”.

The GCEE projections an inflation rate for Germany of 3.1% in 2021 and then 2.6% in 2022. “Longer-lasting supply-side bottlenecks, higher wage settlements, and rising energy prices pose a risk, however, that what are in fact temporary drivers of prices could lead to persistently higher inflation rates,” it said.

“Fiscal policy needs to normalise following the crisis. Public finances have to be made more sustainable and crisis-resilient again,” says Volker Wieland, member of the GCEE. “The best way for monetary policy to contribute to sustainable economic growth is by maintaining price stability. A normalisation strategy should be published for this purpose.”

From Germany, CPI was finalized at 0.5% mom, 4.5% yoy in October. Italy industrial output rose 0.1% mom in September versus expectation of -0.1% mom.

Australia Westpac consumer sentiment rose to 105.3 in Nov

Australia Westpac Consumer Sentiment rose 0.6% to 105.3 in November, up from 104.6. Looking at some details, the index on economic conditions for the next 12 months improved from 103.2 to 106.6, as reopening of major cities looked to have shored up confidence. Unemployment expectations index dropped notably from 107.1 to 95.3, as more consumers expect unemployment to fall than rise.

Westpac expects RBA to continue with the current AUD 4B per week asset purchases to continue as planned till February, and then reduce it to AUD 2-3B until next most likely review in May. Yet, if RBA assess that the pace of achieving its targets is satisfactory, it could decide to cut taper to ADU 2B per week and Fed, and than end the program altogether by May.

New Zealand ANZ business confidence dropped to -18.1, surging inflation expectations

According to preliminary reading, ANZ business confidence dropped to from -13.4 to -18.1 in November. Own activity outlook dropped from 21.7 to 15.6. Export intentions ticked down from 8.6 to 8.0. Investment intentions dropped from 13.8 to 11.6. Employment intentions jumped from 10.9 to 16.1. Cost expectations rose from 87.2 to 89.0. Pricing intentions dropped from 65.6 to 64.6. Inflation expectations surged sharply from 3.45 to 4.33.

ANZ said: “Overall, the survey shows an understandable wariness as we move into a COVID-endemic world. The one certainty is that costs are through the roof.”

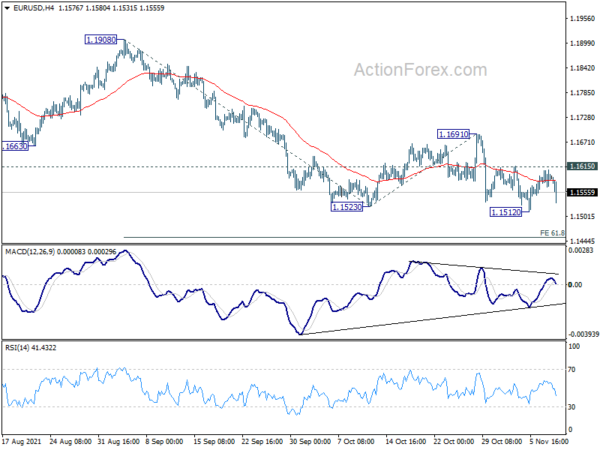

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1574; (P) 1.1591; (R1) 1.1612; More…

EUR/USD dips notably in early US session but stays in range above 1.1512. Intraday bias remains neutral first. Further decline is in favor as long as 1.1615 minor resistance holds. Break of 1.1512 will extend the pattern from 1.2348 to 61.8% projection of 1.1908 to 1.1523 from 1.1691 at 1.1453. Break will pave the way to 100% projection at 1.1306. On the upside, though, above 1.1615 minor resistance will dampen the bearish case and turn bias back to the upside for 1.1691 resistance.

In the bigger picture, price actions from 1.2348 should at least be a correction to rise from 1.0635 (2020 low). As long as 1.1908 resistance holds, deeper fall would be seen to 61.8% retracement of 1.0635 to 1.2348 at 1.1289. Nevertheless break of 1.1908 resistance will revive medium term bullishness and turn focus back to 1.2348 high.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Nov | 0.60% | -1.50% | ||

| 23:50 | JPY | Money Supply M2+CD Y/Y Oct | 4.20% | 4.30% | 4.20% | |

| 01:30 | CNY | CPI Y/Y Oct | 1.50% | 1.40% | 0.70% | |

| 01:30 | CNY | PPI Y/Y Oct | 13.50% | 12.00% | 10.70% | |

| 07:00 | EUR | Germany CPI M/M Oct F | 0.50% | 0.50% | 0.50% | |

| 07:00 | EUR | Germany CPI Y/Y Oct F | 4.50% | 4.50% | 4.50% | |

| 09:00 | EUR | Italy Industrial Output M/M Sep | 0.10% | -0.10% | -0.20% | -0.30% |

| 13:30 | USD | Initial Jobless Claims (Nov 5) | 267K | 266K | 269K | 271K |

| 13:30 | USD | CPI M/M Oct | 0.90% | 0.50% | 0.40% | |

| 13:30 | USD | CPI Y/Y Oct | 6.20% | 5.30% | 5.40% | |

| 13:30 | USD | CPI Core M/M Oct | 0.60% | 0.30% | 0.20% | |

| 13:30 | USD | CPI Core Y/Y Oct | 4.60% | 4.00% | 4.00% | |

| 15:00 | USD | Wholesale Inventories Sep F | 1.10% | 1.10% | ||

| 15:30 | USD | Crude Oil Inventories | 1.6M | 3.3M | ||

| 15:30 | USD | Natural Gas Storage | 9B | 63B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals