The Q3 unemployment rate fell to a record-equalling 3.4% at the start of November, matching the rate last seen in Q4 2007.

“The fall in the unemployment rate is in line with reports of difficulty finding workers and high labour turnover, and continued travel restrictions on international arrivals, which put pressure on domestic labour supply,” work and wellbeing statistics senior manager Becky Collett noted after the data was released.

Elsewhere, inflation is running at its highest level in a decade, and forward-looking indicators warn of further gains. Last week’s RBNZ survey of expectations noted a significant increase in inflation expectations. Both the 1 year and 2 year ahead measures jumped by 0.7% pts to 3.7% and 2.96%, respectively – well above the RBNZ’s 2% target midpoint.

The strength of recent data has the market fully priced for a 25bp hike to 0.75% tomorrow, and there is a 40% chance priced that the bank will hike by 50bp to 1.00%. Adding intrigue and uncertainty to the decision will be a new set of forecasts and an updated OCR track.

Therefore, trader interest will be two-fold. Firstly, on the size of the rate hike and secondly on the magnitude of the increase in the OCR track, with most expecting the track to pull forward forecast rate hikes and show an end rate near 3.00%.

Due to a considerable tightening in financial conditions via higher fixed mortgage rates, the RBNZ will likely only deliver a 25bp hike. A decision that has the potential to disappoint and keep the pressure on the NZDUSD in the face of a surging U.S. dollar

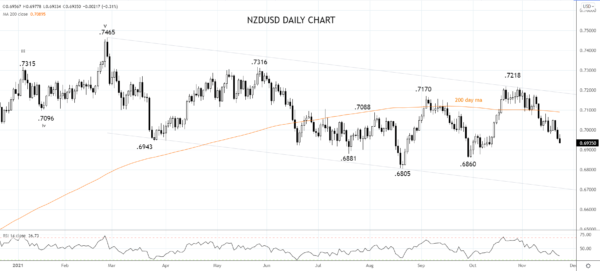

Technically, the NZDUSD has been trading within a downward sloping trend channel for the past nine months. Consider selling bounces back towards short-term resistance at .7000c, looking for a retest of the September .6860 low before a retest of the August .6805 low.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals