The markets are relatively quiet in Asian session today. Major Asian indexes are mixed despite steep selloff last Friday. Currencies are bounded inside tight range, with Swiss Franc and Yen consolidation some of recent gains. Aussie and other commodity currencies also recover mildly. Gold and oil prices are also staying in tight range. Nonetheless, big selloff was seen in cryptocurrencies during the weekend.

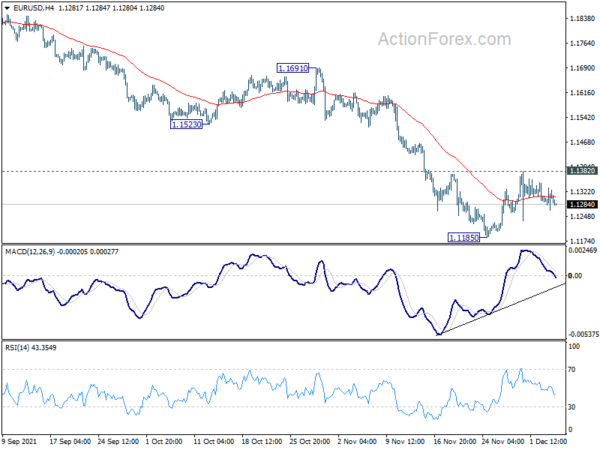

Technically, we’re still paying attention to EUR/USD. For now downside breakout through 1.1185 support is in favor. But considering bullish convergence condition in 4 hour MACD, break of 1.1382 resistance should confirm short term bottoming and bring stronger rebound. In that case, we might see USD/CHF breaking through 0.9156 minor support to confirm weakness in Dollar.

In Asia, Nikkei closed down -0.26%. Hong Kong HSI is down -1.23%. China Shanghai SSE is up 0.13%. Singapore Strait Times is up 0.88%. Japan10-year JGB yield is down -0.0122 at 0.045.

CBI downgrades UK growth forecasts to 6.9% in 2021 and 5.1% in 2022

The Confederation of British Industry downgraded UK GDP growth forecast for 2021 from 8.2% to 6.9%. For 2022, GDP growth forecast was also lowered from 6.1% to 5.1%. Inflation is projected to peak at 5.2% in the coming April while unemployment rate would fall to 3.8% by the end of 2023.

“The challenge for January 1st is now very clear for the UK economy. Significant headwinds and rising costs of living threaten the extent of recovery and prospects for economic success. These hurdles for firms will provide a major test for the government – can they foster sustainable UK investment and growth?” said Tony Danker, CBI director-general.

“The UK’s New Year resolution must be to give firms the confidence to go for growth. We should be raising our sights on the economy’s potential and seizing the moment.”

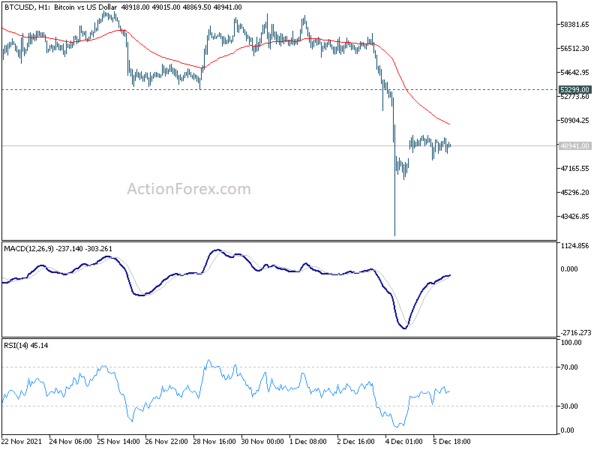

Bitcoin in ugly weekend selloff, downside risks remain

Cryptocurrencies suffered an ugly selloff over the weekend, as Bitcoin dived to as low as 41908, and then recovered and settled in range around 48k/49k. The move was exaggerated by low liquidity and cascading selling and liquidations. But it’s also part of the overall risk-off moves late last week.

Technically, downside risks will remain in Bitcoin as long as 53299 support turned resistance holds. But we’re not expecting a break of 40k handle for now, which is close to 39559. However, firm break of 39559 could trigger even steeper selling to 30k handle, which is close to 29261.

RBA and BoC to stand pat, US CPI a major mover

Two central banks will meet this week. RBA is expected to keep monetary policy unchanged, with cash rate target at 0.10% and asset purchases at AUD 4B per week. RBA is unlikely to drop any hint on what to do after finishing the current asset purchase commitment in mid-February, given the uncertainty over Omicron. So, the meeting will probably be a non-event.

After ending the quantitative easing program back in October, BoC is generally expected to keep interest rate unchanged at effective lower bound of 0.25% first. It’s also likely to maintain the forward guidance that rate hike won’t happen until “sometime in the middle quarters of 2022”. While the economy is strong and inflation is hot, BoC will wait-and-see more information on Omicron first.

On the data front, US CPI will be major market mover this week. Before there, Eurozone Sentix, German ZEW, China trade balance and UK GDP will also be closely watched.

- Monday: Germany factory orders; Italy retail sales; Eurozone Sentix investor confidence; UK PMI construction.

- Tuesday: Australia AiG services, house price index, RBA rate decision; Japan average cash earnings, household spending; China trade balance; Swiss unemployment rate, foreign currency reserves; Germany industrial production, ZEW economic sentiment; France trade balance; Eurozone GDP revision; Canada trade balance, Ivey PMI; US trade balance, non-farm productivity.

- Wednesday; Japan GDP final, current account; BoC rate decision.

- Thursday: New Zealand manufacturing sales; Japan BSI manufacturing; China CPI, PPI; Swiss SECO economic forecasts; Germany trade balance; US jobless claims.

- Friday: New Zealand BusinessNZ manufacturing; Japan PPI; Germany CPI final; UK GDP, production, goods trade balance; Italy industrial production; US CPI, U of Michigan sentiment.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6962; (P) 0.7031; (R1) 0.7068; More…

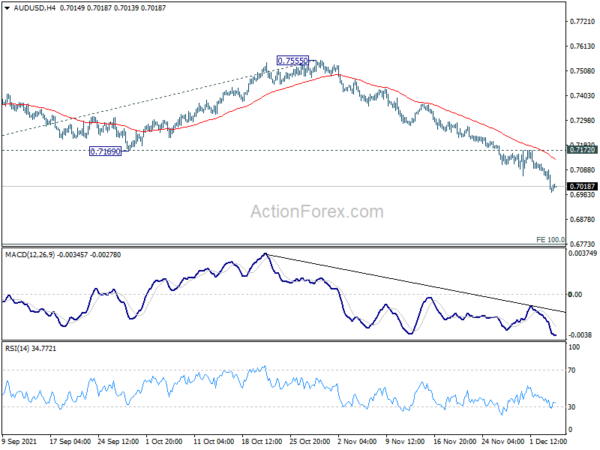

Intraday bias in AUD/USD remains on the downside with focus on 0.6991 key structural support. Sustained break there will carry larger bearish implication. Next target is 100% projection of 0.7890 to 0.7105 from 0.7555 at 0.6770. On the upside, break of 0.7172 resistance will indicate short term bottoming and bring stronger rebound.

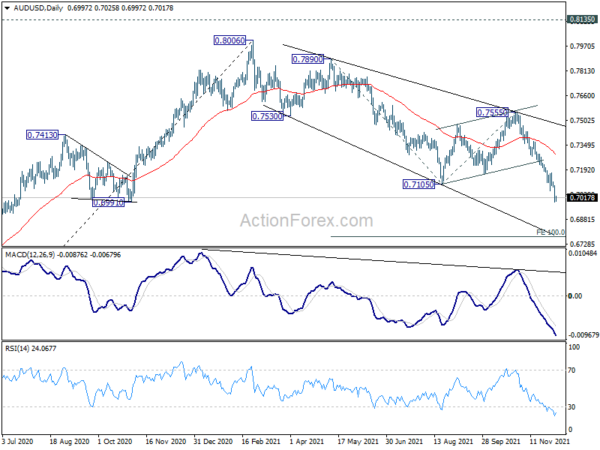

In the bigger picture, sustained break of 0.6991 cluster support will argue that the who up trend from 0.5506 might be finished at 0.8006, after rejection by 0.8135 long term resistance. Deeper decline would then be seen back to 61.8% retracement of 0.5506 to 0.8006 at 0.6461). For now, medium term outlook will stay bearish as long as 0.7555 resistance holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | AUD | TD Securities Inflation M/M Nov | 0.30% | 0.20% | ||

| 07:00 | EUR | Germany Factory Orders M/M Oct | -0.20% | 1.30% | ||

| 09:00 | EUR | Italy Retail Sales M/M Oct | 0.40% | 0.80% | ||

| 09:30 | EUR | Eurozone Sentix Investor Confidence Dec | 15.9 | 18.3 | ||

| 09:30 | GBP | Construction PMI Nov | 52 | 54.6 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals