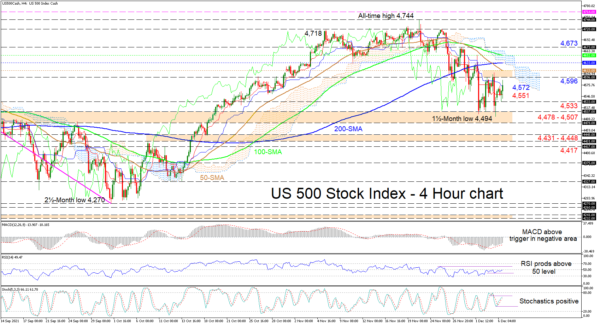

The US 500 stock index (Cash) is trying to recoup previously lost ground from the decline off the 4,720 level until the one-and-a-half month low of 4,494. The bearish 50- and 100-period simple moving averages (SMAs) are endorsing the pullback, and a downward crossover of the 200-period SMA by the approaching 100-period SMA could boost the negative trajectory.

That said, the Ichimoku lines are suggesting downward forces are taking a breather, while the short-term oscillators are signalling that buyers may be gaining the upper hand. The MACD is above its red trigger line, implying that negative momentum is waning. The RSI has nudged above the 50 threshold and is hinting that upside impetus is growing. The positively charged stochastic oscillator is promoting additional gains in the index.

To the upside, buyers face an initial resistance band from the 4,596 level until the 50-period SMA at 4,613 ahead of the Ichimoku cloud. Should the bulls overstep the cloud, a zone of resistance between the 200-period SMA at 4,633 and the 100-period SMA at 4,652 may impede additional advances from testing the 4,673 high.

If sellers retake control, downside friction could arise at the red Tenkan-sen line at 4,551 and the 4,533 low, before the bears challenge the 4,478-4,507 support border. In the event selling pressures increase and drive the price beneath this obstacle, the support boundary of 4,431-4,448 could come into focus prior to the 4,417 barrier.

Summarizing, the US 500 index is currently exhibiting a neutral-to-bearish tone below the 4,596-4,613 resistance barrier.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals