After a super exciting week, things will wind down significantly in the run up to the Christmas weekend, with the biggest risk for traders likely being suffering from post-central bank blues. Out of all the meetings, the Fed’s announcement undoubtedly had the largest bearing on the markets, whipsawing the dollar. But the bumpy times may not be over just yet for the greenback as the US agenda is the busiest in an otherwise quiet week. Meanwhile, stocks could get an end-of-year boost if China’s central bank heeds calls to cut rates.

Can the aussie, kiwi and loonie find some love?

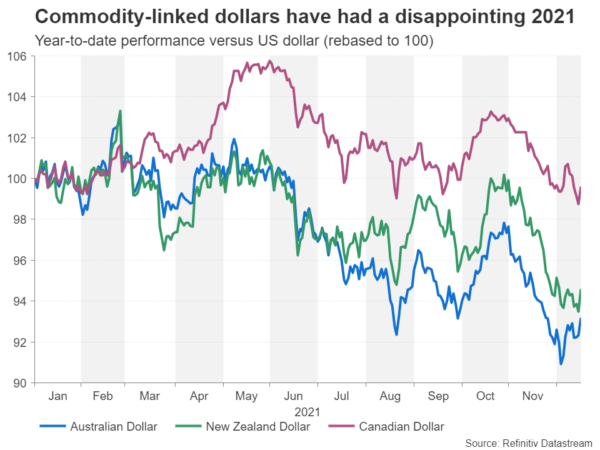

It’s been a surprisingly dismal year for the major commodity-linked currencies. The Australian and New Zealand dollars started 2021 with gains but slipped into losses as unexpected lockdowns and the resiliency of their US counterpart undermined their appeal. The Canadian dollar has fared somewhat better and could finish the year mostly flat.

After the Fed’s hawkish pivot, the Bank of Canada will probably feel more comfortable to hike rates sooner than expected amid a robust bounce back in Canada’s labour market. Retail sales figures on Tuesday and the monthly GDP print for October due on Thursday might further bolster the case for earlier tightening.

Australia’s jobless rare is also falling fast following the easing of virus restrictions. But even though markets are not convinced by the RBA’s dovish front, the aussie has not been able to advance much on the back of the growing expectations that policymakers will begin to raise rates in mid-2022.

The minutes of the RBA’s December meeting will be published on Tuesday and could reveal whether there was any discussion about ending bond purchases in February, which would pave the way for earlier rate hikes.

In New Zealand, November trade numbers will kick off the week on Monday but are unlikely to attract much attention for the kiwi.

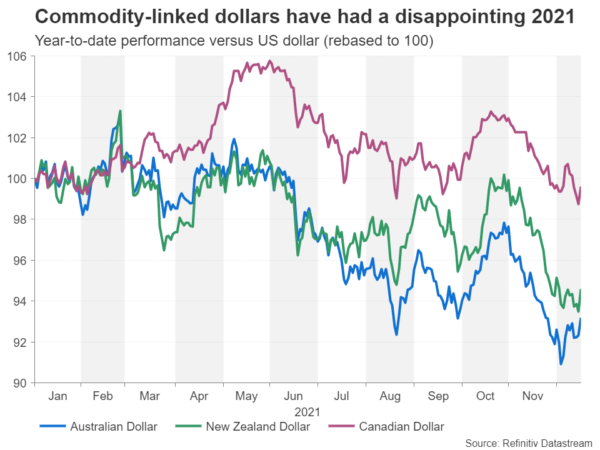

The PBOC might slash rates

In fact, a more important announcement for the kiwi and its risky rivals will be that of China’s central bank. The PBOC is to decide on Monday whether to cut rates amid stuttering growth in China. Pressure has been growing on Chinese policymakers lately to do more to stimulate the economy. After all, consumer inflation remains manageable for now even though producer prices are soaring, and following the recent reduction in the reserve requirement ratio, there’s been talk that the next move will be a cut in the one- and five-year loan prime rates, which have been on hold since April 2020.

If the key lending rates are lowered by a significant margin, there should be a sizeable boost for Asian equity markets as well as for the China-sensitive aussie and broader risk assets.

China’s property crisis is almost certain to drag on well into 2022, and with the global supply chain chaos further choking growth, a rate cut could go some way in easing the current pessimism.

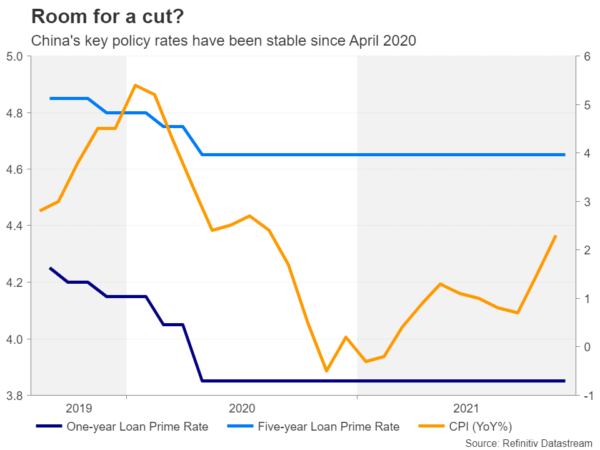

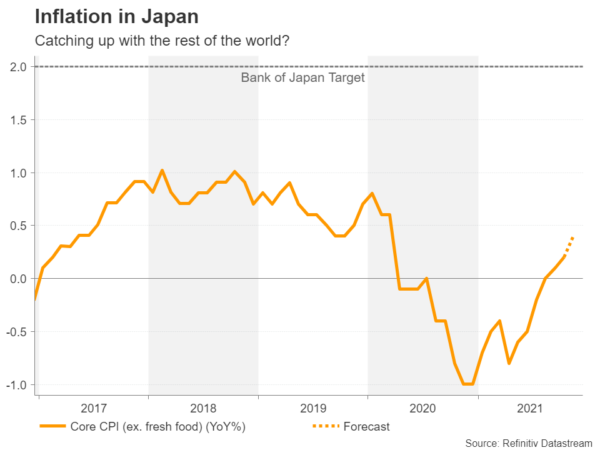

Inflation is creeping higher in Japan

Another country where consumer prices have yet to skyrocket is Japan. Core CPI was just 0.2% y/y in October. The November readings will be released on Friday and are expected to show an uptick to 0.4%. The upward trend will probably accelerate in 2022 as a big manufacturing nation like Japan that relies on imports for energy and raw materials is unlikely to dodge the inflation surge indefinitely.

Yet, even with higher inflation, the Bank of Japan is the least likely to tighten policy over the coming year as the country could actually benefit from prices running hot for a while after years of deflation.

Hence, any positive surprise in the CPI data is not expected to provide much of a boost to the Japanese yen.

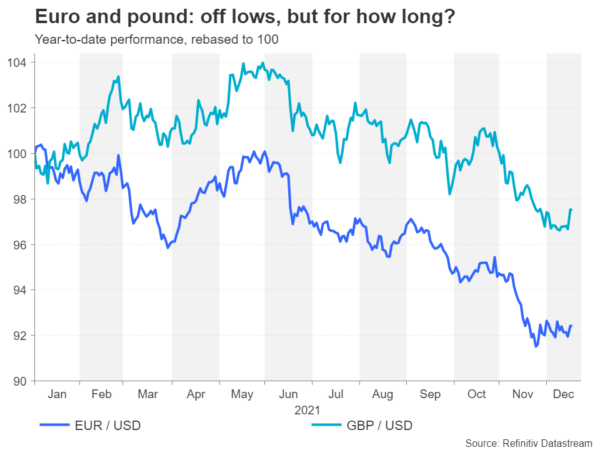

Euro and pound rebound on shaky ground

Over in Europe, it will be even quieter, and despite plenty of policy signals in the last few days, the euro and pound may still struggle for direction.

The ECB just indicated that it thinks inflation will fall back below 2% by 2023 so there is no need to raise interest rates prematurely, while the Bank of England wrong footed investors for the second meeting in a row, lifting borrowing costs by 15bps.

The BoE clearly is worried about the tight labour market at a time when the supply constraints that are fuelling inflation look set to persist for some time yet. However, the Eurozone has a high unemployment problem so there is less of a risk of elevated inflation becoming entrenched.

But whilst the pound’s positive response to the BoE decision can be justified, the euro’s post-ECB gains are perplexing. Markets have been used to the ECB coming up with dovish twists but in December, policymakers did the least they needed to do to maintain their dovish posture so perhaps this disappointed some traders.

Moreover, although the Fed was quite hawkish, there was relief that Chair Powell didn’t put the FOMC in auto-pilot towards full normalization. All this could be aiding the euro in its efforts to form a stronghold around $1.13. In the meantime, the pound is making progress in reclaiming the $1.33 handle.

Revised UK GDP estimates for the third quarter due Wednesday are unlikely to have much impact on sterling. But US data might ruffle both the pound’s and euro’s feathers.

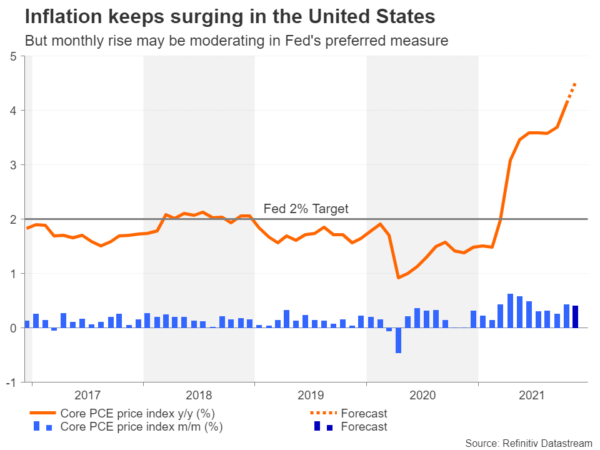

Dollar bulls eye PCE inflation

The US data dump will begin with the closely watched consumer confidence index and existing home sales on Wednesday. On Thursday, personal income and spending numbers, along with the core PCE price index will be the week’s highlights. Durable goods orders, new home sales and the final reading of the University of Michigan’s consumer sentiment gauge are out Thursday too.

Markets were relaxed about the Fed’s very hawkish turn at the December FOMC. Powell’s clear messaging and willingness to change course if needed probably played a role in staving off panic. But there seems to be a bit of relief too that the Fed wants to bring inflation under control as well as put a stop to all the excess stimulus that some say is to blame for the price spikes.

However, investors may additionally be hoping that acting early means interest rates won’t need to rise by much. But what if the inflation data keeps getting worse? The market calm will be put to the test from the PCE inflation numbers.

The core PCE price index – the Fed’s preferred price metric – is forecast to have edged up from 4.1% to 4.5% y/y in November. In addition, consumption is expected to have remained strong, rising by 0.6% month-on-month.

The US dollar took a dive after the Fed decision as Treasury yields slid. This could simply have been a case of buy the rumour, sell the news for the greenback. But things could easily switch around again if investors are reminded that it may take a few more months at the very least before the inflation picture improves.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals