Twitter and Square CEO Jack Dorsey says ‘hyperinflation’ will happen soon in the U.S. and the world

Jack Dorsey, CEO of Twitter and co-founder & CEO of Square, speaks during the crypto-currency conference Bitcoin 2021 Convention at the Mana Convention Center in Miami, Florida, on June 4, 2021. Marco Bello | AFP | Getty Images Twitter co-founder...

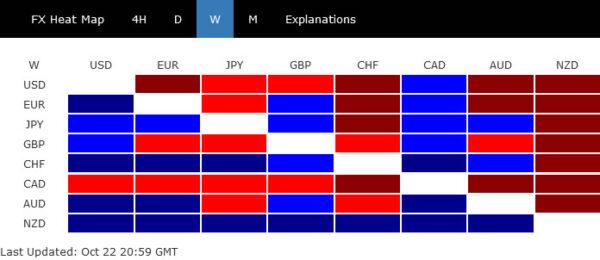

Dollar Ended Lower Despite Increasing Bets on Fed Hike, US Stocks Hit New Records

The markets have turned a bit mixed last week and have likely entered into a near term consolidative mode already. Dollar ended broadly lower even though traders continued to add their bet on a Fed rate hike next year. Indeed,...

Week Ahead: Central Banks Return, Political Drama and BIG Earnings

Without many catalysts for the markets over the last few weeks, potential market moving events will return in force this week! After a few weeks out of the limelight for major central banks, the BOC, BOJ, and ECB meet to...

Mexico’s Inflation Continues to Rise Despite Interest Rate Increases USD/MXN

At Mexico’s last central bank meeting on September 30th , Banxico hiked interest rates from 4.5% to 4.75% and said that the recent rise in inflation is transitory (like so many other central banks around the globe). They also stated...

The Weekly Bottom Line: Inflation Keeps on Persisting

U.S. Highlights Inflation remained top of mind this week as economic indicators offered little evidence of moderation in supply-side disruptions. The bond market continued to reassess the path of monetary policy, pulling its expectations for the first rate hike forward...

Weekly Economic & Financial Commentary: Economic Disruption in China & U.K. CPI Fueling BoE Rate Hike Bets

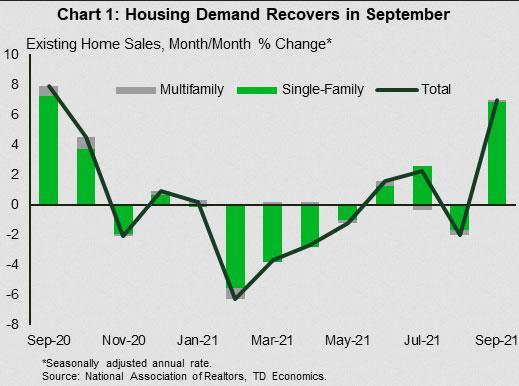

Summary United States: Snarled Supply Chains Stymie Production Supply chain snags continue to bedevil the factory sector. Industrial production fell 1.3% in September. Tangled value chains are worsening building material shortages and hampering new home construction. During September, housing starts...

Week Ahead – Between a Rock and a Hard Place

Inflation is a growing concern For years central banks have been operating under the assumption that inflation will eventually return to target while having the flexibility to wait until the economy is fully ready for higher rates. That luxury is...

David Tepper doesn’t think stocks are a great investment here, but says it all depends on rates

Hedge fund manager David Tepper has turned somewhat bearish on the stock market, citing uncertainties around interest rates and inflation. “I don’t think it’s a great investment right here,” Tepper said Friday on CNBC’s “Halftime Report.” “I just don’t know...

Longevity annuities can be a good deal for seniors. But not many people buy them

MoMo Productions | DigitalVision | Getty Images American life expectancy is trending up — and that creates more financial risk for retirees, who must make their nest eggs last a longer time. An average 65-year-old today will live another 20...

Jeffrey Gundlach says inflation will stay above 4% through 2022

Billionaire bond investor Jeffrey Gundlach said Friday that inflation in consumer prices likely will remain elevated through 2021 and stay above 4% through at least 2022. Citing pressures from shelter costs and rising wages, the head of DoubleLine Capital told...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals