After the holiday lull, markets will be getting back into full swing this week as the Fed publishes the minutes of its December FOMC meeting on Wednesday (19:00 GMT) and the latest nonfarm payrolls report comes out on Friday (13:30 GMT). The ISM manufacturing and non-manufacturing PMIs are also due this week, on Tuesday and Thursday, respectively, both at 15:00 GMT. Will the data further ease Omicron fears or actually revive them, and just how hawkish was the Fed at its last meeting? Any surprises might just bolt the US dollar index out of its month-long sideways range.

A positive dollar outlook

The greenback just had its best year since 2015, and with the Fed expected to pull the rate hike trigger in 2022 on the back of a strong economy as well as surging inflation, the positive outlook should hold for at least the first few months of the year. Although the broader health of the economy is important for policymakers, the labour market is their top priority, and the past year couldn’t have been better proof of this as the Fed was willing to sacrifice runaway inflation for a full jobs recovery.

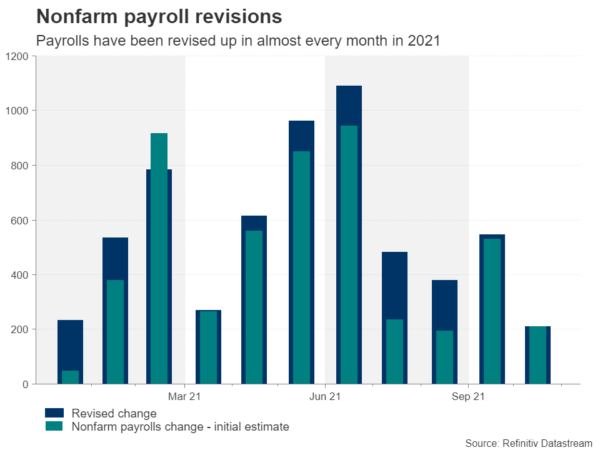

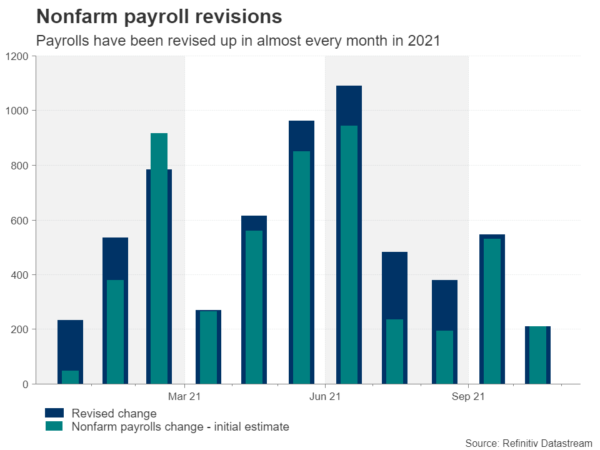

To be fair to the Fed, both the jobs and inflation data have been greatly distorted by the pandemic. For the labour market, in particular, there have been a lot of revisions to the initial payroll readings, while not even the Fed has a good explanation for the shrinking labour force. Excluding November and December, nonfarm payrolls have been revised up by almost one million, indicating jobs growth wasn’t as slow as first deemed.

Panic at the Fed?

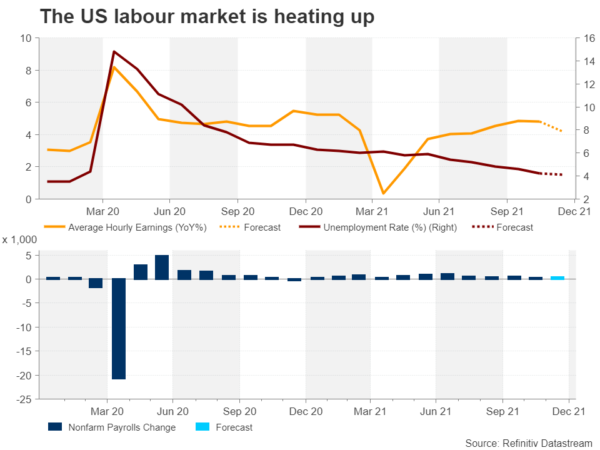

But the bigger puzzle at the moment is whether the estimated remaining 3.5 million people who left the labour force during the pandemic and have yet to return will ever do so. Worker shortages are putting an upward strain on wage costs for businesses, adding to already burgeoning price pressures. Should the wage-price spiral get worse, inflation expectations could become unanchored and the Fed would then have no option but to press on the brakes much harder.

Investors already got a glimpse of this in December when Chair Powell made a dramatic hawkish pivot by announcing an accelerated pace of tapering, which paved the way for earlier rate hikes. The majority of FOMC members now predict three rate increases in 2022. Moreover, Powell hinted that liftoff could happen soon after tapering ends in March. Wednesday’s minutes will reveal how far those discussions went in the December meeting.

But the main risk from the minutes is the overall tone, which could come through as much more hawkish than Powell’s expertly handled press conference where he successfully appeased investor concerns. An overly hawkish Fed may yet pose a problem for the markets now that Omicron is sweeping across America, potentially dampening growth in the early parts of 2022. Hence, any sign that Omicron has started to have contractionary effects on the economy might weigh on sentiment.

Another solid month for US jobs

Looking at the consensus estimates for Friday’s data, nonfarm payrolls are expected to have risen by 400k in December versus November’s disappointing 210k increase, which may get revised. The unemployment rate is forecast to have hit another post-pandemic low, dropping 0.1 percentage points to 4.1%.

Average hourly earnings might be the more interesting release, however, as the month-on-month rate is expected to have quickened slightly to 0.4% but the yearly rate is anticipated to have moderated from 4.8% to 4.2% in December. A much stronger-than-projected pickup in the monthly pace would indicate that the hiring difficulties are getting worse, meaning wage growth has yet to peak.

A positive wage shock is probably the biggest potential upside from the NFP report for the US currency, while another disappointment in the headline jobs print could spark a frantic knee-jerk selloff, although given the recent strong weekly jobless claims numbers, a large miss is unlikely. The ISM surveys could exacerbate the moves if they deliver a double blow or boost to the dollar.

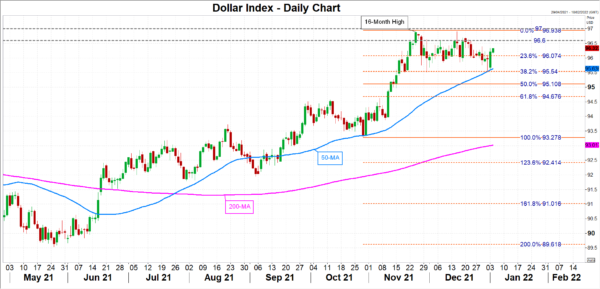

Uncertainties may keep the dollar in a range

Its index has been trading within a range for over a month, with the floor seen at the 38.2% Fibonacci retracement of the late October-late November upleg around 95.54 and the ceiling at November’s 16-month high of 96.94. That peak around 97 could be tested soon if the greenback keeps up its advances, but before then there is another resistance in the 96.60 zone. On the other hand, should the dollar index crack through the range floor and slip below the 50-day moving average, that would not bode well for the near-term outlook.

On the whole, though, it’s quite likely that the dollar will continue to consolidate until there is a clearer picture on how much of an impact Omicron will have on the global economy and on whether inflation is any closer to plateauing. The latter will undoubtedly determine how fast the Fed moves with rate hikes.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals