Overall risk sentiment turns sour again following terrible US retail sales data. DOW futures reverse early gains and turn deep red, pointing to a much lower open. Yen is powering up following risk-off sentiment while Aussie is now leading commodity currencies lower. At the same time, Dollar is turning mixed. But for the week, the greenback is still the worst performing while Yen looks set to secure its position as the top gainer.

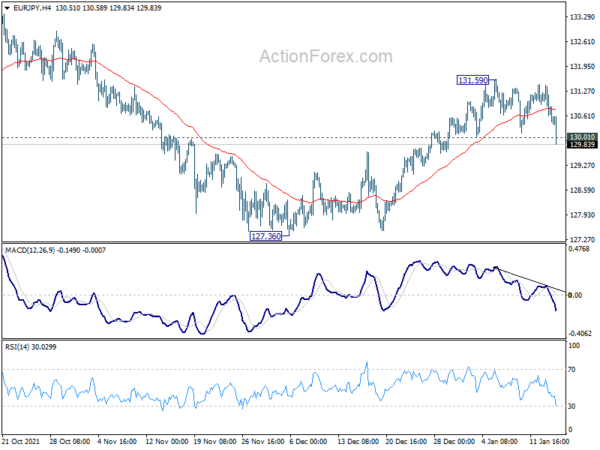

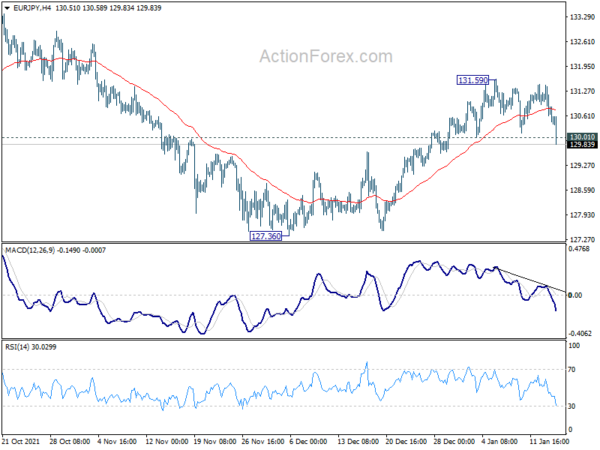

Technically, EUR/JPY’s break of 130.01 support how argues that rise from 127.36 is finished at 131.59. The whole corrective pattern from 134.11 is going to extend with another falling leg. We’ll see if GBP/JPY would follow, and align with the outlook, by breaking through 154.85 support.

In Europe, at the time of writing, FTSE is down -0.50%. DAX is down -1.08%. CAC is down -0.96%. Germany 10-year yield is up 0.0041 at -0.084. Earlier in Asia, Nikkei dropped -1.28%. Hong Kong HSI dropped -0.19%. China Shanghai SSE dropped -0.96%. Singapore Strait Times rose 0.76%. Japan 10-year JGB yield rose 0.0192 to 0.151.

US retail sales dropped -1.9% mom in Dec, ex-auto sales down -2.3% mom

US retail sales dropped -1.9% mom to USD 626.8B in December, much worse than expectation of 0.0%. Ex-auto sales dropped -2.3% mom, below expectation of 0.2% mom. Ex-gasoline sales dropped -2.0% mom. Ex-auto, ex-gasoline sales dropped -2.5% mom.

Total sales for the 12 months of 2021 were up 19.3% from 2020. Total sales for the October 2021 through December 2021 period were up 17.1% from the same period a year ago.

ECB Lagarde: Monetary accommodation is still needed for inflation to settle at 2%

In a speech, ECB President Christine Lagarde said the “rapid reopening” of the economy has led to steep rises in fuel prices, gas and electricity and price hikes in durable goods and some services. These factors are “weighing on growth in the near term”. Higher energy prices are “cutting into household incomes and denting confidence”. Supply bottlenecks are leading to “shortages in the manufacturing sector.

“That is why, at our last Governing Council meeting, we recalibrated our policy measures, allowing for a step-by-step reduction in the pace of our net asset purchases,” she added.

However, Lagarde also noted, “at the same time, we concluded that monetary accommodation is still needed for inflation to settle at 2% over the medium term.”

Eurozone exports rose 14.4% yoy in Nov, imports rose 32.0% yoy

Eurozone exports of goods rose 14.4% yoy, to EUR 225.1B in November. Imports rose 32.0% yoy to EUR 226.6B. Trade deficit came in at EUR -1.5B. Intra-Eurozone trade rose 22.1% yoy to EUR 204.3B.

On seasonally adjusted bases, extra-Eurozone exports rose 3.0% mom to EUR 213.2B. Imports rose 4.5% mom to EUR 214.5B. Trade balance turned into EUR -1.3B deficit. Intra-Eurozone trade rose from EUR 192.2B to EUR 193.9B.

UK GDP grew 0.9% mom in Nov, back above pre-pandemic level

UK GDP rose strongly by 0.9% mom in November, well above expectation 0.4% mom. Looking at some details, services grew 0.7%, production rose 1.0% mom, and production increased 3.5% mom.

Monthly GDP was back above pre-COVID level in February 2020, for the first time, by 0.7%. Also, if there are no other data revision, Q4 GDP should either reach or surpass its pre-coronavirus level in Q4 2019, provided monthly December GDP does not fall by more than -0.2% mom.

Also released, industrial production rose 1.0% mom, 0.1% yoy versus expectation of 0.2% mom, 0.5% yoy. Manufacturing rose 1.1% mom, 0.4% yoy, versus expectation of 0.2% mom, -0.3% yoy. Index of services rose 1.3% 3mo3m, versus expectation of 0.5%. Goods trade deficit narrowed slightly to GBP -11.3B, versus expectation of GBP -14.2B.

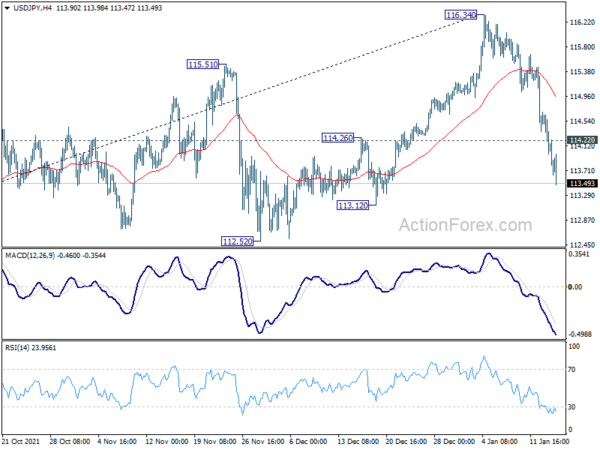

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 113.88; (P) 114.29; (R1) 114.59; More…

USD/JPY’s fall from 116.34 is still in progress and intraday bias stays on the downside for 112.52 support. Considering bearish divergence condition in in daily MACD, break of 112.52 will confirm that it’s already in correction to the up trend from 102.58. Deeper decline would be seen to 38.2% retracement of 102.58 to 116.34 at 111.08. On the upside, above 114.22 minor resistance will turn intraday bias neutral first.

In the bigger picture, no change in the view that rise from 102.58 is the third leg of the up trend from 101.18 (2020 low). Such rally should target a test on 118.65 (2016 high). Sustained break there will pave the way to 120.85 (2015 high) and raise the chance of long term up trend resumption. However, firm break of 112.52 support will dampen this bullish case and we’ll assess the outlook based on subsequent price actions later.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | PPI Y/Y Dec | 8.50% | 8.80% | 9.00% | 9.20% |

| 02:00 | CNY | Trade Balance (USD) Dec | 94.5B | 73.4B | 71.7B | |

| 02:00 | CNY | Exports (USD) Y/Y Dec | 20.90% | 22% | ||

| 02:00 | CNY | Imports (USD) Y/Y Dec | 19.50% | 31.40% | 31.70% | |

| 02:00 | CNY | Trade Balance (CNY) Dec | 604.69B | 451B | 461B | |

| 02:00 | CNY | Exports (CNY) Y/Y Dec | 17.30% | 16.60% | ||

| 02:00 | CNY | Imports (CNY) Y/Y Dec | 16.00% | 26.00% | ||

| 07:00 | GBP | GDP M/M Nov | 0.90% | 0.40% | 0.10% | 0.20% |

| 07:00 | GBP | Manufacturing Production M/M Nov | 1.10% | 0.20% | 0.00% | 0.10% |

| 07:00 | GBP | Manufacturing Production Y/Y Nov | 0.40% | -0.30% | 1.30% | 1.10% |

| 07:00 | GBP | Industrial Production M/M Nov | 1.00% | 0.20% | -0.60% | -0.50% |

| 07:00 | GBP | Industrial Production Y/Y Nov | 0.10% | 0.50% | 1.40% | 0.20% |

| 07:00 | GBP | Index of Services 3M/3M Nov | 1.30% | 0.50% | 1.10% | 1.20% |

| 07:00 | GBP | Goods Trade Balance (GBP) Nov | -11.3B | -14.2B | -13.9B | -11.8B |

| 10:00 | EUR | Eurozone Trade Balance (EUR) Nov | -1.3B | 1.6B | 2.4B | 1.8B |

| 13:30 | USD | Retail Sales M/M Dec | -1.90% | 0.00% | 0.30% | |

| 13:30 | USD | Retail Sales ex Autos M/M Dec | -2.30% | 0.20% | 0.30% | |

| 13:30 | USD | Import Price Index M/M Dec | -0.20% | 0.30% | 0.70% | |

| 14:15 | USD | Industrial Production M/M Dec | 0.40% | 0.50% | ||

| 14:15 | USD | Capacity Utilization Dec | 76.90% | 76.80% | ||

| 15:00 | USD | Michigan Consumer Sentiment Index Jan P | 70.6 | 70.6 | ||

| 15:00 | USD | Business Inventories Nov | 1.00% | 1.20% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals