Canadian Dollar is trading as the strongest one for today, and remains firm after stronger than expected manufacturing sales data. Dollar is currently following, with help by rebound against Yen. Sterling is also slightly weaker, following Yen. Other currencies are mixed for now. Overall, trading is rather subdued with US on holiday.

Technically, while Canadian Dollar is firm, it’s currently still engaging in consolidation against Dollar. Further decline is expected with 1.2619 resistance intact. Break of 1.2452 will resume the fall from 1.2963 to 1.2286 and even further to 1.2005. However, if WTI oil reverses recent rally after being rejected by 85.92 high, a setback in Canadian Dollar could be triggered. That, if happens, could push USD/CAD through 1.2619 for a stronger rebound.

In Europe at the time of writing, FTSE is up 0.77%. DAX is up 0.39%. CAC is up 0.66%. Germany is up 0.0153 at -0.030. Earlier in Asia, Nikkei rose 0.74%. Hong Kong HSI dropped -0.68%. China Shanghai SSE rose 0.58%. Singapore Strait Times rose 0.18%. Japan 10-year JGB yield dropped -0.0046 to 0.146.

Canada manufacturing sales rose 2.6% mom in Nov, supply chains impacts continued

Canada manufacturing sales rose 2.6% mom to CAD 63.1B in November, above expectation of 1.7% mom. Sales increased in 18 of 21 industries, led by the primary metal, petroleum and coal product, non-metallic mineral, and food product industries.

Statistics Canada said, “despite the gains observed for November, supply chain issues continued to impact manufacturing production in many industries including transportation, chemical, and food. Moreover, floods in British Columbia further exacerbated the situation.”

China GDP grew 4.0% yoy in Q4, weak retail sales

China GDP grew 4.0% yoy in Q4, much faster than expectation of 3.3% yoy. On a quarterly basis, GDP grew 1.6% qoq, above expectation of 1.1% qoq. For 2021 as a whole, GDP grew 8.1%, slightly above expectation of 8.1%.

In December, industrial production rose 4.3% yoy, above expectation of 3.6%. Retail sales rose 1.7% yoy, below expectation of 3.7% yoy. Fixed asset investment rose 4.9% ytd yoy, slightly above expectation of 4.8%.

The National Bureau of Statistics said, “we must be aware that the external environment is more complicated and uncertain, and the domestic economy is under the triple pressure of demand contraction, supply shock and weakening expectations.”

Also from China, steel production dropped for the first time in six years in 2021, down -3% from 1.065B tonnes to 1.03B tonnes. Birth rate dropped to a record low of 7.52 births per 1000 people in 2021, down from 2020’s 8.52 births per 1000 people.

China’s rate cut failed to lift HSI

China’s rate cuts were not enough to lift investor sentiment in the region. PBoC lowered its one-year medium-term lending facility rate by 10bps to 2.85%. The seven-day reverse repurchase rate was also cut by 10bps to 2.1%. They’re the first rate cut since April 2020.

Also, the PBoC injected more liquidity by offering 700 billion yuan of MLF loans, exceeding the 500 billion yuan maturing, and added 100 billion yuan with seven-day reverse repurchase agreements, more than the 10 billion yuan due.

Hong Kong HSI closed down -165 pts or -0.68% at 24218.03. Downside momentum has been diminishing since mid December. Yet there is no clear sign of bullish reversal. HSI is still inside medium term falling channel. Another fall remains in favor to extend the down trend from 31183.35 through 22665.25 low.

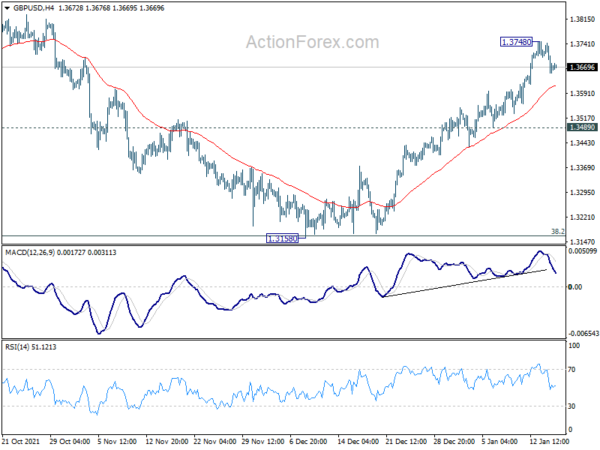

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.3642; (P) 1.3692; (R1) 1.3732; More…

Intraday bias in GBP/USD remains neutral for consolidation below 1.3748 temporary top. Downside of retreat should be contained by 1.3489 support to bring another rally. As noted before, corrective fall from 1.4282 should have completed with three waves down to 1.3158, after hitting 1.3164 medium term fibonacci level. Above 1.3748 will target 1.3833 first. Sustained break of 1.3833 will pave the way back to retest 1.4248 high.

In the bigger picture, strong support was seen from 38.2% retracement of 1.1409 to 1.4248 at 1.3164. The development suggests that up trend from 1.1409 (2020 low) is still in progress. On resumption, next target will be 38.2% retracement of 2.1161 to 1.1409 at 1.5134. Nevertheless sustained break of 1.3164 will argue that whole rise from 1.1409 has completed and bring deeper fall to 61.8% retracement at 1.2493.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Machinery Orders M/M Nov | 3.40% | 1.40% | 3.80% | |

| 00:01 | GBP | Rightmove House Price Index M/M Jan | 0.30% | -0.70% | ||

| 02:00 | CNY | GDP Y/Y Q4 | 4.00% | 3.30% | 4.90% | |

| 02:00 | CNY | Retail Sales Y/Y Dec | 1.70% | 3.70% | 3.90% | |

| 02:00 | CNY | Industrial Production Y/Y Dec | 4.30% | 3.60% | 3.80% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Dec | 4.90% | 4.80% | 5.20% | |

| 04:30 | JPY | Tertiary Industry Index M/M Nov | 0.40% | 1.10% | 1.50% | 1.90% |

| 13:30 | CAD | Manufacturing Sales M/M Nov | 2.60% | 1.70% | 4.30% | |

| 15:30 | CAD | BoC Business Outlook Survey |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals