Overall market sentiment is slightly weaker entering into US session. While Russia showed videos of tanks leaving Crimea, NATO questioned de-escalation and said troop buildup was still going on. There is little reaction to much stronger than expected US retail sales. Nevertheless, Canadian Dollar is popped up by higher than expected, surging consumer inflation data. As for today, Canadian Dollar is the strongest one for now, followed by Aussie. Dollar is the weakest, followed by Euro and Sterling. Swiss Franc is quietly firming up slightly while Yen is mixed. Focus will turn to FOMC minutes, but eyes will still be on the Russia-Ukraine developments.

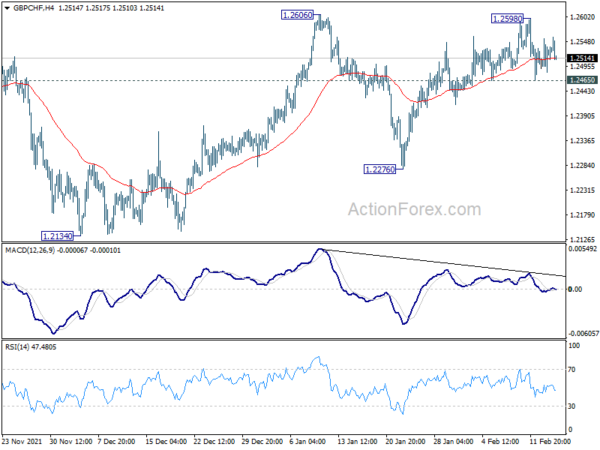

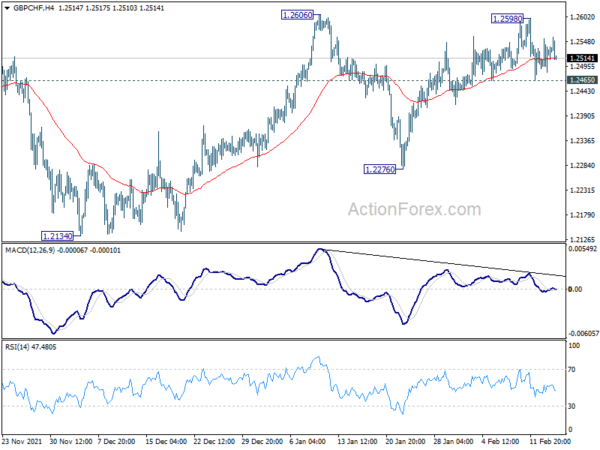

Technically, attention will be on Swiss Franc pairs to gauge if nervousness on war is back. In particular, Break of 1.2465 support in GBP/CHF will at least indicate that rise from 1.2276 has completed at 1.2598. Deeper fall would be seen back to this support level. That would also retain near term bearishness for resuming larger down trend from 1.3070 through 1.2134 low at a later stage.

In Europe, at the time of writing, FTSE is down -0.41%. DAX is down -0.16%. CAC is down -0.25%. Germany 10-year yield is down -0.051 at 0.262. Earlier in Asia, Nikkei rose 2.22%. Hong Kong HSI rose 1.49%. China Shanghai SSE rose 0.57%. Singapore Strait Times rose 0.52%. Japan 10-year JGB yield rose 0.0049 to 0.221.

US retail sales rose 3.8% mom in Jan, ex-auto sales up 3.3% mom

US retail sales rose 3.8% mom to USD 649.8B in January above expectation of 1.8% mom. Ex-auto sales rose 3.3% mom, above expectation of 1.0% mom. Ex-gasoline sales rose 4.2% mom. Ex-auto, ex-gasoline sales rose 3.8% mom. Retail trade rose 4.4% mom.

Total sales for November 21 through January 2022 period were up 16.1% from the same period a year ago.

Import price index rose 2.0% mom in January, above expectation of 1.3% mom.

Canada CPI jumped to 5.1% yoy in Jan, highest since 1991

Canada CPI jumped from 4.8% yoy to 5.1% yoy in January, above expectation of 4.8% yoy. Also, inflation surpassed 5% for the first time since September 1991. On monthly basis, CPI rose 0.9% mom, above expectation of 0.6% mom, highest since January 2017.

Excluding gasoline, CPI rose 4.3% yoy, highest since the introduction of the index in 1999. Prices for services was unchanged at 3.4% yoy. Prices for goods accelerated from 6.8% yoy to 7.2% yoy.

CPI common rose from 2.1% yoy to 2.3% yoy, above expectation of 2.1% yoy. CPI median rose from 3.1% yoy to 3.3% yoy, above expectation of 3.1% yoy. CPI trimmed rose from 3.8% yoy to 4.0% yoy, above expectation of 3.7% yoy.

Also released, manufacturing sales rose 0.7% mom in December. Wholesale sales rose 0.6% mom.

Eurozone industrial production rose 1.2% mom in Dec, EU up 0.7% mom

Eurozone industrial production rose 1.2% mom in December, well above expectation of 0.3% mom. Production of capital goods rose by 2.6%, intermediate goods by 0.5% and non-durable consumer goods by 0.4%, while production of durable consumer goods fell by -0.3% and energy by -0.8%.

EU industrial production rose 0.7% mom. Among Member States for which data are available, the largest monthly increases were registered in Ireland (+10.3%), Lithuania (+6.2%) and Luxembourg (+5.1%). The highest decreases were observed in Czechia (-2.9%), Austria (-1.1%) and Italy (-1.0%).

UK CPI rose to 5.5% yoy in Jan, highest since 1992

UK CPI rose further from 5.4% yoy to 5.5% yoy in January, matched expectations. That’s the highest level in the National Statistics series since January 1997. It was last higher in the historical modelled series in March 1992, which as at 7.1%. CPI core rose from 4.2% yoy to 4.3% yoy, above expectation of 4.3% yoy.

Also released, PPI input came in at 0.9% mom, 13.6% yoy, versus expectation of 0.7% mom, 14.2% yoy. PPI output was at 1.2% mom, 9.9% yoy, versus expectation of 0.6% mom, 9.4% yoy. PPI output core was at 1.1% mom, 0.7% yoy, versus expectation of 0.7% mom, 9.0% yoy.

BoJ Kuroda: Basic approach to allow 10-yr JGB yield to move 25 bps up-down 0%

Speaking in the parliament, BoJ Governor Haruhiko Kuroda said there is no plan to change the band for 10-year JGB yield to fluctuate in. He added, “our basic approach is to buy a sufficient amount of bonds to allow 10-year JGB to move 25 basis points up and down each around our 0% target.”

“How much JGBs BoJ will buy to defend its yield target depends on market conditions at the time,” he said. “BoJ’s fixed-rate bond-buying offer was made in light of such unusual market situation. If market conditions become unusual again, BoJ will of course use tools such as fixed-rate market operation.”

Australia Westpac leading index turned positive, signalling above trend growth

Australia Westpac-Melbourne Institute leading index rose from -0.1% to 0.4% in December. That’s the first positive, above trend, read on the since Since Delta outbreak last August. The index signalled that growth outlook has improved with above trend growth over the next three to nine months.

Westpac expects contraction in spending in January due to Omicron, and zero growth in GDP in Q1. But the economy is expected to bounce back strongly over the rest of 2022, with a solid 5.5% growth for the year overall.

Westpac also continues to expect interest rate hike by RBA before August meeting.

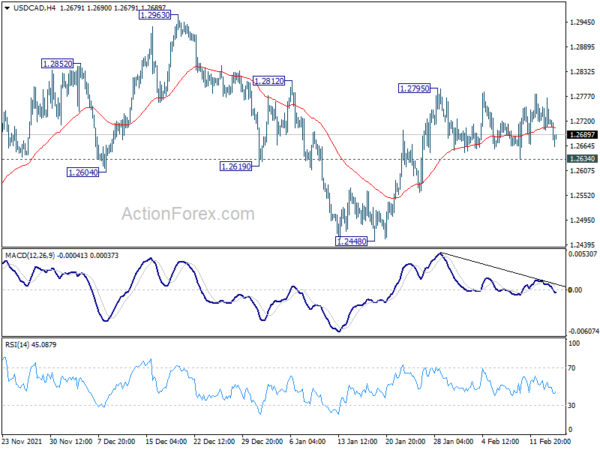

USD/CAD Mid-Day Outlook

Daily Pivots: (S1) 1.2687; (P) 1.2730; (R1) 1.2760; More…

USD/CAD dips mildly today but stays in range of 1.2634/2795 and intraday bias remains neutral. Further rally is mildly in favor with 1.2634 support intact. On the upside, break of 1.2795 will resume the rally from 1.2448 to 1.2963 resistance next. However, break of 1.2634 support will turn bias back to the downside for 1.2448 support instead.

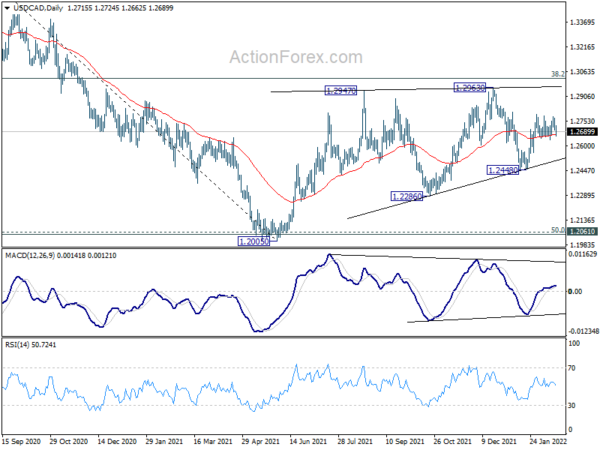

In the bigger picture, focus stays on 38.2% retracement of 1.4667 (2020 high) to 1.2005 (2021 low) at 1.3022. Sustained break there should confirm that the down trend from 1.4667 has completed after defending 1.2061 long term cluster support. Further rise would then be seen towards 61.8% retracement at 1.3650. However, rejection by 1.3022 will maintain medium term bearishness. Break of 1.2005 will resume the down trend from 1.4667 and that carries larger bearish implications too.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Leading Index M/M Jan | 0.10% | 0.00% | ||

| 01:30 | CNY | CPI Y/Y Jan | 0.90% | 1.00% | 1.50% | |

| 01:30 | CNY | PPI Y/Y Jan | 9.10% | 9.40% | 10.30% | |

| 04:30 | JPY | Tertiary Industry Index M/M Dec | 0.40% | 0.50% | 0.40% | |

| 07:00 | GBP | CPI Y/Y Jan | 5.50% | 5.50% | 5.40% | |

| 07:00 | GBP | Core CPI Y/Y Jan | 4.40% | 4.30% | 4.20% | |

| 07:00 | GBP | RPI Y/Y Jan | 7.80% | 7.50% | 7.50% | |

| 07:00 | GBP | PPI Input M/M Jan | 0.90% | 0.70% | -0.20% | 0.10% |

| 07:00 | GBP | PPI Input Y/Y Jan | 13.60% | 14.20% | 13.50% | 13.80% |

| 07:00 | GBP | PPI Output M/M Jan | 1.20% | 0.60% | 0.30% | |

| 07:00 | GBP | PPI Output Y/Y Jan | 9.90% | 9.40% | 9.30% | |

| 07:00 | GBP | PPI Core Output M/M Jan | 1.10% | 0.70% | 0.50% | 0.60% |

| 07:00 | GBP | PPI Core Output Y/Y Jan | 9.30% | 9.00% | 8.70% | 8.60% |

| 10:00 | EUR | Eurozone Industrial Production M/M Dec | 1.20% | 0.30% | 2.30% | 2.40% |

| 13:30 | CAD | Manufacturing Sales M/M Dec | 0.70% | 0.00% | 2.60% | 3.40% |

| 13:30 | CAD | Wholesale Sales M/M Dec | 0.60% | 2.70% | 3.50% | |

| 13:30 | CAD | CPI Y/Y Jan | 5.10% | 4.80% | 4.80% | |

| 13:30 | CAD | CPI Common Y/Y Jan | 2.30% | 2.10% | 2.10% | |

| 13:30 | CAD | CPI Median Y/Y Jan | 3.30% | 3.10% | 3.00% | 3.10% |

| 13:30 | CAD | CPI Trimmed Y/Y Jan | 4.00% | 3.70% | 3.70% | 3.80% |

| 13:30 | USD | Retail Sales M/M Jan | 3.80% | 1.80% | -1.90% | -2.50% |

| 13:30 | USD | Retail Sales ex Autos M/M Jan | 3.30% | 1.00% | -2.30% | -2.80% |

| 13:30 | USD | Import Price Index M/M Jan | 2.00% | 1.30% | -0.20% | -0.40% |

| 14:15 | USD | Industrial Production M/M Jan | 1.40% | 0.50% | -0.10% | |

| 14:15 | USD | Capacity Utilization Jan | 77.60% | 76.70% | 76.50% | |

| 15:00 | USD | Business Inventories Dec | 2.10% | 1.30% | ||

| 15:00 | USD | NAHB Housing Market Index Feb | 83 | 83 | ||

| 15:30 | USD | Crude Oil Inventories | -2.2M | -4.8M | ||

| 19:00 | USD | FOMC Minutes |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals