Australian Dollar rises mildly in Asian session, together with New Zealand Dollar. But both were hammed down after a Russian media reported that Ukraine forces opened fire on four settlements of the LPR. Overall market sentiment remains rather fragile and ultra-sentiment. Dollar and Yen are both picking up some buying while European majors are mixed.

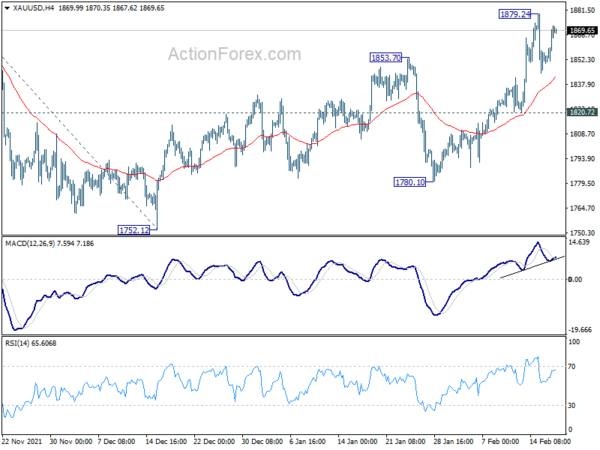

Technically, Gold’s retreat from 1879.24 was rather shallow and contained well above rising 4 hour 55 EMA so far. This keeps near term bullish bias intact. Focus could soon be back on 1879.24 temporary top. Break there will resume recent rally to 1916.30 resistance. If happens, that could also come with another down leg in Dollar.

In Asia, at the time of writing, Nikkei is down -0.14%. Hong Kong HSI is up 0.30%. China Shanghai SSE is up 0.35%. Singapore Strait Times is up 0.40%. Japan 10-year JGB yield is up 0.0014 at 0.223. Overnight, DOW dropped -0.16%. S&P 500 rose 0.09%. NASDAQ dropped -0.11%. 10-year yield rose 0.002 to 2.047.

FOMC minutes: Officials to update their assessments at each meeting

The minutes of the January FOMC meeting contained little surprises. Fed acknowledged that ” recent inflation readings had continued to significantly exceed the Committee’s longer-run goal and elevated inflation was persisting longer than they had anticipated.” And, ” elevated inflation was a burden on U.S. households, particularly those who were least able to pay higher prices for essential goods and services.”

Most participants noted, “if inflation does not move down as they expect, it would be appropriate for the Committee to remove policy accommodation at a faster pace than they currently anticipate.” But, “the appropriate path of policy would depend on economic and financial developments and their implications for the outlook and the risks around the outlook.”

Fed officials “will be updating their assessments of the appropriate setting for the policy stance at each meeting.”

Meanwhile, ” in light of the current high level of the Federal Reserve’s securities holdings, a significant reduction in the size of the balance sheet would likely be appropriate.”

Fed Kashkari: Let’s not overdo policy normalization

Minneapolis Fed President Neel Kashkari said yesterday that it’s “appropriate” to start normalizing policy. However, he cautioned “let’s not overdo it”. “If we raise rates really aggressively, we run the risk of slamming the brakes on the economy, putting the economy into recession, which would then — we’d be crashing back down into this low inflation environment,” he warned.

Kashkari also revealed that he and his family had COVID earlier this year, and “a lot of families are experiencing what we just experienced.” He added “this will be a while” before people can be comfortably living with the coronavirus.

Japan monthly trade deficit at 8-yr high in Jan, as imports surged to record

Japan exports rose 9.6% yoy to JPY 6332B in January. Imports surged 39.6% yoy to record JPY 8523B. Trade balance came in as JPY -2191B deficit, largest single month deficit since January 2014.

Exports to China dropped -5.4% yoy, first contraction in 19 months. Imports from China rose 23.7% yoy, highest in four months. Exports to US rose 11.5% yoy.

In seasonally adjusted term, exports rose 0.1% mom to JPY 7355B. Imports rose 4.9% mom to JPY 8287B. Trade balance was at JPY -933B deficit.

Australia employment grew 12.9k driven by part-time jobs, hours worked fell

Australia employment grew 12.9k in January, better than expectation of 0k. Full-time jobs dropped -17k but part-time jobs rose 30k.

Unemployment rate was unchanged at 4.2%, but participation rate rose 0.1% to 66.2%. Monthly hours worked, however, dropped -8.8% mom.

Bjorn Jarvis, head of labour statistics at the ABS, “While we again saw higher than usual numbers of people taking annual leave – even more so than last year – the 8.8 per cent fall in hours worked in January 2022 also reflected much higher than usual numbers of people on sick leave.”

“As with earlier rapid changes in the labour market during the pandemic, hours continue to be much more affected than employment. This reflects people working reduced or no hours, without necessarily losing their jobs.”

Looking ahead

Swiss trade balance will be released in European session. ECB will publish monthly economic bulletin. Later in the day, US will release jobless claims, housing starts and building permits, and Philly Fed survey.

AUD/USD Daily Report

Daily Pivots: (S1) 0.7158; (P) 0.7182; (R1) 0.7219; More…

AUD/USD is still staying in range below 0.7247 and intraday bias remains neutral for the moment. Further rise would remain mildly in favor as long as 0.7050 support holds. Above 0.7247 will target 0.7313 resistance. Decisive break there argue that correction from 0.8006 has completed at 0.6966, after hitting 0.6991 key support. Outlook will be turned bullish for 0.7555 resistance next. On the downside, however, break of 0.7050 support will bring retest of 0.6966 low instead.

In the bigger picture, focus remains on 0.6991 key structural support. Sustained break there will argue that the whole up trend from 0.5506 might be finished at 0.8006, after rejection by 0.8135 long term resistance. Deeper decline would then be seen back to 61.8% retracement of 0.5506 to 0.8006 at 0.6461. Meanwhile, strong rebound from 0.6991 will retain medium term bullishness. That is, whole up trend from 0.5506 is still in progress.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance (JPY) Jan | -0.93T | -0.46T | -0.44T | -0.55T |

| 23:50 | JPY | Machinery Orders M/M Dec | 3.60% | -1.80% | 3.40% | |

| 00:30 | AUD | Employment Change Jan | 12.9K | 0.0K | 64.8K | |

| 00:30 | AUD | Unemployment Rate Jan | 4.20% | 4.20% | 4.20% | |

| 07:00 | CHF | Trade Balance (CHF) Jan | 4.23B | 3.69B | ||

| 09:00 | EUR | ECB Economic Bulletin | ||||

| 13:30 | USD | Housing Starts Jan | 1.70M | 1.70M | ||

| 13:30 | USD | Building Permits Jan | 1.79M | 1.87M | ||

| 13:30 | USD | Initial Jobless Claims (Feb 11) | 219K | 223K | ||

| 13:30 | USD | Philadelphia Fed Manufacturing Survey Feb | 21 | 23.2 | ||

| 15:30 | USD | Natural Gas Storage | -203B | -222B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals