Russia invasion of Ukraine remains the dominant theme in the markets today. Safe haven flow pushes gold to highest level in more than a year, marching towards 2k handle. WTI crude oil also surges pass 100 level, rising as it does in geopolitical tensions. In the currency markets, Yen and Dollar are overwhelmingly the strongest ones, followed by Swiss Franc. Euro and Sterling are the weakest together with Kiwi. Aussie and Loonie are weak too, but not as bad as Euro and the Pound.

Technically, Yen appears to have a slight upper hand against Swiss Franc in current risk aversion trade, with CHF/JPY dipping notably today. Immediate focus will be on near term trend line (now at 124.01), and 123.52 support. Firm break of this zone will complete a head and shoulder top pattern (ls: 125.48; h: 127.05; rs: 125.56). In this case, CHF/JPY would likely dive further to long term channel support (now at 120.23), before finding a bottom.

In Europe, at the time of writing, FTSE is down -2.84%. DAX is down -4.54%. CAC is down -3.90%. Germany 10-year yield is down -0.0843 at 0.145. Earlier in Asia, Nikkei dropped -1.81%. Hong Kong HSI dropped -3.21%. China Shanghai SSE dropped -1.70%. Singapore Strait Times dropped -3.45%. Japan 10-year JGB yield dropped -0.0110 to 0.187.

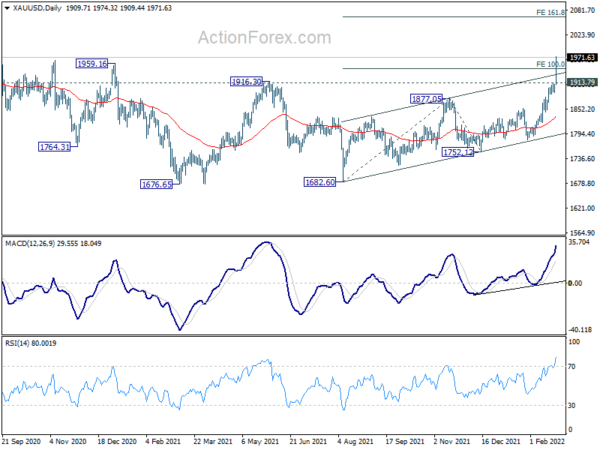

Gold to target 2074 high on upside acceleration

Gold’s rally continues further today and powers through, 100% projection of 1682.60 to 1877.05 from 1752.12 at 1946.57. This is a clear sign of upside acceleration. In any case, outlook will stay bullish as long as 1913.79 resistance turned support holds. Next target is 161.8% projection at 2066.74, which is close to 2074.84 high.

Also, the chance of long term up trend resumption is increasing with current rally. On break of 2074.84, next medium term target will be 61.8% projection of 1160.17 to 2074.84 from 1682.60 at 2247.86.

WTI oil breaks 100 with upside acceleration, 107.4 next

WTI crude oil surges sharply as Russia started invading Ukraine, and it’s now above 100 handle. For the near term, outlook will stay bullish as long as 95.98 resistance turned support holds. Next target is 61.8% projection of 66.46 to 95.98 from 89.23 at 107.43.

Note that 4 hour MACD clearly indicates that it’s in upside acceleration. Firm break of 107.43 could prompt further acceleration to 100% projection at 118.75.

US initial jobless claims dropped to 232k, continuing claims dropped to 1.476m

US initial jobless claims dropped -17k to 232k in the week ending February 19, slightly below expectation of 239k. Four-week moving average of initial claims dropped -7k to 236k.

Continuing claims dropped -112k to 1476k in the week ending February 12, lowest since March 14, 1970. Four-week moving average of continuing claims dropped -49k to 1576k, lowest since June 30, 1973.

US GDP grew 7% annualized in Q4

According to second estimate, US GDP grew 7.0% annualized in Q4. The increase in real GDP primarily reflected increases in private inventory investment, exports, PCE, and nonresidential fixed investment that were partly offset by decreases in both federal and state and local government spending. Imports, which are a subtraction in the calculation of GDP, increased.

ECB Stournaras: Asset purchases should continue until end of the year

ECB Governing Council member Yannis Stournaras said in a Reuters interview that the asset purchase program should continue until at least the end of the year, to cushion the fallout from the Ukraine crisis.

He said, “judging the situation from today’s point of view, I would rather favour a continuation of the APP at least until the end of the year, beyond September, rather than bringing the end closer… I wouldn’t be in favour of announcing the end of APP in March.”

Stournaras added that the crisis

was bound to depress prices “in the medium to long term” after an initial spike.”In my view it is going to have a short-term inflationary effect – that is prices will increase due to higher energy costs,” he said. “But in the medium to long term I think that the consequences will be deflationary through adverse trade effects and of course through the rise in energy prices.”

BoJ Kuroda: No immediate plans to scale back stimulus

BoJ Governor Haruhiko Kuroda told the parliament, “unlike Western countries, we have no immediate plans to scale back our monetary stimulus.” But the central bank will continue to look at inflation expectations. “We will look not just at price indicators, but also surveys showing how the public feels about price moves,” he added.

On exchange rate, Kuroda said, “if the yen weakens further, that could push up import costs. But the recent rise in import costs is driven mostly by an increase in dollar-denominated raw material prices, rather than a weak yen.”

“It’s desirable for currency rates to move stably reflecting economic fundamentals. I think recent (yen) moves are in line with this trend,” Kuroda added.

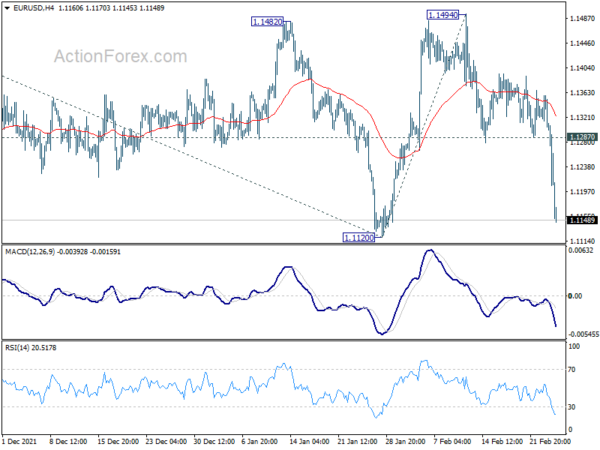

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1283; (P) 1.1321; (R1) 1.1341; More…

EUR/USD falls to as low as 1.1147 so far today and intraday bias stays on the downside for 1.1120 low. Decisive break there will confirm resumption of larger down trend from 1.2348. Next target is 61.8% projection of 1.2265 to 1.1120 from 1.1494 at 1.0786. For now, risk will stay on the downside as long as 1.1287 support turned resistance holds, in case of recovery.

In the bigger picture, the decline from 1.2348 (2021 high) is seen as a leg inside the range pattern from 1.2555 (2018 high). Sustained trading above 55 week EMA (now at 1.1593) will argue that it has completed and stronger rise would be seen back towards top of the range between 1.2348 and 1.2555. However, firm break of 1.0635 (2020 low) will raise the chance of long term down trend resumption and target a retest on 1.0339 (2017 low) next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | Private Capital Expenditure Q4 | 1.10% | 2.90% | -2.20% | -1.10% |

| 13:30 | USD | Initial Jobless Claims (Feb 18) | 232K | 239K | 248K | 249K |

| 13:30 | USD | GDP Annualized Q4 P | 7.00% | 7.10% | 6.90% | |

| 13:30 | USD | GDP Price Index Q4 P | 7.10% | 6.90% | 6.90% | |

| 15:00 | USD | New Home Sales M/M Jan | 803K | 811K | ||

| 15:30 | USD | Natural Gas Storage | -137B | -190B | ||

| 16:00 | USD | Crude Oil Inventories | -1.0M | 1.1M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals