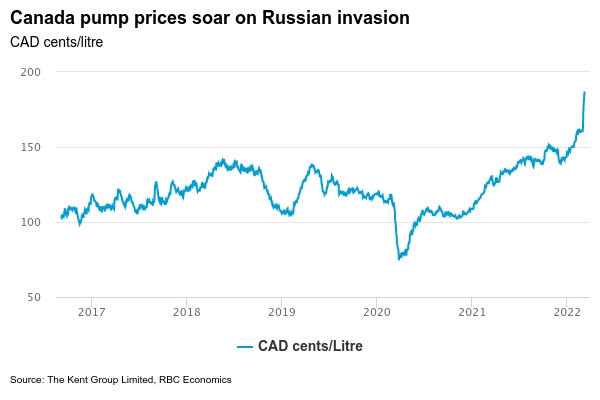

Canada’s CPI report for February is expected to show a firm 5.4% year-over-year increase. It will likely rise closer to 6% in March on the back of surging pump prices. In the first week of March alone, gas prices soared 16%—to 46% above year ago levels—as the Russian invasion of Ukraine sent global oil prices surging. Commodity prices for products including wheat and metals have risen sharply too, and are expected to dominate the near-term inflation outlook. Broadening price pressures across a widening array of products was already a big concern for central banks. Our forecast for CPI in February is again expected to have been widely-based, as even more goods and services see faster price appreciation. That trend mirrors what’s happening in the US, which saw inflation rising to 7.9% in February. We expect the U.S. Fed to follow the Bank of Canada’s rate hike from earlier this month with their own 25 basis point increase next week.

Despite rising inflation and intensifying geopolitical risks, domestic economic data is expected to look firm. Early estimates for January manufacturing and wholesale sales were surprisingly strong given a large drop in hours worked tied to the rapid spread of Omicron during that month. The preliminary estimate for retail sales in January was up 2.4%. And our own tracking of card spending is pointing to another firm reading for February alongside a sharp rebound in travel and hospitality spending as pandemic restrictions eased.

Week ahead data watch:

We expect Canadian housing starts to rise to 260,000 in February, up from 231,000 in January. Permit issuance has been substantially stronger, averaging 300,000 over the last three months ending in January. But labour shortages remain a significant issue, and that may be lengthening the time between permit issuance and actual house starts.

Policymakers at the U.S. Federal Reserve are expected to hike the Fed funds target range by 25 basis points—the first increase since 2019 as very low unemployment and firming inflation pressures offset increased geopolitical headwinds tied to the Russian invasion of Ukraine. We expect another four (equal-sized) hikes in 2022 to push the target range to 1.25% to 1.50% by end of year.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals