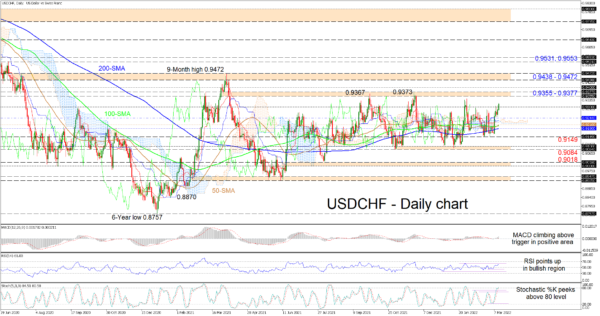

USDCHF has climbed above the 0.9300 handle, extending the latest surge in upward forces, and is now eyeing the 0.9355-0.9377 resistance barrier, which includes the September and November 2021 highs. The minor upturn in the simple moving averages (SMAs) confirm no clear trend in the pair but do imply the positive impetus is growing.

The neutral Ichimoku cloud and lines indicate that driving forces in the pair are currently feeble, while the short-term oscillators are skewed to the upside. The MACD, slightly north of the zero mark, is strengthening above its red signal line, while the RSI is steering higher in the bullish zone. The stochastic lines are marginally in overbought territory with the %K line rising, hinting that the pair’s positive bearing is still intact.

If the pair manages to preserve its current trajectory, preliminary upside limitations could arise at the 0.9355-0.9377 resistance boundary. However, if buyers overcome this tough obstacle, the 0.9400 level overhead may impede additional progress in the pair from challenging the 0.9438-0.9472 resistance section, which has opposed advances since July 2020. Should a more profound upward thrust stretch beyond the nine-month high of 0.9472 from April 2021, the 0.9531 and the 0.9553 highs identified in June 2020 may come under attack.

Meanwhile, if the positive drive wanes considerably, sellers could face a hardened buffer zone from the 0.9244 level until the 200-day SMA at 0.9190. Should buyers fail to find footing off any of the multiple support barriers within this region, sellers may then confront the 0.9149 lows. If negative forces amplify, the 0.9084-0.9100 base could draw focus before the bears pursue the 0.9000-0.9018 support band.

Summarizing, USDCHF is sustaining a neutral-to-bullish tone above the cloud and the 0.9149 trough. A price retreat below the 0.9084-0.9100 foundation may spark worries about negative tendencies, while a jump above the 0.9355-0.9377 obstacle would nourish the bullish outlook.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals