Key Highlights

- USD/CHF started a major increase after it broke the 0.9250 resistance.

- It is up over 150 pips and broke many hurdles on the 4-hours chart.

- EUR/USD is still struggling below 1.1080, and GBP/USD is consolidating above 1.3000.

- The Fed Interest Rate Decision is scheduled today (forecast 0.50%, versus 0.25% previous).

USD/CHF Technical Analysis

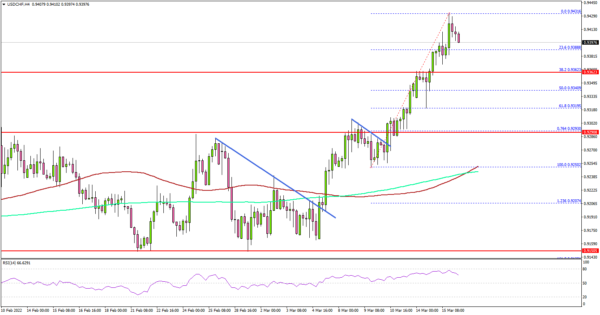

The US Dollar formed a support base above 0.9200 against the Swiss Franc. USD/CHF started a strong increase and broke many hurdles near 0.9250.

Looking at the 4-hours chart, the pair gained bullish momentum above the 0.9300 resistance. The pair even settled above the 0.9350 level, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

During the increase, there was a clear move above a few key bearish trend lines. Finally, the pair spiked above 0.9400 and is currently consolidating gains.

An immediate resistance on the upside is near the 0.9420 level. The next major resistance is near the 0.9440 level. Any more gains might send USD/CHF towards the 0.9500 resistance.

If there is no upside break above 0.9420, the pair could start a downside correction. An initial support is near the 0.9360 level. The first major support is near the 0.9330 level. The main support is near the 0.9300 zone.

A successful break below the 0.9300 support could start a major decline. In the stated case, USD/CHF may perhaps revisit the 0.9250 support.

Looking at EUR/USD, the pair is still struggling to surpass the 1.1080 resistance zone. Besides, GBP/USD is attempting a recovery wave from the 1.3000 zone.

Economic Releases

- US Retail Sales for Feb 2022 (MoM) – Forecast +0.4%, versus +3.8% previous.

- Fed Interest Rate Decision – Forecast 0.50%, versus 0.25% previous.

- Canadian Consumer Price Index for Feb 2022 (MoM) – Forecast +0.9%, versus +0.9% previous.

- Canadian Consumer Price Index for Feb 2022 (YoY) – Forecast +5.5%, versus +5.1% previous.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals