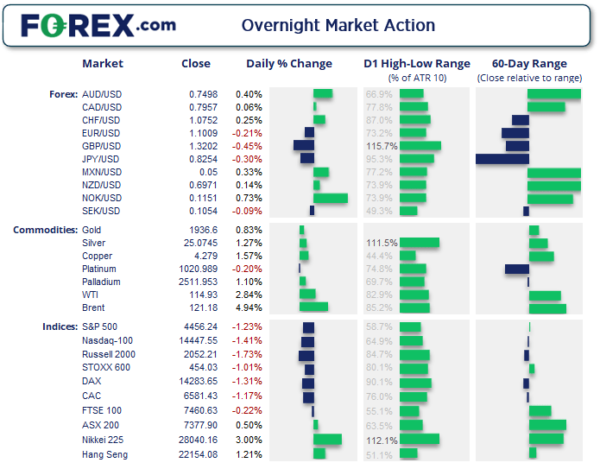

US indices pulled back from their highs overnight as bond yields continued to scream higher as Fed officials maintained their hawkish rhetoric.

Wednesday US cash market close:

- The Dow Jones Industrial fell -448.96 points (-1.29%) to close at 34,358.50

- The S&P 500 index rose -55.37 points (2.51%) to close at 34,058.75

- The Nasdaq 100 index fell -206.787 points (-1.41%) to close at 14,447.55

Asian futures:

- Australia’s ASX 200 futures are up 2 points (0.03%), the cash market is currently estimated to open at 7,379.90

- Japan’s Nikkei 225 futures are down -450 points (-1.62%), the cash market is currently estimated to open at 27,590.16

- Hong Kong’s Hang Seng futures are down -114 points (-0.52%), the cash market is currently estimated to open at 22,040.08

- China’s A50 Index futures are down -21 points (-0.15%), the cash market is currently estimated to open at 13,822.50

The invasion of Ukraine has entered its second month, and concerns over oil supplies has sent crude higher. Bonds also rose to send yields and equity markets lower with all Wall Street benchmarks in the red. 9 of the 11 S&P 500 sectors posted losses, led by health care and financials, with energy being the only one to post materials gains of 1.7% (utilities were only slightly higher).

- +10.7% – Uniti Group Ltd (UWL.AX)

- +9.62% – Imugene Ltd (IMU.AX)

- +7.52% – Zip Co Ltd (Z1P.AX)

Underperformers:

- -7.88% – Fisher & Paykel Healthcare Corporation Ltd (FPH.AX)

- -3.40% – Champion Iron Ltd (CIA.AX)

- -2.96% – Resmed Inc (RMD.AX)

Oil remains bid ahead of NATO meeting

WTI rose to a high of 115.40 and now trades around the 2011 high of 114.83. A bullish engulfing candle formed on the daily chart and with Russia upping the ante ahead of the NATO meeting, oil will likely remain supported with the potential to rally. Whilst there is chatter that the Iran deal is imminent, it would only account for a fraction of oil lost if Europe decides to ban Russian energy imports.

Gold considers its latest breakout

The yellow metals continues to track oil prices, albeit with lower levels of volatility. But the rise in oil has helped gold prices recover to the top of the 1900 – 1950 range. A bullish hammer formed last Wednesday to show demand around 1900, and price action has mostly remained above the June high of 1916.53 since. A bullish engulfing formed yesterday, so we’re on guard for a breakout today.

The four-hour chart shows a higher low formed along its 200-bar eMA, and prices have broken out of a corrective channel. Ideally prices can hold above the weekly pivot point (black line) and move towards our 1980 target.

Rubles for oil please

Russia will begin demanding that “unfriendly countries” (the West) pay for gas in rubles, a move that could force a back door relaxation of some sanctions and support their struggling currency. And that will give EU officials another talking point at today’s meeting, which will focus on whether they can agree to ban Russian oil imports. Not that they need any more to talk about. The ruble rose to a 5-week high against the US dollar.

GBP weakest major despite 30-year high CPI

UK inflation hit a 30-year high but it wasn’t enough to save a weaker GBP alongside a weaker economic forecast from OBR, which saw growth slashed to 3.8% this year from 6% in October. AUD was the strongest major as it tracked commodities higher. The US dollar index pulled back from its 7-day high and formed a bearish engulfing candle on the daily chart, despite higher bond yields.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals