Cable holds in a choppy and directionless mode for the second straight day and remained resilient despite downbeat UK retail sales data for February.

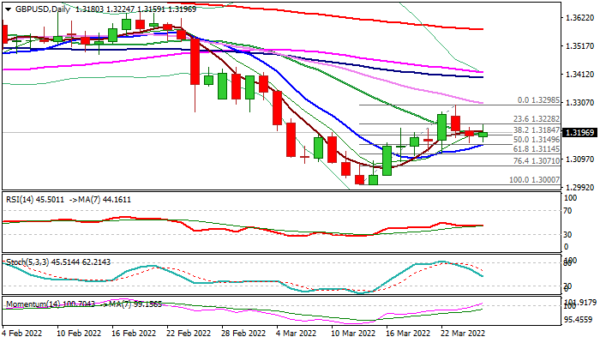

Weaker dollar in European trading on Friday helped sterling ahead of pivotal support at 1.3150 (50% retracement of 1.3000/1.3298, reinforced by 10DMA), after the action was already rejected at this zone on Thursday.

Technical studies on daily chart lack clearer direction signal as bullish momentum is rising but stochastic is heading south and 10/20DMA’s are in mixed mode.

Watch the action around 1.3150, as firm break here would encourage sellers and risk test of Fibo supports at 1.3114 and 1.3071 (Fibo 61.8% and 76.4% of 1.3000/1.3298 respectively) which guard key 1.30 level.

At the upside, initial barrier lays at 1.3245 (Fibo 38.2% of 1.3642/1.3000) followed by 1.3298 (Mar 23 recovery peak), violation of which would bring bulls back to play.

Res: 1.3245; 1.3282; 1.3298; 1.3321.

Sup: 1.3150; 1.3114; 1.3071; 1.3034.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals