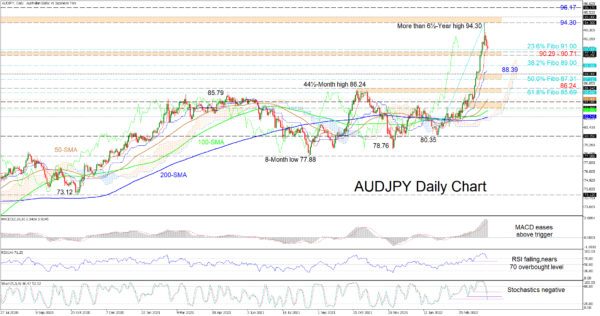

AUDJPY’s latest pullback from the fresh multi-year peak is resting on the red Tenkan-sen line around the 91.00 price level, which is the 23.6% Fibonacci retracement of the up leg from 80.35 until the more than 6½-year high of 94.30. The positive incline in the slopes of the simple moving averages (SMAs) have yet to signal any serious damage to the bullish bearing in the pair.

Currently, the Ichimoku lines indicate a decrease in the potency of positive forces, while the short-term oscillators confirm that recent negative momentum continues to strengthen. The MACD is very far in the positive region but is rolling over towards its red trigger line, while the diving RSI is confronting the 70 overbought level. Furthermore, the negatively charged stochastic oscillator is promoting a more profound retracement in the pair.

Presently the 23.6% Fibo at 91.00 along with the 90.29-90.71 support band are denying negative moves from gaining pace. However, if the latter, which is formed by the December 2015 and September 2017 rally peaks, fails to mute negative pressures, the price may then aim for the 38.2% Fibo at 89.00. If sellers remain in the driver’s seat, the blue Kijun-sen line at 88.39 could come under attack prior to the bears testing the support zone between the 88.00 handle and the 50.0% Fibo of 87.31. Surrendering extra ground, the pair may then seek out the support border existing between the 86.24 inside swing high and the 61.8% Fibo of 85.69.

If buyers create positive traction from the 90.29-90.71 support and the 23.6% Fibo’s vicinity, the bulls may try to revisit the more than 6½-year high of 94.30, which is the lower boundary of a resistance zone extending higher until the 95.00 handle. Should buyers overcome this obstacle that stretches back to June 2015, they may then target the 96.17 high.

Summarizing, AUDJPY is sustaining a bullish tone above the 90.29-90.71 support and the 23.6% Fibo of 91.00. A significant drop in the price below the October 2021 high of 86.24 may spark concerns about growing negative pressures.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals