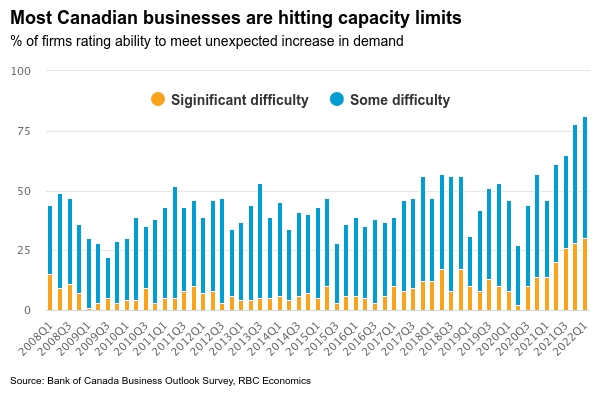

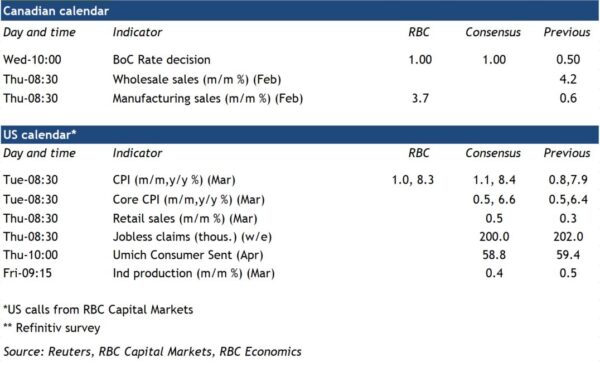

We expect the Bank of Canada to hike interest rates by 50 basis points next week. The move will follow up on the 25 bp rate hike in March and come alongside the widely-expected start of ‘quantitative tightening’ as the central bank begins to reduce asset holdings. Labour markets have strengthened dramatically, pushing the unemployment rate back below pre-pandemic levels. Acute labour shortages are now widespread. And the latest Bank of Canada Business Outlook Survey reiterated that longer-run production capacity limits and surging input costs are larger concerns for businesses than any weakness in demand. The central bank will likely take some comfort from the fact that businesses expect inflation to return to the 2% target after the next couple of years. But current price growth is still running too firm to ignore, with pressures building over a widening array of products and services. Easing off the monetary policy accelerator—and getting interest rates back to a more ‘neutral’ level that won’t add to or subtract from longer-run inflation pressures—is a the most likely path near-term.

We expect more rate hikes from the Bank of Canada to lift the overnight rate to 2.00% (up from 0.5% currently) before the end of this year. The bank will likely pause at that point to assess what we expect to be a slowing economic growth backdrop. The U.S. Federal Reserve is expected to be more aggressive, continuing to hike into 2023, as it grapples with more significant production capacity pressures and firmer inflation readings. March U.S. CPI data next week will reinforce those inflation concerns with the headline rate likely to increase to the 8.3% range, driven by skyrocketing gasoline prices following the Russian invasion of Ukraine. But gas isn’t the only thing to see faster year over year price growth. And pressures are broadening as strong consumer demand bumps up against production capacity limits and extremely tight labour markets.

Week ahead data watch:

Canadian home resale markets remained exceptionally tight in February. Regional reports this week flagged still heated activity across Canada in March with prices continuing to grow and inventories very low—albeit with some signs of moderation in some larger markets including Montreal and Toronto.

The flash estimate of February Canadian manufacturing sales was very firm at 3.7%, reflecting higher petroleum prices but also some easing in auto production disruptions and a surge back in hours worked after a sharp January decline when Omicron kept a large share of the workforce off sick and/or self-isolating. We expect sale volumes (excluding price changes) to also look firm at +2%.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals