Sterling drops broadly today as weak UK retail sales data argues that the expected consumption drag from high inflation might have arrived already. Aussie is currently the second worse for the day, then Kiwi. On the other hand, Dollar is rebounding broadly, followed with help from risk aversion again. Yen also strengthens slightly in tight range while Euro is also steady. Canadian little gives little reaction to retail sales data.

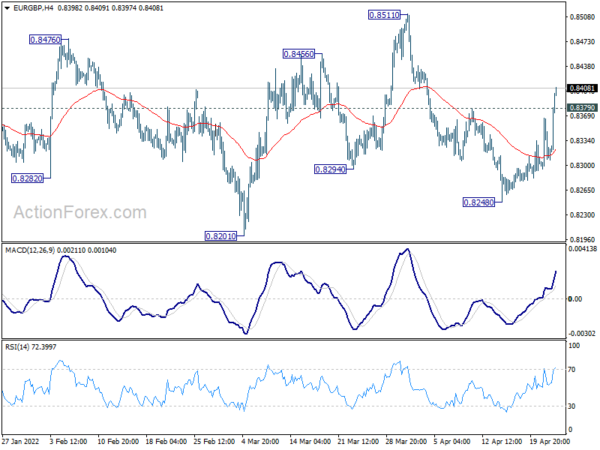

Technically, EUR/GBP has finally break through 0.8379 resistance today, but that’s more about the Pound’s selloff than Euro’s strength. Anyway, further rise is now expected back to 0.8511 resistance. Firm break there will reaffirm the case of medium term bottoming at 0.8201. A key to such development would be on downside acceleration in GBP/USD below 1.29 handle.

In Europe, at the time of writing, FTSE is down -0.67%. DAX is down 1.42%. CAC is down -1.50%. Germany 10-year yield is up 0.010 at 0.956. Earlier in Asia, Nikkei dropped -1.63%. Hong Kong HSI dropped -0.21%. China Shanghai SSE rose 0.23%. Singapore Strait Times rose 0.38%. Japan 10-year JGB yield dropped -0.0042 to 0.250.

Canada retail sales rose 0.1% mom in Feb, to rise 1.4% in Mar

Canada retail sales rose 0.1% mom to CAD 59.9B in February, better than expectation of -0.5% mom decline. That’s the fourth increase in the last five months. Higher sales at clothing and clothing accessories stores (+15.1%) and gasoline stations (+6.2%) were offset by lower sales at motor vehicle and parts dealers (-5.1%).

Sales were up in 6 of the 11 subsectors, representing 47.2% of retail trade. Core retail sales—which exclude sales at gasoline stations and motor vehicle and parts dealers—increased 1.4%.

According to advance estimate, sales increased 1.4% mom in March.

UK PMI composite dropped to 57.6 in Apr, a marked cooling in growth

UK PMI Manufacturing ticked up from 55.2 to 55.3 in April, above expectation of 54.9. PMI Services dropped from 62.6 to 58.3, below expectation of 60.3. PMI Composite dropped from 60.9 to 57.6.

Chris Williamson, Chief Business Economist at S&P Global said: “The survey data signal a marked cooling in the pace of UK economic growth during April, caused by an abrupt slowing in demand… High prices and the associated rising cost of living were often cited as a principal cause of lower demand, with covid also continuing to affect many businesses. Brexit and transport delays were seen as having further impeded export sales, while the Ukraine war and Russian sanctions also led to lost overseas trade… Concerns over the worsening inflation picture are meanwhile flamed by another near-record leap in firms’ costs.”disruptions and rising interest rates.”

UK retail sales dropped -1.4% mom in Mar, led by non-store retailing

UK retail sales dropped -1.4% mom in March, much worse than expectation of -0.3% mom. The largest contribution to the fall came from non-store retailing in which sales volumes fell by -7.9% mom. Food store sales volumes fell by -1.1% mom. Automotive fuel sales volumes fell by -3.8% mom.

Overall, sales volumes were still 2.2% above their pre-coronavirus level in February 2020.

Eurozone PMIs: Two-speed economy with common cost pressures

Eurozone PMI Manufacturing dropped from 56.5 to 55.3 in April, above expectation of 54.5. That’s the lowest level in 15 months. PMI Services rose from 55.6 to 57.7, above expectation of 55.0. That’s the highest level in 8 months. PMI Composite rose from 54.9 to 55.8, a 7-month high.

Chris Williamson, Chief Business Economist at S&P Global said: “April saw a two-speed eurozone economy. Manufacturing came close to stalling due to ongoing supply constraints, rising prices and signs of spending being hit by risk aversion due to the war. However, April also saw manufacturers suffer due to a shift in demand from goods to services amid looser pandemic restrictions, most notably via a record surge in spending on activities such as travel and recreation.

“Common across both sectors, however, was a further surge in cost pressures, driven by soaring energy and raw material costs, as well as rising wages. Average prices charged for goods and services rose at an unprecedented rate in April as these higher costs were passed on to customers, sending a worrying signal that inflationary pressures continue to build.”

Germany PMI Manufacturing dropped from 56.9 to 54.1 in April, below expectation of 54.4. That’s also the lowest in 20 months. PMI Services rose from 56.1 to 57.9, above expectation of 55.5. That’s a 3-month high. PMI Composite dropped from 55.1 to 54.5 a 3-month low.

France PMI Manufacturing rose from 54.7 to 55.4 in April, below expectation of 56.4. PMI Services rose from 57.4 to 58.8, above expectation of 53.7, highest in 51 months. PMI Composite jumped from 56.3 to 57.5, also a 51-month high.

Bundesbanks: Germany to lose 5% of GDP on suspending all trade with Russia

In the latest monthly report, Bundesbank presented the scenario analysis on the impact of further escalation of invasion of Ukraine, with the assumption that trade with Russia, including energy imports, will be suspended.

Germany GDP could be up to -5% lower than March forecast by the ECB. Comparing to 2021, GDP would fall by almost -2% in 2022.

Price incase could be significant, with inflation 1.5% higher in 2022, and 2% higher in 2023 than ECB forecast. “The upward risks of inflation predominate, since price increases in downstream production stages or wage increases could be greater.”

Japan CPI core accelerated to 0.8% yoy in Mar

Japan all item CPI rose fro 0.9% to 1.2% in March, below expectation of 1.3% yoy. CPI core (ex-food) rose form 0.6% yoy to 0.8% yoy, matched expectations. CPI core-core (ex-food and energy) improved from -1.0% yoy to -0.7% yoy, better than expectation of -1.1% yoy.

The core CPI rate was the fastest in over 2 years. Energy prices jumped 20.8% yoy, largest gain since 1981, with kerosene up 30.6% and gasoline up 19.4%.

Japan PMI manufacturing dropped to 53.4 in Apr, services rose to 50.5

Japan PMI Manufacturing dropped from 54.1 to 53.4 in April, above expectation of 53.3. PMI Services rose from 49.4 to 50.5, signalling the first expansion since last December. PMI Composite rose from 50.3 to 50.9.

Usamah Bhatti, Economist at S&P Global, said: “The latest Flash PMI data showed that Japanese private sector activity improved at a sharper rate at the start of the second quarter of 2022. Services companies recorded an expansion in activity for the first time since last December, while manufacturers saw output levels rise for the second successive month.

“April data signalled the sharpest expansion in four months, though the pace of growth was only marginal. Moreover, growth in incoming business in the private sector stagnated amid increased headwinds.

Australia PMI manufacturing rose to 57.9, services rose to 56.6

Australia PMI Manufacturing rose from 57.7 to 57.9 in April, a 5-month high. PMI Services rose from 55.6 to 56.6. PMI Composite rose from 55.1 to 56.2.

Jingyi Pan, Economics Associate Director at S&P Global said: “The expansion of the Australian economy continued in April, according to the S&P Global Flash Australia Composite PMI, buoyed by the easing of COVID-19 disruptions. Foreign demand played a part as well with new export business rising for the first time since December 2021.

“Price pressures persisted, however, for private sector firms that faced higher costs across raw material to wages. Input costs rose at the fastest pace since data collection began in May 2016, reflecting the impact from both the Ukraine war and lockdowns in China.

“Higher employment levels in April remained a bright spot to highlight, though the lack of suitable candidates have contributed to a slowdown of hiring activity. Meanwhile, despite better output growth, business confidence eased in April which is a worrying trend.”

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3004; (P) 1.3047; (R1) 1.3071; More…

GBP/USD’s down trend resumes today by breaking through 1.2971 support. Intraday bias back on the downside. Sustained trading below 61.8% projection of 1.3641 to 1.2999 from 1.3297 at 1.2900 will pave the way to 100% projection at 1.2655. On the upside, break of 1.3089 resistance is needed to indicate short term bottoming. Otherwise, outlook will stay bearish in case of recovery.

In the bigger picture, rise from 1.1409 (2020 low) has completed at 1.4248. Decline from 1.4248 could still be a corrective move, or it could be the start of a long term down trend. In either case, deeper decline would be seen back to 61.8% retracement of 2.1161 to 1.1409 at 1.2493. In any case, break of 1.3158 support turned resistance is needed to be the first sign of medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | AUD | Manufacturing PMI Apr P | 57.9 | 57.7 | ||

| 23:00 | AUD | Services PMI Apr P | 56.6 | 55.6 | ||

| 23:01 | GBP | GfK Consumer Confidence Apr | -38 | -33 | -31 | |

| 23:30 | JPY | National CPI Core Y/Y Mar | 0.80% | 0.80% | 0.60% | |

| 00:30 | JPY | Manufacturing PMI Apr P | 53.4 | 53.3 | 54.1 | |

| 06:00 | GBP | Retail Sales M/M Mar | -1.40% | -0.30% | -0.30% | -0.50% |

| 06:00 | GBP | Retail Sales Y/Y Mar | 0.90% | 2.80% | 7.00% | 7.20% |

| 06:00 | GBP | Retail Sales ex-Fuel M/M Mar | -1.10% | -0.50% | -0.70% | -0.90% |

| 06:00 | GBP | Retail Sales ex-Fuel Y/Y Mar | -0.60% | 0.60% | 4.60% | 4.70% |

| 07:15 | EUR | France Manufacturing PMI Apr P | 55.4 | 56.4 | 54.7 | |

| 07:15 | EUR | France Services PMI Apr P | 58.8 | 53.7 | 57.4 | |

| 07:30 | EUR | Germany Manufacturing PMI Apr P | 54.1 | 54.4 | 56.9 | |

| 07:30 | EUR | Germany Services PMI Apr P | 57.9 | 55.5 | 56.1 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Apr P | 55.3 | 54.5 | 56.5 | |

| 08:00 | EUR | Eurozone Services PMI Apr P | 57.7 | 55 | 55.6 | |

| 08:00 | EUR | Current Account (EUR) Feb | 20.8B | 22.8B | 22.6B | |

| 08:30 | GBP | Manufacturing PMI Apr P | 55.3 | 54.9 | 55.2 | |

| 08:30 | GBP | Services PMI Apr P | 58.3 | 60.3 | 62.6 | |

| 12:30 | CAD | Industrial Product Price M/M Mar | 4.00% | 2.00% | 3.10% | 2.60% |

| 12:30 | CAD | Raw Material Price Index Mar | 11.80% | 7.10% | 6.00% | 6.40% |

| 12:30 | CAD | Retail Sales M/M Feb | 0.10% | -0.50% | 3.20% | 3.30% |

| 12:30 | CAD | Retail Sales ex Autos M/M Feb | 2.10% | 0.20% | 2.50% | 2.90% |

| 13:45 | USD | Manufacturing PMI Apr P | 58.3 | 58.8 | ||

| 13:45 | USD | Services PMI Apr P | 58.1 | 58 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals