Yen falls broadly in Asian session today after BoJ stands pat and even maintains a dovish bias. 10-year JGB yield also tumbles after BoJ reiterates the pledged to defend the cap. Dollar, on the other hand, rises broadly, and it’s trading as the strongest one for the week so far. Euro and Sterling are the worst performers for the moment but selloff is picking up in Aussie and Kiwi too.

Technically, Gold’s decline finally resumed with some conviction. Fall from 1998.23 is seen as the third leg of the pattern from 2070.06 high. Deeper decline is expected as long as 1911.07 minor resistance holds. Next target is 100% projection of 2070.06 to 1889.79 from 1998.23 at 1817.98. The development affirms broad based strength in Dollar.

In Asia, at the time of writing, Nikkei is up 1.52%. Hong Kong HSI is up 1.22%. China Shanghai SSE is up 0.25%. Singapore Strait Times is up 0.19%. Japan 10-year JGB yield is down -0.0252 at 0.225. Overnight, DOW rose 0.19%. S&P 500 rose 0.21%. NASDAQ dropped -0.01%. 10-year yield rose 0.046 to 2.818.

BoJ stands pat, maintains dovish bias

BoJ left monetary policy unchanged as widely expected, by 8-1 vote, with dove Goushi Kataoka dissented again. Under the yield curve control framework, short-term policy interest rate is held at -0.10%. 10-year JGB yield target is kept at around 0%, without upper limit on JGB purchases. BoJ also clarified that it will offer to purchase 10-year JGBs at 0.25$ every business day through fixed-rate purchase operations.

The central bank also reiterated that it will “expanding the monetary base until the year-on-year rate of increase in the observed consumer price index (CPI, all items less fresh food) exceeds 2 percent and stays above the target in a stable manner.”

It also pledged that it “will not hesitate to take additional easing measures if necessary; it also expects short- and long-term policy interest rates to remain at their present or lower levels.”

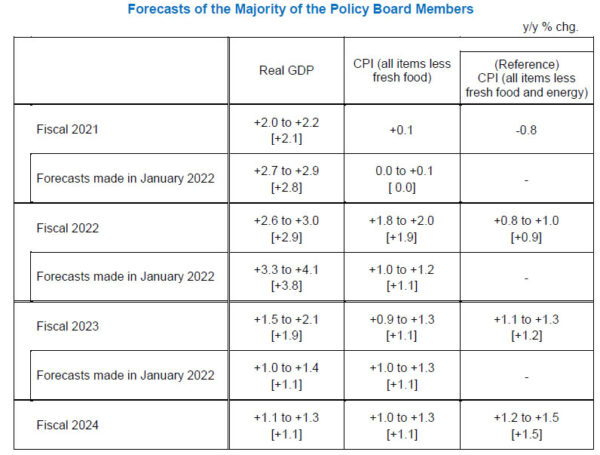

In the new economic projections, GDP is forecast to grow:

- 2.9% in fiscal 2022 (revised down from 3.8%)

- 1.9% in fiscal 2023 (revised up from 1.1%)

- 1.1% in fiscal 2024 (new).

CPI (all items less fresh food) is expected to be at:

- 1.9% in fiscal 2022 (revised up from 1.1%).

- 1.1% in fiscal 2023 (unchanged).

- 1.1% in fiscal 2024 (new).

Also released from Japan, industrial production rose 0.3% mom in March, below expectation of 0.5% mom. Retail sales rose 0.9% yoy in march, below expectation of 0.4% yoy.

New Zealand ANZ business confidence ticked down to -42 in Apr

New Zealand ANZ business confidence dropped slightly from -41.9 to -42.0 in April. Own activity outlook rose from 3.3 to 8.0. Export intentions rose from 7.9 to 9.5. Investment intentions dropped from 5.2 to 3.1. Employment intentions dropped from 12.3 to 9.4. Cost expectations dropped from 95.9 to 95.5. Inflation expectations rose further from 5.51 to 5.92.

ANZ said: “With plenty of wage and other cost inflation in the pipeline, it’ll be some time before the RBNZ can conclude that they’re getting ahead of the inflation game. We continue to expect another 50bp hike in May, and steady 25bp increases thereafter taking the OCR to a peak of 3.5%.”

NZ goods exports rose 17% yoy in Mar, imports rose 25% yoy

New Zealand goods exports rose 17% yoy to NZD 6.7B in March. Goods imports rose 25% yoy to NZD 7.1B. Trade balance was a deficit of NZD -392m, versus expectation of NZD -648m.

As a result of the monthly deficit in March 2022, the annual goods trade deficit has further widened to reach NZD -9.1B for the March 2022 year.

Looking ahead

Germany CPI flash is a focus in European session. Eurozone will release economic sentiment indicator. ECB will publish monthly bulletin. Later in the day, US advance GDP will be the main focus, together with jobless claims.

USD/JPY Daily Outlook

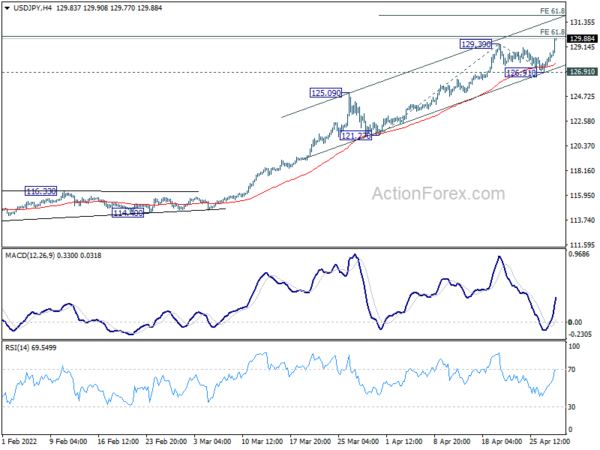

Daily Pivots: (S1) 127.39; (P) 127.99; (R1) 129.03; More…

USD/JPY’s up trend resumed by breaking through 129.39 temporary top and intraday bias is back on the upside. Immediate focus is now on 130.04 long term projection level. Sustained break there will carry larger bullish implications. Next near term target is 61.8% projection of 121.27 to 129.39 from 126.91 at 131.92, and then 100% projection at 135.03. On the downside, break of 126.91 support is needed to indicate short term topping. Otherwise, outlook will stay bullish in case of retreat.

In the bigger picture, the break of 125.85 resistance (2015 high) suggests that whole up trend from 75.56 (2011 low) is resuming. Further rise should be seen to 61.8% projection of 75.56 (2011 low) to 125.85 (2015 high) from 98.97 at 130.04. Sustained break there wave the way to 100% project at 149.26, which is close to 147.68 (1998 high). For now, this will remain the favored case as long as 121.27 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) Mar | -392M | -648M | -385M | -691M |

| 23:50 | JPY | Industrial Production M/M Mar P | 0.30% | 0.50% | 2.00% | |

| 23:50 | JPY | Retail Trade Y/Y Mar | 0.90% | 0.40% | -0.80% | -0.90% |

| 01:00 | NZD | ANZ Business Confidence Apr | -42 | -41.9 | ||

| 01:30 | AUD | Import Price Index Q/Q Q1 | 5.10% | 7.10% | 5.80% | |

| 03:00 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 05:00 | JPY | Housing Starts Y/Y Mar | -0.50% | 6.30% | ||

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 09:00 | EUR | Eurozone Economic Sentiment Indicator Apr | 107.6 | 108.5 | ||

| 09:00 | EUR | Eurozone Industrial Confidence Apr | 9.3 | 10.4 | ||

| 09:00 | EUR | Eurozone Services Sentiment Apr | 12.7 | 14.4 | ||

| 09:00 | EUR | Eurozone Consumer Confidence Apr F | -16.9 | |||

| 09:00 | EUR | Eurozone Business Climate Apr | 1.67 | |||

| 12:00 | EUR | Germany CPI M/M Apr P | 1.70% | 2.50% | ||

| 12:00 | EUR | Germany CPI Y/Y Apr P | 7.30% | 7.30% | ||

| 12:30 | USD | Initial Jobless Claims (Apr 22) | 178K | 184K | ||

| 12:30 | USD | GDP Annualized Q1 P | 1.00% | 6.90% | ||

| 12:30 | USD | GDP Price Index Q1 P | 6.00% | 7.10% | ||

| 14:30 | USD | Natural Gas Storage | 39B | 53B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals