New Zealand’s economy has had a bumpy but strong recovery from the pandemic lockdowns and data due on Thursday (Wednesday, 22:45 GMT) is expected to show GDP kept expanding in the first quarter. The healthy economic backdrop has allowed the Reserve Bank of New Zealand to ramp up rate increases as inflation has skyrocketed. But the local dollar has not been able to enjoy much of a boost from tighter monetary policy as the market turmoil from inflation and recession worries has only favoured the mighty US dollar.

From virus crisis to inflation crisis

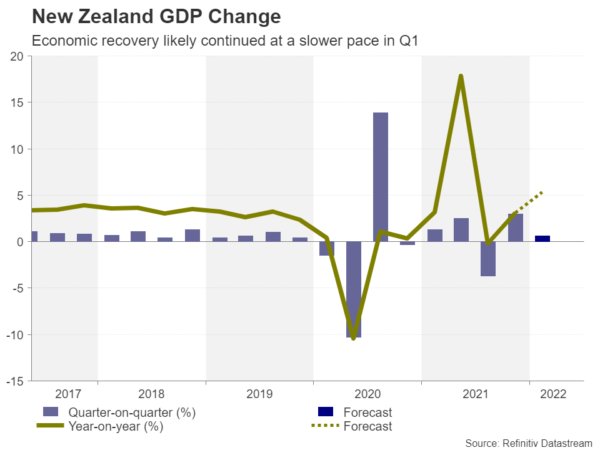

Despite having one of the most stringent virus curbs in the world, New Zealand’s gross domestic product (GDP) was the first to rise above pre-pandemic level. But GDP peaked in the second quarter of 2021 and growth in Q1 is unlikely to be strong enough to surpass it. New Zealand tightened its virus rules in the first few months of the year as the country battled the Omicron wave.

Nevertheless, consumption fell only marginally, while higher commodity prices boosted the income earned from exports. Overall, the economy is expected to have expanded by 0.6% over the quarter and by 5.3% in the 12 months to March.

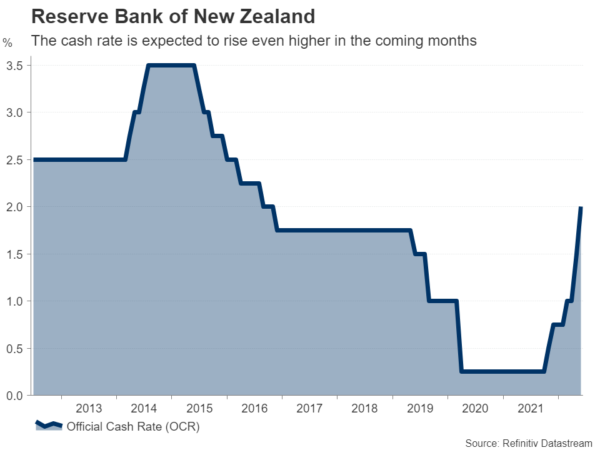

Growth in the second quarter likely accelerated as most restrictions have now been lifted. However, the economy is facing a different threat and this time it’s not a new Covid variant. As in most other countries, inflation is surging. New Zealand’s consumer price index jumped the most in more than 30 years in the first quarter, hitting 6.9% y/y. The RBNZ has already raised the cash rate to 2.0% but more hikes are on the way.

RBNZ leads in terms of stimulus withdrawal

The central bank has even gone a step further than its global peers by deciding to actively sell its government bond holdings. Over a five-year plan, the RBNZ will reduce its pandemic-era bond purchases by NZ$5 billion a year down to zero. The decision last week fuelled the selloff in New Zealand government debt as it came at a time when bonds are already under pressure from intensifying expectations that central banks will have to get a lot tougher to bring inflation under control.

The immediate risk in New Zealand from higher rates is the impact on the housing market from rising mortgage costs. A slowdown is already underway in the property sector and house prices have started to decline in many regions. A sharp drop in prices could eventually hit consumer confidence and that would be even more bad news for the economy.

However, New Zealand isn’t quite in the recession danger zone like many European economies are for example, and there are several positives for the outlook. For one, the government recently unveiled plans to spend up to NZ$1 billion to help low income families with the cost of living crisis, and this could only be the start of a new round of fiscal stimulus. China’s easing of its virus restrictions is another positive as it bodes well for exporters, not to mention the tight labour market.

Kiwi has been a surprise laggard

This then begs the question as to why the New Zealand dollar has been performing so poorly against the greenback this year. The kiwi’s year-to-date losses stand at about 8.5%, worse only than the yen and pound. New Zealand’s large current account deficit might explain why the kiwi is seen as a riskier bet than it’s aussie cousin.

But generally, risky currencies like the pound, aussie and kiwi take their cues as much from the US dollar and the mood on Wall Street as from domestic policies. With expectations of Fed rate hikes being continuously scaled up, the greenback has been on a winning streak this year, overpowering currencies with similarly if not more hawkish central banks as it has the added attraction of being the world’s reserve currency.

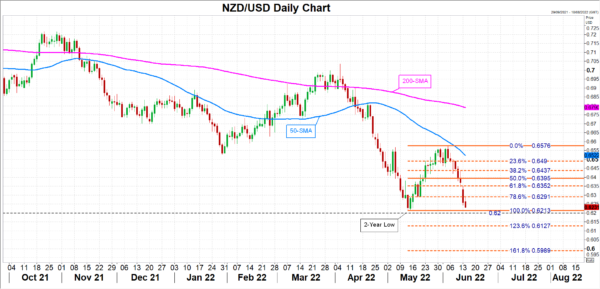

$0.62 level is looking shaky

Unless broader market sentiment improves – something that can only happen if inflationary pressures begin to ease – solid economic indicators out of New Zealand are unlikely to substantially shore up the kiwi, which is in danger of brushing a fresh two-year low soon.

If the May trough of $0.6213, or more importantly, the $0.62 level is breached, the next stop could be the 123.6% Fibonacci extension of the May-June rebound at $0.6127, followed by the 161.8% Fibonacci of $0.5989.

However, should the selling pressure subside, the kiwi could initially recover towards the 50% Fibonacci of $0.6395 before having another go at the June peak of $0.6576.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals