Summary

- Central banks were in the limelight this week, including the Swiss National Bank (SNB). At its June monetary policy meeting, SNB policymakers opted to raise its policy rate, which was a surprise in terms of timing, and also magnitude as the central bank delivered and 50 bps policy rate increase to -0.25%.

- With inflation having moved significantly higher, the SNB highlighted their actions were in an effort to protect against elevated inflation from becoming entrenched within the economy. In addition to the rate hike, SNB policymakers noted that the Swiss franc is no longer highly valued, and they now stand ready to intervene in FX markets in either direction.

- Going forward, we believe economic conditions are supportive of further SNB policy rate hikes. Activity growth is still sound, while SNB projections suggest inflation should remain somewhat elevated for the time being. In that context, we also forecast the SNB to lift policy rates by 25 bps in September 2022 as well as December 2022. In addition, we believe SNB rate hikes will continue in 2023 and expect another 25 bps rate hike in March 2023.

Swiss National Bank Delivers Sizeable Surprise Rate Hike

Among a flurry of central bank policy announcements this week, the Swiss National Bank (SNB) caught the attention of financial markets by delivering a surprise tightening of monetary policy. While SNB policymakers had in recent weeks expressed some increased inflation concerns and hinted at possible interest rate increases, only one of twenty economists surveyed by Bloomberg had forecast a policy change at the June meeting. In the event, not only did the SNB raise its policy rate at its June meeting, but also lifted that policy rate by a larger 50 bps to -0.25%.

In making the monetary policy adjustment, the SNB noted there were signs inflation was spreading to goods and services not directly affected by the war in Ukraine or by the pandemic. As a result, the central bank acted in an effort to avoid higher inflation becoming entrenched as a result of increased second-round effects, and added that it cannot be ruled out that further increases in the policy rate will be necessary over time. Indeed, the SNB’s updated inflation forecasts hint at some possibility of those further rate increases. While CPI inflation is seen slowing gradually over much of the forecast horizon, the SNB projects some renewed pickup of inflation from mid-2024, a hint perhaps that further rate increases my still be needed.

In another significant change, the SNB also said the Swiss franc is no longer “highly valued”. Indeed, the central bank said the franc had depreciated in trade-weighted terms, and that was adding to imported inflation in Switzerland. The SNB said it was willing to be active in the foreign exchange market as necessary, but also that such intervention could be in either direction – that is, it could be foreign currency purchases or foreign currency sales. Clearly, the SNB is less sensitive to Swiss franc strength than previously, and would be more likely to accommodate a stronger franc going forward in our view.

Swiss Economic Backdrop Consistent With Further Rate Hikes

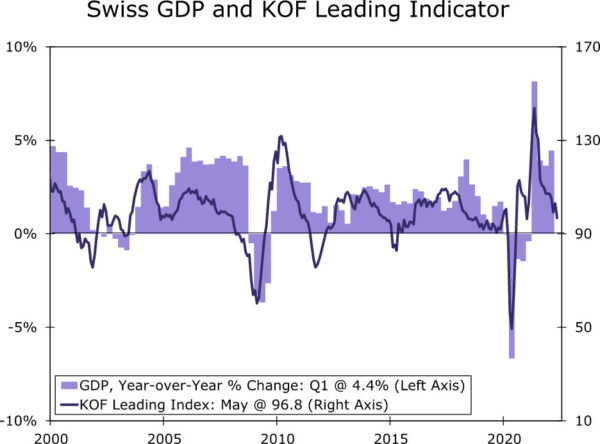

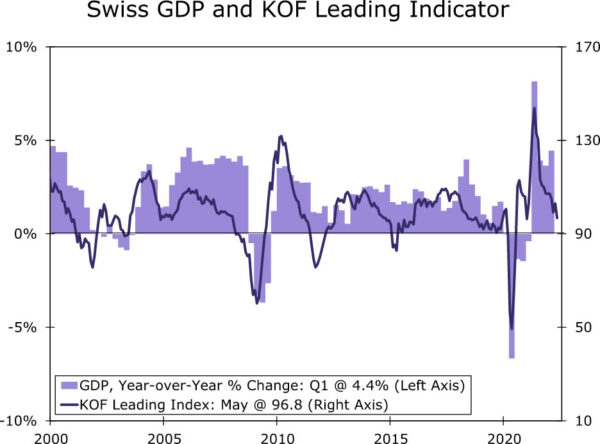

In assessing recent Swiss data and indicators, we believe the economic backdrop will be supportive of further policy rate increases from the Swiss National Bank. From a growth perspective, the SNB projects GDP growth of around 2.5% in 2022, while we also note the Swiss economy started this year on a reasonable footing. Q1 GDP rose 0.5% quarter-over-quarter and by 4.4% year-over-year. With respect to quarterly sequential growth, private consumption rose 0.4%, government consumption rose 1.4% and goods exports rose 1.4%, and investment spending was disappointing, declining in Q1. We also note some decline in confidence surveys in recent months, including a decline in the KOF leading indicator to 96.8 in May. While that might portend a moderate slowing in economic growth going forward, our own outlook for Swiss GDP growth of 2.6% in 2022 is broadly consistent with the central bank’s view, and overall supportive of further monetary tightening.

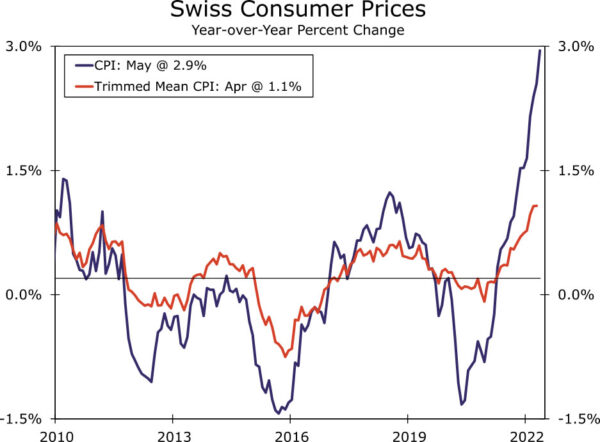

Meanwhile, CPI has quickened in recent months, with the headline CPI rising 2.9% year-over-year in May and trimmed mean CPI (a core inflation measure) rising 1.1% in April. We will be paying particular attention to trimmed mean inflation, as that could offer the best insight as to what extent broader second-round inflation pressures are emerging. In particular, should trimmed mean inflation move closer the 2% (the central bank’s inflation target), that would in our view reinforce the likelihood of additional central bank tightening. Previously, we had forecast a cumulative 75 bps of rate hikes, with 25 bps increases anticipated at the December 2022, March 2023 and June 2023 announcement. However, after the surprise and large SNB policy rate increase in June, we now forecast a slightly more pronounced rate hike cycle. We expect the Swiss National Bank to follow through with 25 bps rate increases at the September 2022, December 2022 and March 2023 announcements, which would see the SNB’s policy rate rise to +0.25% by the end of 2022, and to +0.50% by early next year.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals