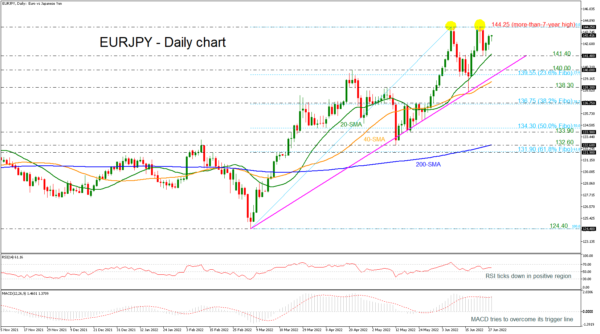

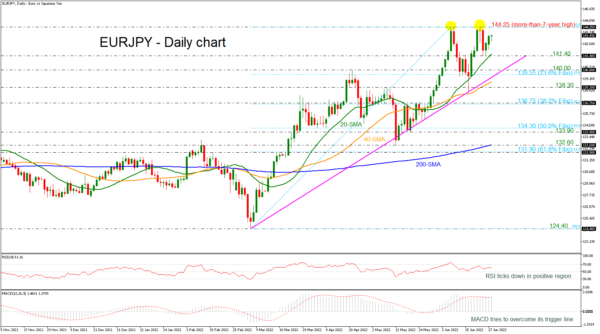

EURJPY has posted a double top around the more-than-seven-year high of 144.25 over the last couple of weeks. The MACD oscillator is extending its positive momentum above its trigger and zero lines; however, the RSI indicator is pointing slightly lower in the positive region. The 20- and 40-day simple moving averages (SMAs) are still developing above the bullish crossover, suggesting that the bull market is still on the cards.

On the upside, resistance could occur around the multi-year high of 144.25 that may be a strong resistance level for traders. Higher still, the peak from December 2014 at 149.75 would increasingly come into scope.

A reversal to the downside could stall at the latest bottom at 141.40, which overlaps with the 20-day SMA ahead of the medium-term ascending trend line near the 140.00 round number. Further below, the 23.6% Fibonacci retracement level of the upward movement from 124.40 to 144.25 at 139.55 could also provide support, while any violation at this point could potentially trigger further sell-off in the market, probably leading the price down to 138.30.

The medium-term picture continues to look predominantly bullish, with trading activity taking place above the 200-day SMA.

Overall, EURJPY has been completing a double top formation and any declines below the 138.30 support may shift the outlook to bearish.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals