Dollar is starting to pare back this week’s gains in early US session, after retail sales data were not materially stronger than expectations. It looks like EUR/USD could close the week above parity, and may start to stabilize for the near term. US futures are trading higher after the data and could point to a rebound in stocks. There is prospect of stronger rebound for Aussie and Loonie for the rest of the session.

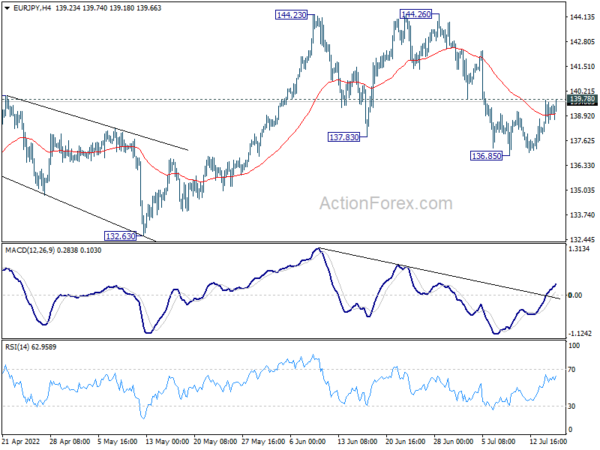

Technically, before the close of the week, some attention could be on EUR/JPY, which is pressing 139.78 minor resistance. Firm break there will argue that that pull back from 144.26 has completed, and would bring retest of this high next week, probably with up trend resumption later in the month. Rebound is stocks would help EUR/JPY achieve it.

In Europe, at the time of writing, FTSE is up 0.86%. DAX is up 1.31%. CAC is up 0.32%. Germany 10-year yield is down -0.029 at 1.150. Earlier in Asia, Nikkei rose 0.54%. Hong Kong HSI dropped -2.19%. China Shanghai SSE dropped -1.64%. Singapore Strait Times rose 0.28%. Japan 10-year JGB yield dropped -0.0002 to 0.235.

US retail sales rose 1% mom in Jun, ex-auto sales up 1%

US retail sales rose 1.0% mom to USD 680.6B in June, above expectation of 0.8% mom. Ex-auto sales rose 1.0% mom, above expectation of 0.6% mom. Ex-gasoline sales rose 0.7% mom. Ex-auto, ex-gasoline sales rose 0.7% mom. Retail trade rose 1.0% mom. Gasoline sales rose 3.6% mom. Total sales for the three months through June were up 8.1% yoy.

Eurozone exports rose 28.9% yoy in May, imports rose 52% yoy

Eurozone exports of goods to the rest of the world rose 28.9% yoy to EUR 248.5B in May. Imports of goods rose 52.0% yoy to EUR 274.8B. Trade deficit came in at EUR -26.3B. Intra-eurozone trade rose 33.0% yoy to EUR 231.6B.

In seasonally adjusted term, exports rose 4.8% mom to EUR 241.8B. Imports rose 2.0% mom to EUR 267.8B. Trade deficit narrowed from April’s EUR -31.8B to EUR -26.0B, slightly smaller than expectation of EUR -26.3B. Intra-eurozone trade rose from EUR 217.2B to EUR 221.4B.

NZ BusinessNZ manufacturing dropped to 49.7, sector remains in struggle street

New Zealand BusinessNZ Performance of Manufacturing Index dropped from 52.9 to 49.7 in June. Production dropped from 52.6 to 47.8. Employment dropped from 52.8 to 51.2. New orders dropped fro 52.3 to 47.8. Finished stocks dropped from 52.8 to 50.0. Deliveries dropped from 55.1 to 51.7.

BusinessNZ’s Director, Advocacy Catherine Beard said that the drop in activity levels for June highlights the fact that the sector remains in struggle street to get back to long-term activity levels.

“The key sub index values of Production (47.8) and New Orders (47.8) both recorded the same level of contraction, which had a combined negative effect on the overall Index. As mentioned in previous months, a strong and consistent activity level for both these key sub index values will be the only way to push the PMI towards better results.”

China GDP grew only 0.4% yoy in Q2, but Jun data improved

China GDP grew only 0.4% yoy in Q2, missing even the expectation of 1.0% yoy. For June, industrial production rose 3.9% yoy, below expectation of 4.3% yoy/. Nevertheless, retail sales rose 3.1% yoy, above expectation of 0.4% yoy. Fixed asset investment rose 6.1% ytd yoy, versus expectation of 6.0%.

“Domestically, the impact of the epidemic is lingering,” NBS spokesman Fu Linghui said. “Economic growth is still much lower than its potential, as the fear of Covid outbreaks continues to hurt consumer and corporate sentiment… Even accounting for June’s strength, the data are consistent with negative year-on-year growth last quarter,” he added.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 0.9960; (P) 1.0013; (R1) 1.0074; More…

Intraday bias in EUR/USD is turned neutral with current recovery. On the upside, firm break of 1.0121 minor resistance will indicate short term bottoming at 0.9951. Intraday bias will be back on the upside for strong rebound back to 1.0348 support turned resistance. On the downside, sustained break of 100% projection of 1.1184 to 1.0348 from 1.0773 at 0.9937 will extend larger down trend to 161.8% projection at 0.9420.

In the bigger picture, down trend from 1.6039 (2008 high) is still in progress. Next target is 100% projection of 1.3993 to 1.0339 from 1.2348 at 0.8694. In any case, outlook will stay bearish as long as 1.0773 resistance holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PMI Jun | 49.7 | 52.9 | ||

| 02:00 | CNY | GDP Y/Y Q2 | 0.40% | 1.00% | 4.80% | |

| 02:00 | CNY | Retail Sales Y/Y Jun | 3.10% | 0.40% | -6.70% | |

| 02:00 | CNY | Industrial Production Y/Y Jun | 3.90% | 4.30% | 0.70% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Jun | 6.10% | 6.00% | 6.20% | |

| 04:30 | JPY | Tertiary Industry Index M/M May | 0.80% | 4.30% | 0.70% | |

| 09:00 | EUR | Eurozone Trade Balance (EUR) May | -26.0B | -26.3B | -31.7B | -31.8B |

| 12:30 | CAD | Wholesale Sales M/M May | 1.60% | 0.20% | -0.50% | |

| 12:30 | USD | Retail Sales M/M Jun | 1.00% | 0.80% | -0.30% | |

| 12:30 | USD | Retail Sales ex Autos M/M Jun | 1.00% | 0.60% | 0.50% | |

| 12:30 | USD | Empire State Manufacturing Index Jul | 11.1 | -3.8 | -1.2 | |

| 12:30 | USD | Import Price Index M/M Jun | 0.20% | 0.70% | 0.60% | |

| 13:15 | USD | Industrial Production M/M Jun | 0.20% | 0.20% | ||

| 13:15 | USD | Capacity Utilization Jun | 79.20% | 79.00% | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Jul P | 49 | 50 | ||

| 14:00 | USD | Business Inventories May | 1.10% | 1.20% |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals