U.S. Highlights

- Market sentiment soured this week on stronger than expected CPI data and a weak start to corporate earnings season.

- US CPI accelerated in June, rising 1.3% m/m, pushing the year-ago measure to a new multidecade high of 9.1%. Core inflation accelerated by 0.7% m/m, as hefty gains were seen across both goods (0.8% m/m) and service (0.7% m/m) categories.

- June retail sales surprised to upside, with both the headline (1% m/m) and control measure (0.8% m/m) recording decent nominal gains. However, sales were lower after adjusting for inflation.

Canadian Highlights

- The Bank of Canada delivered a surprise 1% rate hike this week as fears over high inflation persist.

- Existing home sales and house prices continue to decline as higher rates pressure markets.

- Next week, all eyes will be on the Canada CPI release, which is expected to show another leg up in inflation.

U.S. – Gotta Bend Before You Can Break

Market sentiment decisively shifted to risk-off mode this week, as a stronger than expected print on CPI and a weak start to corporate earnings season helped cast further doubt on the economic outlook. At the time of writing, the S&P 500 is down 2% on the week and has now had one of the worst starts to a year in nearly a century. The deteriorating market sentiment led to a further widening in the yield curve inversion – highlighting the growing fear among market participants that a recession may be on the horizon. The 10Y-2Y spread now sits at -20 basis points (bps). The sour market sentiment also spilled over to commodity markets, with WTI down 8% to $98 per-barrel on the week.

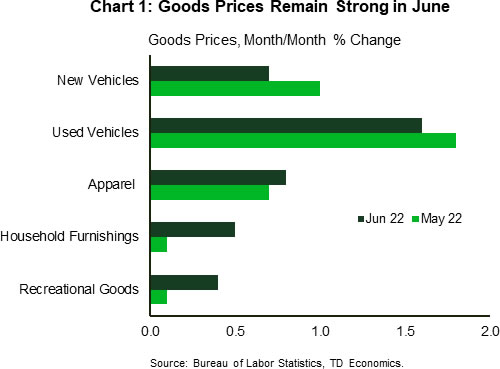

Any hopes of inflationary pressures easing in June were quickly dashed on Wednesday following the Bureau of Labor Statistics’ release of last month’s CPI data. Headline CPI accelerated by 1.3% month-on-month (m/m), pushing the year-ago measure to a new multidecade high of 9.1%. Indeed, with fuel prices having surged by 11% last month, and more recent gains in food prices showing incredible persistence, a further acceleration in the headline measure was inevitable. What was not anticipated, however, was the uptick in core inflation (0.7% m/m). Perhaps most disconcerting was the breadth in price gains across core, particularly among goods categories (Chart 1). Further gains in goods prices are at odds with more recent spending data, which has shown consumers pulling back on purchases of most discretionary goods in recent months. While inflation is notoriously a lagged indicator, it was thought that the combination of weakening demand and anecdotal reports of retailers carrying excess inventory would soon start to exert downward pressure on goods prices. That narrative has yet to come to fruition, and that detail will not be lost on policymakers when they meet later this month.

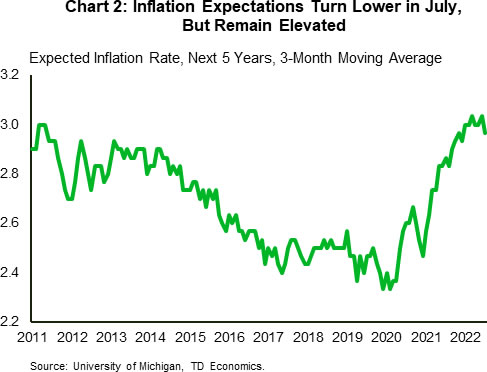

Perhaps one piece of encouraging news came from the July reading of the University of Michigan consumer confidence survey, which showed that expectations for inflation over the next five years now sit at 2.8% – down from last month’s reading of 3.1% (Chart 2). Chair Powell highlighted the recent upward drift in inflation expectations as being one of the key contributors in the FOMC’s decision to raise rates more forcefully in June. While the turn lower will provide some relief to policymakers, it won’t be enough to dissuade them from pushing ahead with another supersized hike later this month. This sentiment has been mirrored in market pricing, with odds a near coin toss on whether the Fed will raise by 75bps or 100bps.

The big question now is to what extent higher interest rates will ultimately weigh on domestic demand. Retail sales data for June showed that consumers are remaining somewhat resilient, with both headline (1.0% m/m) and the control (0.8% m/m) up on the month. That said, consumer spending is only tracking around 1% q/q (annualized) for the second quarter, which is a marked slowdown from the 4.5% averaged through the second half of last year. With inflation continuing to erode purchasing power and rates expected to move decisively higher through year-end, the hope is that consumers will only bend under the weight of the dual-income shock and not completely break.

Canada – BoC Delivers Shock 1% Hike

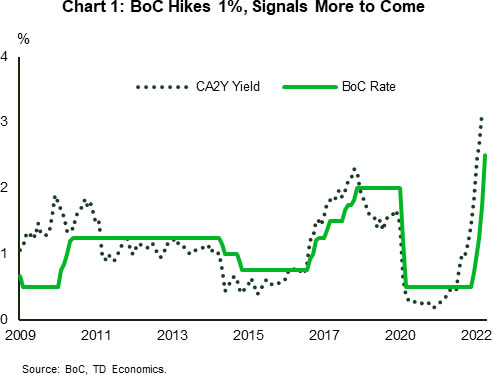

The Bank of Canada (BoC) made global headlines this week as it delivered on a super upsized rate hike of 1% (Chart 1). Though we are running out of superlatives to describe the magnitude of the BoC’s actions, expectations are for more to come as inflation is poised to continue to run at elevated levels. Financial market participants are expecting 1% to 1.25% in additional rate hikes over this year.

BoC Cuts Growth, Upgrades Inflation

In the BoC’s accompanying Monetary Policy Statement there were a number of nuggets the revealed insight into the Bank’s thinking. The first is the change in their growth forecast. The Bank stated that economic growth will slow from 3.5% this year to 1.75% in 2023, as global economic momentum decelerates on the back of higher global interest rates and high inflation.

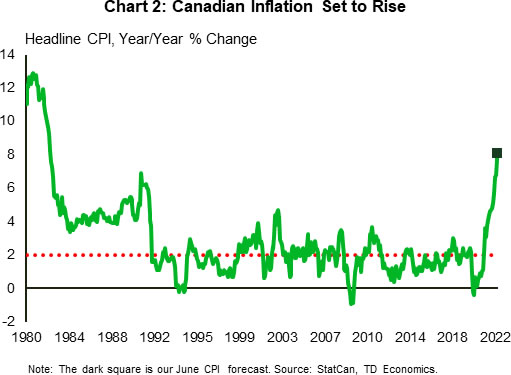

On inflation, the BoC’s new forecast shows that it believes CPI will remain around 8% over the coming months and decelerate to only 7.5% by the end of this year, reaching 3.2% by the end of 2023. That means the central bank doesn’t think it will be able to bring inflation down to the target band (1%-3%) within its 12-18 month monetary policy window. Given the recent Business Outlook Survey and Canadian Survey of Consumer Expectations, which showed an unmooring of inflation expectations over the forecast horizon, the Bank of Canada’s forecast of higher inflation for longer hits the spot.

We also got data on Canadian existing home sales and home prices on Friday. Following the recent trend, sales declined another 5.6% month-over-month (m/m). Combined with the 4.1% m/m rise in new listings, the sales-to-listings ratio continued to fall further into balanced territory (51.7%). This caused the average Canadian home price to drop another 4.3% m/m, pushing the peak-to-trough decline to a whopping -14% since February.

Looking Ahead to Next Week

All eyes will be on Wednesday’s CPI release next week. With inflation already at 7.7% year-on-year, expectations are for a +8% reading on the headline number (Chart 2). We are looking to see further increases in price pressures on food and fuel, which have been the main drivers of inflation over the last few months. Any surprise to the upside on inflation will likely cause markets to price even more hikes by the BoC. Recent re-pricing has caused the Canada 2-year to continue to rise, while the Canada 10-year has remained stable just above 3%. This has pushed the 10-year/2-year yield spread (a popular signal of recession) even deeper into negative territory. Though the BoC is still forecasting a soft landing, where it raises rates without causing recession, markets are preparing for a bumpy ride.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals