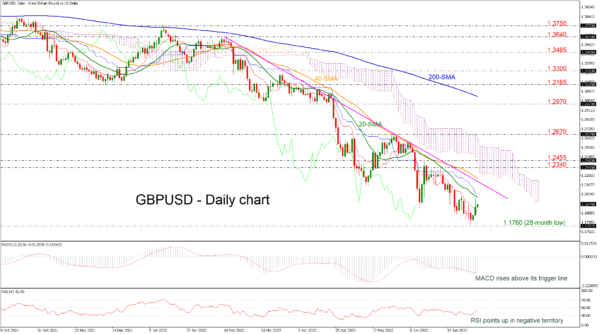

GBPUSD is showing signs of being positive in the short run, after gaining ground on Thursday and breaking over its 28-month low of 1.1760. The technical indicators are pointing upwards as the RSI is on the rise, but it has not yet come close to the neutral threshold of 50, and the MACD is crossing its trigger line to the upside while still being in the negative region.

The 20-day simple moving average (SMA), which is located at 1.2040, and the blue Kijun-sen line are expected to present an immediate barrier to any additional price advances. This is also close to the descending trend line of 1.2200, which means that this could prove to be a challenging obstacle for the pair to overcome. In the event that a successful breakout occurs above this region, additional resistance is likely to be found in the area of 1.2340-1.2455.

On the other hand, if the momentum weakens, and the pair were to start moving in the opposite direction again, the multi-month low at 1.1760 would be the first support level. If prices break below this level, they may move closer to the barrier at 1.1410, which was registered in March 2020.

As long as prices are located below the declining trend line, the bearish scenario will most likely continue to apply to the more medium-term picture, where it has not changed at all and where it is likely to continue to hold.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals