Summary

- The Reserve Bank of Australia (RBA) raised its Cash Rate by 50 bps to 1.85% at its August meeting and signaled that further rate hikes will be needed to bring inflation back toward target over time.

- Several elements of the monetary policy announcement were essentially unchanged from previous meetings. However, there were also some important changes in language that lead us to believe the RBA will revert to smaller hikes going forward. Notably, the central bank indicated that while further normalization of policy is expected in the months ahead, it also noted that policy is “not on a pre-set path”. The RBA also dropped references to “extraordinary monetary support” that had appeared in previous announcements, suggesting it now sees itself a bit further along the monetary tightening path, and perhaps does not need to move at an accelerated 50 bps pace anymore. Given these changes, we believe the RBA will be more flexible moving forward with regard to the size and timing of future rate hikes.

- With signals of further tightening but more flexibility, we now expect 25 bps rate hikes at the RBA’s next several meetings in September, October, November, December and February, which would see the Cash Rate peak at 3.10% by early next year.

RBA Signals More Rate Hikes, but by How Much and at What Pace?

In a widely expected move, the Reserve Bank of Australia (RBA) continued down the path of monetary tightening at its August meeting, raising its Cash Rate by 50 bps to 1.85%. The central bank signaled that further rate hikes are needed to bring inflation down to target and rebalance supply and demand dynamics.

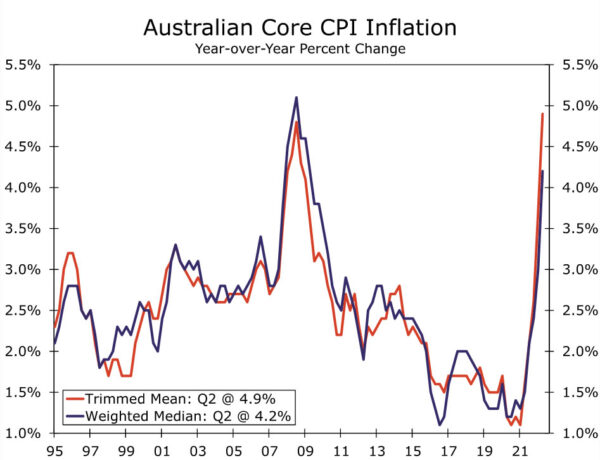

Taking a closer look at the details of the monetary policy announcement, with a few exceptions, the RBA’s language was very similar to prior meetings. As in previous announcements, the central bank brought attention to tightness in the labor market and evidence of wage growth, as well as resilient consumer spending, while reiterating that the outlook for household spending remains a key uncertainty amid high inflation. Speaking of inflation, the central bank emphasized that price pressures are still elevated within Australia, driven by both global and local factors, and released updated inflation forecasts in its Statement on Monetary Policy. The RBA’s lifted its central CPI forecast for CPI inflation and now expects it to reach around 7.75% over 2022, 4.25% in 2023, and 3% in 2024. In addition, looking at underlying price pressures, trimmed mean inflation is expected to peak at 6% this year and decline to 3%, the top end of the RBA’s target, by 2024. The central bank expects wage growth to accelerate further, and to eventually be the primary driver of inflation in a tight labor market. On the growth front, GDP forecasts show the economy experiencing respectable growth, averaging 4% this year before slowing to 2.25% in 2023 and 1.75% in 2024. The growth outlook suggests the economy should be able to absorb further tightening. With much of the language unchanged from previous announcements, we believe the RBA is still on track to continue hiking rates. The question is: by how much and at what pace?

To answer this question, we look to the few notable changes in language that lead us to think the RBA will move forward with a smaller magnitude of rate hikes than its recent 50 bps increments. While the RBA again said that it expects to take further steps in normalizing monetary conditions over the months ahead, and that the size and timing of future interest rate increases will be guided by incoming data, the latest announcement added that policy is not on a “pre-set path”. This phrasing suggests the RBA will be more flexible moving forward with regard to the size and timing of future rate hikes, pointing to a meeting-by-meeting approach to monetary policy decisions based on incoming data. Other central banks around the world have also adopted this more flexible meeting-by-meeting approach, notably the Federal Reserve and European Central Bank. Overall, we expect the RBA to pay close attention to Q2 wage data and July employment data released between now and its September policy meeting.

In addition, the August announcement dropped previous references to “withdrawal of extraordinary monetary support”. Instead, this phrase was replaced with more standard language that “the increase in interest rates is a further step in the normalization of monetary conditions in Australia.” This new language hints that the RBA believes it is now a bit further along the monetary tightening path, and perhaps does not need to move at an accelerated 50 bps pace anymore—also a mildly dovish tilt. Furthermore, in its Statement on Monetary Policy, the RBA indicated it is seeking to bring inflation down in a way that keeps the economy on an “even keel”. We believe this language is also consistent with a more measured pace of rate hikes. Against this backdrop, we now expect the RBA to revert to a steady pace of consecutive 25 bps rate hikes at its next several meetings in September, October, November, December and February, which would bring the Cash Rate to 3.10% by early 2023.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals