The Pound Sterling continues to fall against the USD on Monday; the instrument is mostly trading at 1.2117.

First of all, the Pound got under significant pressure from the USD, which has pretty much improved recently. Secondly, statistics published by the United Kingdom last week showed that inflation had a severe impact on key macroeconomic parameters.

For example, Industrial Production lost 0.9% m/m in June after adding 1.3% m/m the month before and against the expected reading of -1.3% m/m. The fact that the actual reading is better than the forecast is not comforting at all: the indicator is declining, and this decline is caused by an inflation boost. Manufacturing Production and Construction Output have also dropped. The preliminary GDP report for the second quarter showed -0.1% q/q after being +0.8% q/q the quarter before.

It’s still rather unclear how much the global price surge might hurt the British economy. However, it will be hurt, there is no doubt about it.

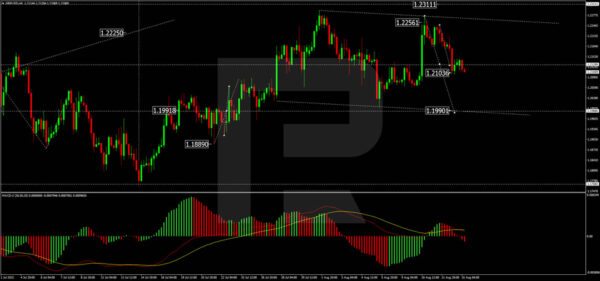

As we can see in the H4 chart, after finishing the ascending impulse at 1.2256, GBP/USD is forming a new descending structure towards 1.1990. Later, the market may start another growth to reach 1.2311 and then resume trading downwards with the target at 1.1990, or even extend this structure down to 1.1890. From the technical point of view, this scenario is confirmed by the MACD Oscillator: its signal line is moving downwards outside the histogram area and may reach new lows soon.

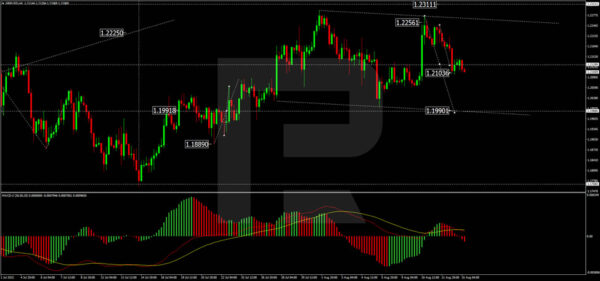

In the H1 chart, having completed the descending structure at 1.2133, GBP/USD is consolidating above this level. If later the price breaks this range to the upside, the market may grow towards 1.2190, and then start a new decline with the target at 1.1990; if to the downside – resume falling to reach the above-mentioned target, and then form one more ascending wave towards 1.2311. From the technical point of view, this scenario is confirmed by the Stochastic Oscillator: after breaking 50, its signal line is falling to reach 20.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals