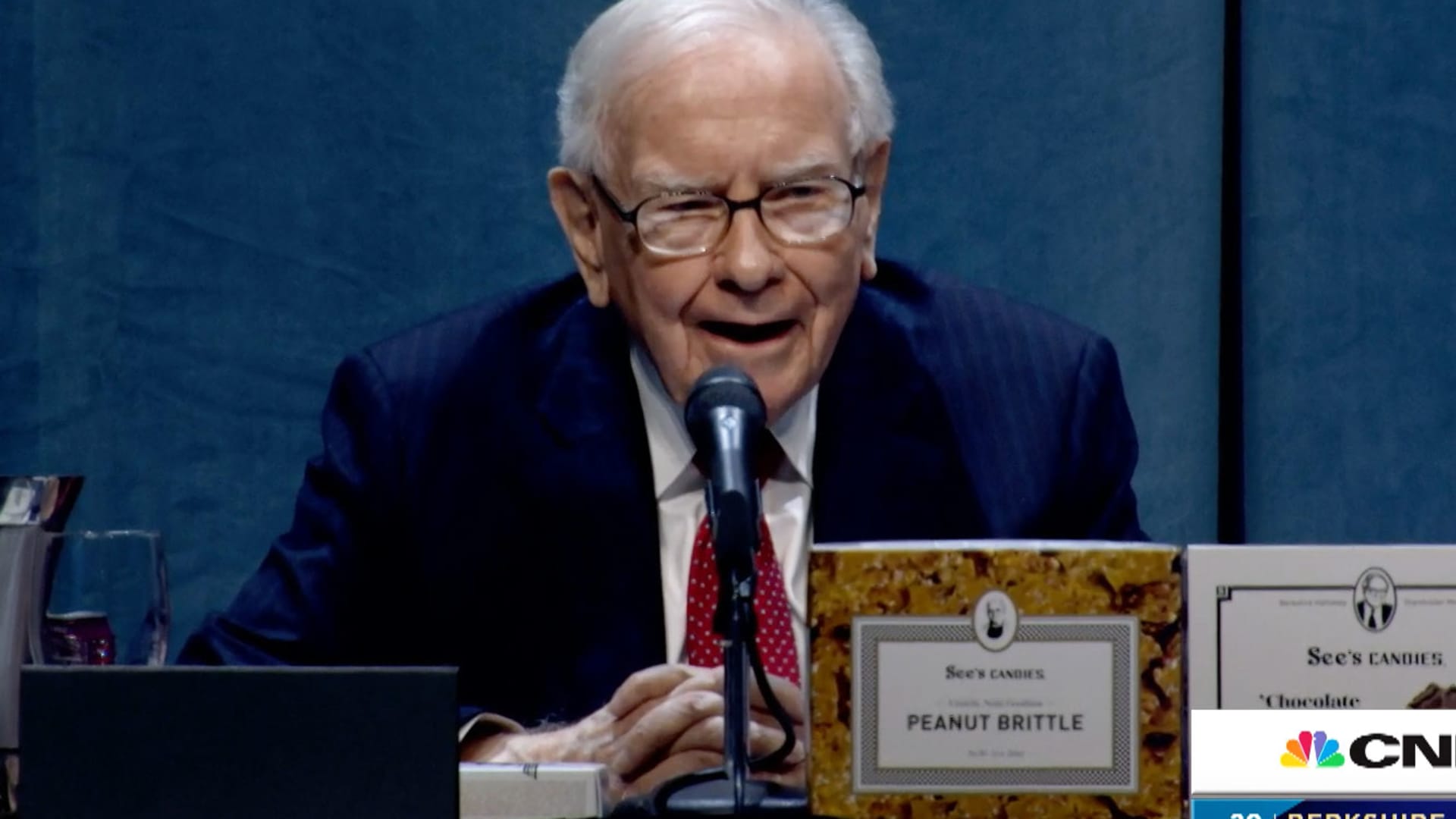

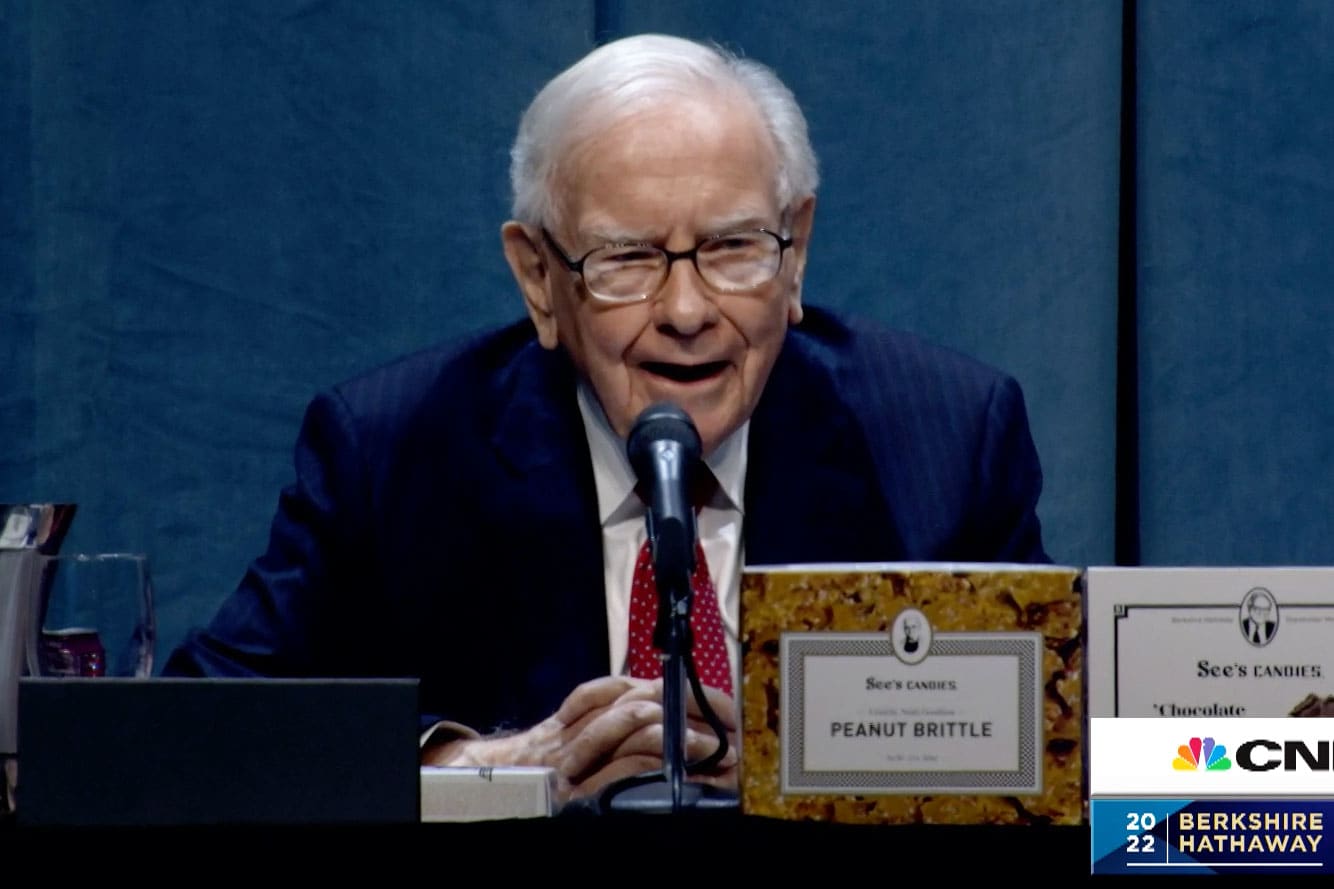

Warren Buffett at press conference during the Berkshire Hathaway Shareholders Meeting, April 30, 2022.

CNBC

Warren Buffett’s Berkshire Hathaway on Friday received regulatory approval to purchase up to 50% of oil giant Occidental Petroleum.

Shares of Occidental jumped 10% on the news to above $70 apiece, pushing their 2022 gains to more than 140%.

On July 11, Berkshire filed an application with the Federal Energy Regulatory Commission to buy more of the oil company’s common stock in secondary market transactions. The conglomerate argued that a maximum 50% stake wouldn’t hurt competition or diminish regulatory authority.

Carlos Clay, acting director of division of electric power regulation, granted the permission Friday, saying authorization was “consistent with the public interest.”

The conglomerate has already increased its Occidental stake drastically this year. Berkshire currently owns 188.5 million shares of Occidental, equal to a 20.2% position. It surpassed a key threshold where Berkshire could record some of the oil company’s earnings with its own, potentially adding billions of dollars in profit.

Berkshire also owns $10 billion of Occidental preferred stock, and has warrants to buy another 83.9 million common shares for $5 billion, or $59.62 each. The warrants were obtained as part of the company’s 2019 deal that helped finance Occidental’s purchase of Anadarko. The stake would rise to nearly 27% if Berkshire exercises those warrants.

Friday’s news fueled speculations that Buffett will be interested in acquiring the whole company eventually.

“He will likely continue to buy as much as he can get below $70 or $75. If you own 30% or 40% and would like to buy it out at $95 or $100, you saved a lot of money,” said Cole Smead, president of Smead Capital Management and a Berkshire shareholder. “This stock trades like a casino. The market is giving him all the stock he wants.”

The “Oracle of Omaha” start buying the stock after reading through Occidental’s annual report and gained confidence in the company’s growth and its leadership.

“What Vicki Hollub was saying made nothing but sense. And I decided that it was a good place to put Berkshire’s money,” Buffett said during Berkshire’s annual meeting in April. “Vicki was saying what the company had gone through and where it was now and what they planned to do with the money.”

Occidental has been the best-performing stock in the S&P 500, benefitting from surging oil prices.

Buffett’s growing bet on Occidental has inspired a legion of small investors to follow suit, making it a favorite retail stock this year, according to data from VandaTrack.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals