Euro’s selloff continues today after poor PMI data and stays as the worst performer for the week. Swiss Franc is also weak for now, together with Sterling. Dollar remains the strongest one, but struggle to extend gains against commodity currencies. In other markets, major European indexes are soft but downside is limited. US futures also point to flat open. Major treasury yields are extending near term rally. Gold is engaging in weak recovery.

Technically, selling focus appears to be turning from Euro to Swiss Franc. A focus in on EUR/CHF. Further decline is expected as long as 0.9698 resistance holds. However, considering bullish convergence condition in 4 hour MACD, break of 0.9698 resistance will indicate short term bottoming and bring stronger rebound. If happens, that could help Euro stabilize slightly elsewhere.

In Europe, at the time of writing, FTSE is down -0.75%. DAX is down -0.08%. CAC is down -0.32%. Germany 10-year yield is up 0.0349 at 1.341. Earlier in Asia, Nikkei dropped -1.19%. Hong Kong HSI dropped -0.78%. China Shanghai SSE dropped -0.05%. Singapore Strait Times dropped -0.50%. Japan 10-year JGB yield dropped -0.0088 to 0.222.

ECB Panetta: Slowdown or recession would mitigate inflationary pressures

ECB Executive Board Member Fabio Panetta warned in a conference today, “the probability of a recession is increasing. If we will have a significant slowdown or even a recession, this would mitigate inflationary pressures.”

“I think that (policy) adjustments are possible but the most recent evolution of the economy should induce us to exercise one of the main features of central bankers which is prudence,” he said.

He also added that real rates are “not too far from the estimated neutral level.

Eurozone PMI composite dropped to 49.2 in Aug, economic contraction in Q3

Eurozone PMI manufacturing dropped from 49.8 to 49.7 in August, above expectation of 49.0, a 26-month low. PMI Services dropped from 51.2 to 50.2, below expectation of 50.5, a 17-month low. PMI Composite dropped from 49.9 to 49.2, an 18-month low.

Andrew Harker, Economics Director at S&P Global Market Intelligence said: “The latest PMI data for the eurozone point to an economy in contraction during the third quarter of the year. Cost of living pressures mean that the recovery in the service sector following the lifting of pandemic restrictions has ebbed away, while manufacturing remained mired in contraction in August, seeing another record accumulation of stocks of finished goods as firms were unable to shift products in a falling demand environment. This glut of inventories suggests little prospect of an improvement in manufacturing production any time soon.”

Germany PMI Manufacturing recovered from 49.3 to 49.8 in August, above expectation of 48.1.PMI Services dropped from 49.7 to 48.2, below expectation of 49.0, an 18-month low. PMI Composite dropped from 48.1 to 47.6, a 26-month low.

France PMI Manufacturing dropped from 49.5 to 49.0 in August, above expectation of 48.8, a 27-month low. PMI Services dropped from 53.2 to 51.0, below expectation of 53.5, a 16-month low. PMI Composite dropped from 51.7 to 49.8, an 18-month low.

UK PMI manufacturing dived to 46 in Aug, services ticked down to 52.5

UK PMI Manufacturing dropped sharply from 52.1 to 46.0 in August, well below expectation of 51.3. That’s also the lowest level in 27 months. PMI Services ticked down from 52.6 to 52.5, above expectation of 52.0, an 18-month low. PMI Composite dropped from 52.1 to 50.9, an 18-month low.

Annabel Fiddes, Economics Associate Director at S&P Global Market Intelligence said:

“The UK private sector moved closer to stagnation in August, as mild growth of activity across the service sector only just offset a deepening downturn at manufacturers. Waning customer demand amid the weaker economic outlook, and shortages of both staff and inputs, were reported to have hit goods producers hard, with firms registering the quickest drops in output and new work since May 2020.

Excluding the initial phase of the pandemic in early-2020, the reduction in manufacturing output was the quickest seen since the start of 2009. Meanwhile, the service sector registered the weakest increase in activity since the recovery began in early 2021.”

Japan PMI manufacturing dropped to 51 in Aug, services down to 49.2

Japan PMI Manufacturing dropped from 52.1 to 51.0 in August, below expectation of 51.8. PMI Manufacturing Output dropped from 49.7 to 48.3. That’s also the lowest level in 19 months. PMI Services dropped from 50.3 to 49.2, first contraction since March. PMI Composite dropped from 50.2 to 48.9, first contraction since February.

Usamah Bhatti, Economist at S&P Global Market Intelligence, said: “The latest Flash PMI data showed that Japanese private sector activity declined for the first time since February midway through the third quarter. Both manufacturing and services companies recorded a contraction in output in August, with the former falling at the fastest pace for 11 months.

“August data signalled the second-weakest reading in the composite index so far this year, though the rate of deterioration was only mild. Of concern was the amount of new business received by private sector firms, which reduced for the first time in six months and pointed to further weaknesses to come.”

Australia PMI composite output dropped to 49.8, a renewed contraction

Australia PMI Manufacturing dropped from 55.7 to 54.5 in August, a 12-month low. PMI Services dropped from 50.9 to 49.6, a 7-month low. PMI Composite Output dropped from 51.1. to 49.8, a 7-month low.

Laura Denman, Economist at S&P Global Market Intelligence said: “A renewed contraction in Australia’s private sector economy indicates that recent interest rate hikes made by the RBA, as well as sustained inflationary pressures, have begun to take a toll on overall demand levels.

“Should new order growth remain subdued, this may help reduce demand-pull inflation factors, but survey data continue to highlight the supply issues that remain prevalent globally, which will continue to keep price levels elevated for the foreseeable.

“As such, the RBA will likely continue along its rate-hiking path, which bodes ill for the wider economy given the latest survey data highlight clear signs of underlying weakness.”

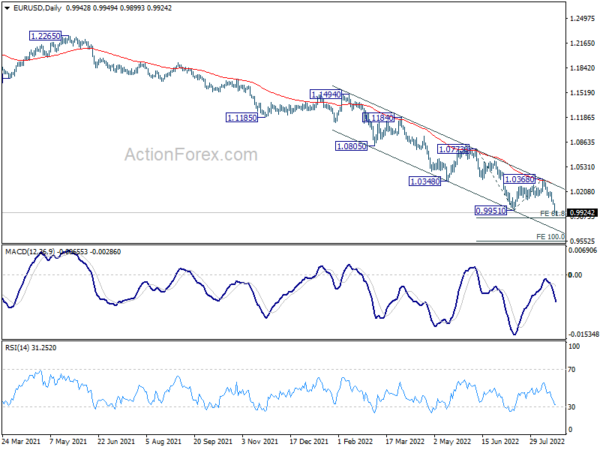

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 0.9897; (P) 0.9972; (R1) 1.0018; More…

Intraday bias in EUR/USD remains on the downside for the moment. Next target is 61.8% projection of 1.0773 to 0.9951 from 1.0368 at 0.9860. Firm break there should prompt downside acceleration to 100% projection at 0.9546. On the upside, above 1.0045 minor resistance will turn intraday bias neutral and bring consolidations. But recovery should be limited well below 1.0368 resistance to bring fall resumption.

In the bigger picture, down trend from 1.6039 (2008 high) is still in progress. Next target is 100% projection of 1.3993 to 1.0339 from 1.2348 at 0.8694. In any case, outlook will stay bearish as long as 1.0368 resistance holds, in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | AUD | Manufacturing PMI Aug P | 54.5 | 55.7 | ||

| 23:00 | AUD | Services PMI Aug P | 49.6 | 50.9 | ||

| 00:30 | JPY | Manufacturing PMI Aug P | 51 | 51.8 | 52.1 | |

| 07:15 | EUR | France Manufacturing PMI Aug P | 49 | 48.8 | 49.5 | |

| 07:15 | EUR | France Services PMI Aug P | 51 | 53.5 | 53.2 | |

| 07:30 | EUR | Germany Manufacturing PMI Aug P | 49.8 | 48.1 | 49.3 | |

| 07:30 | EUR | Germany Services PMI Aug P | 48.2 | 49 | 49.7 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Aug P | 49.7 | 49 | 49.8 | |

| 08:00 | EUR | Eurozone Services PMI Aug P | 50.2 | 50.5 | 51.2 | |

| 08:30 | GBP | Manufacturing PMI Aug P | 46 | 51.3 | 52.1 | |

| 08:30 | GBP | Services PMI Aug P | 52.5 | 52 | 52.6 | |

| 13:45 | USD | Manufacturing PMI Aug P | 51.5 | 52.2 | ||

| 13:45 | USD | Services PMI Aug P | 50.4 | 47.3 | ||

| 14:00 | USD | New Home Sales M/M Jul | 580K | 590K | ||

| 14:00 | EUR | Eurozone Consumer Confidence Aug P | -28 | -27 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals