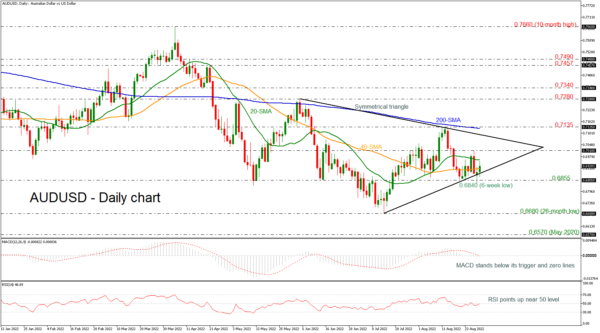

AUDUSD is finding strong support near the short-term ascending trend line and the 0.6855 barrier, after it spiked towards a new six-week low at 0.6840. The RSI indicator is gaining some momentum, mirroring the market’s bullish behavior over the past couple of days, flagging that a recovery could reemerge in the short-term. The MACD is also moving with weak momentum near its trigger and zero lines.

In case the pair changes its short-term direction to the upside, the bulls will probably challenge the previous top at 0.7010. A break higher, could carry the pair until the upper boundary of the symmetrical triangle near the 200-day SMA and the 0.7135 resistance level. Further up, the area around 0.7280 could be another potential obstacle for upward movements.

Alternatively, more declines may drive the price towards the 0.6855 barrier again before the 26-month low of 0.6680 comes into view. Beneath the latter, the trough of May 2020 at 0.6570 could be another level in focus.

Turning to the medium-term picture, the pair switched to neutral mode after the drop off 0.7280. The 200-day SMA continues to head south, and the market’s outlook might improve further in the medium-term. Yet there is still some way to go for the lines of the symmetrical triangle to meet each other.

Summarizing, AUDUSD maintains a bullish bias in the short-term picture, whereas in the medium-term it holds a neutral profile.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals