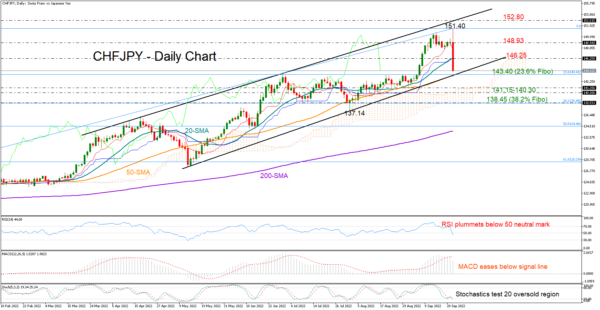

CHFJPY lost almost 2.0% within two hours during Thursday’s European trading hours, plunging to a two-week low of 143.92 before edging slightly higher.

The technical oscillators followed the price sharply lower, with the RSI sliding below its 50 neutral threshold and the MACD easing below its red signal line. The bullish market structure, however, remained intact within the upward-sloping channel, preserving some buying interest. Note that the stochastics are hovering near their 20 oversold level. Hence, an upside reversal at the channel’s lower band cannot be excluded.

If the channel’s support trendline at 143.18 cracks, however, shifting the outlook back to neutral in the three-month picture, the spotlight will fall on the Ichimoku cloud’s surface at 141.15 and the 140.30 restrictive zone. Additional losses from here could squeeze the price directly to 138.50, where the 38.2% Fibonacci retracement of the 117.52-151.40 upleg is placed.

In the positive scenario, where the pair closes above the 20-day SMA at 146.25, buying orders could grow all the way to the 148.93 resistance. Higher, the bulls might attempt to pierce through the 151.40 top and challenge the channel’s surface around 152.80.

Summarizing, although CHFJPY is facing a bearish bias, selling pressures can be considered temporary as long as the price trades above 143.40.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals