Stocks and commodities are two of the most widely-traded financial products today. These asset classes can serve as a powerful influence on the economy, business infrastructure and the trading behaviors of millions around the world. Read on to discover the nuances of commodities vs stocks, the trading styles that suit each, and why understanding their interplay is useful.

Top 5 differences between commodities and stocks

There are a number of differences between commodities and stocks, both as properties and in terms of how they are traded.

| Stock market | Commodities market |

|---|---|

| Investors can own the asset | Traders do not own the asset |

| Often more long-term investment (buy & hold etc) | Commonly shorter-term trading |

| Price based largely on business’s financial health | Price based largely on supply and demand |

| 8-hour markets | Round the clock markets (closed weekends) |

| Normally low spread | Can be high spread |

Here’s a more in-depth look at how the commodities market compares with the stock market.

1. Ownership of the asset

When investing in stocks, you are effectively taking ownership of the asset and a share of the company (unless you are forex trading a derivative). However, with commodities futures, you are not actually buying the underlying commodity, but rather the contract that represents it.

2. Duration of Trade

While stocks can be traded over a short timeframe, investing in stocks using a buy and hold strategy means ideally retaining the asset for many years. This is a popular plan due to the historical long-term trends demonstrated by global stock markets that have enabled wealth creation for investors. However, commodities are more often day traded, swing traded or even scalped, as their price is affected by fundamental drivers that may be more conducive to shorter timeframes in volatile markets (see below).

3. Fundamental Drivers

Stocks and commodities can be affected by some of the same fundamental drivers. For example, interest rates are relevant for commodities as they affect the cost of holding inventory, while interest rates can also impact stocks due to their influence on the cost of borrowing incurred by businesses. However, when push comes to shove, the main driver for commodities is supply and demand , and the main driver for stocks is the financials of the businesses involved: earnings and dividends. These are explored in greater detail below.

4. Trading Hours

While closing times for stock market exchanges vary, they tend to close in the afternoon/evening. For example, the NYSE trades from 9:30am to 4pm local time. Commodities markets, on the other hand, are open almost round the clock with a break during the weekend. For example, gold futures trade Sunday-Friday 6pm-5:00pm EST.

For a full breakdown of trading hours see our Major Commodities page, and our Major Stock Indices page.

Bid-Ask Spread

The bid-ask spread can differ between assets, and the spread for stocks is usually low due to how easily stocks can change hands. However, while there are high volume commodities such as crude oil, lower liquidity assets such as orange juice and feeder cattle can mean a prohibitively high spread.

Commodity trading vs stock trading – which is best for you?

Trading commodities vs stocks will come down to some key decisions. Do you want to take advantage of the short-term fluctuations often found in commodities, or are you in it for the equities long game? What fundamental drivers best fit your knowledge base? And what is your attitude to risk? We’ll explore each of these below.

Short-term or Long-term trading forex EA?

While trading stocks in the short term with technical indicators is a viable approach, if you want to invest in stocks for the long term, a common approach is to purchase the asset itself. This is in the form of company shares, often via a brokerage account, which are held over a longer timeframe – typically at least five years. While it has seen considerable fluctuations, the S&P 500 has returned an average of around 10% year on year over the last century.

Recommended by Ben Lobel

Read our guide to stock forex trading for expert equities insight

However, commodities are mostly shorter-term trades, as there is often more potential to benefit from volatility as an active trader rather than a long-term investor. Commodity volatility tends to be the highest out of the asset classes MT4 EA; for example, the quarterly volatility of crude oil has moved between 12% and 90% since 1983.

This is due to the cyclical nature of the commodity; the shifts in global supply and demand can be extreme, while the fundamental drivers of stocks are often not so pronounced. The below chart shows how the MACD indicator can be used on a one-hour oil chart to identify an entry point to illustrate how traders can benefit from short-term moves in commodities.

Which Fundamental Drivers to Follow?

As mentioned, commodities are largely driven by supply and demand factors. Forex EA. For example, large-scale infrastructure developments might increase the demand for copper , leading to its price rising. For agricultural products, seasonality can affect the market heavily, meaning price rises or falls at a certain time of year. Oil prices can be influenced by factors such as political events, burgeoning industrial output and uptake of alternative fuels. These types of fundamental drivers are all important for commodity traders to consider, so knowledge of how each market responds to such drivers is key.

Alternatively, stock prices are largely driven by company financials and business strategy. What does the balance sheet look like? How has revenue grown? How is the company outsmarting its rivals? These are a different set of considerations to consider than commodities, and may accordingly require a different mindset.

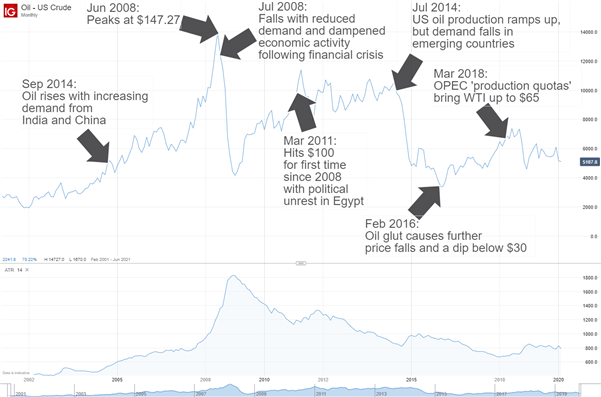

The chart below shows the many price shifts US Crude Oil has seen in the 21st century, with fundamental drivers behind price movements labeled to demonstrate the events that can influence short-term trade decisions for a commodity such as this. The Average True Range , a popular measure of volatility, is also shown on the chart, revealing the short-term volatility of the asset. By contrast, long-term investors would expect a ‘growth stock’ to show a sustained upward trajectory over the same timeframe, with fewer and less pronounced spikes along the way.

Recommended by Ben Lobel

Discover what it takes to be a consistent oil trader today

What is Your Appetite for Risk?

Would-be commodities traders should carefully consider their risk management compared to stock trading. We have seen that certain assets, such as oil, can be extremely volatile. Additionally, as the margin requirement for commodities is much lower than for stocks, there is a potential for heavier losses in commodities. Traders should ensure they have the necessary capital to cover margin calls. Of course, with greater risk comes greater potential reward, which is why so many choose to trade certain commodity assets.

Stocks vs commodities vs forex trading

In addition to the consideration of stocks vs commodities, forex (foreign exchange) is another asset class to consider relative to the others. Forex is the comparison of one currency’s value against another, and these currency pairs in turn can be correlated to commodities and stocks.

The relationship between forex EA and stocks is complex, but basic theory suggests that when domestic equities rise, confidence in that economy grows and encourages funds from international investors, creating a demand for the domestic currency which may cause it to rally against other currencies.

When it comes to commodities vs forex trading, a good example is certain Canadian Dollar pairs historically showing a correlation with oil prices due to the contribution of Canada’s significant oil exports to its GDP , and Australia and New Zealand’s mining sector affording NZD and AUD a close correlation with commodities such as gold and copper.

Interested in more content on stocks and commodities? Check out the following on Daily.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals