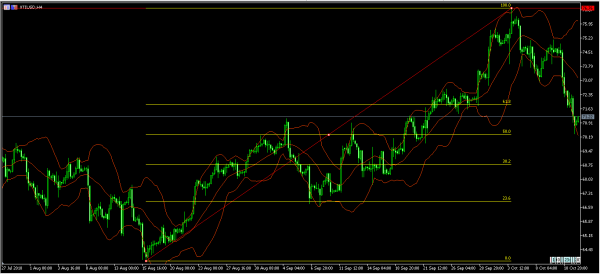

The US 30 index has plummeted considerably over the last couple of days, recording an almost three-month low of 24916. The sharp sell-off drove the index near the ascending trend line, however, the price turned higher after challenging the 200-day simple moving average (SMA), paring some losses.

The momentum indicators are supportive of the reverse to the upside, with the RSI rising above the oversold zone to move towards the 50 level, while the stochastic oscillator is ready to post a bullish crossover with the blue %K line and the red %D line in the negative threshold.

On the upside, the area between 25481 and 25590, outlined by the 38.2% Fibonacci retracement of the February 6 to October 3 upleg, could provide immediate resistance. A penetration of this area would bring in focus the 23.6% Fibonacci mark near the 26166 resistance.

Should the price head south again, it would be interesting to see whether the rising trend line can stop the bearish movement. If this is not the case, the market could slip until the next barrier of the 61.8% Fibonacci region near 24588. Even lower, the 24480 could act as major support as well, confirming the scenario for more losses.

In the longer timeframe, the index has been following an upward move since February.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals